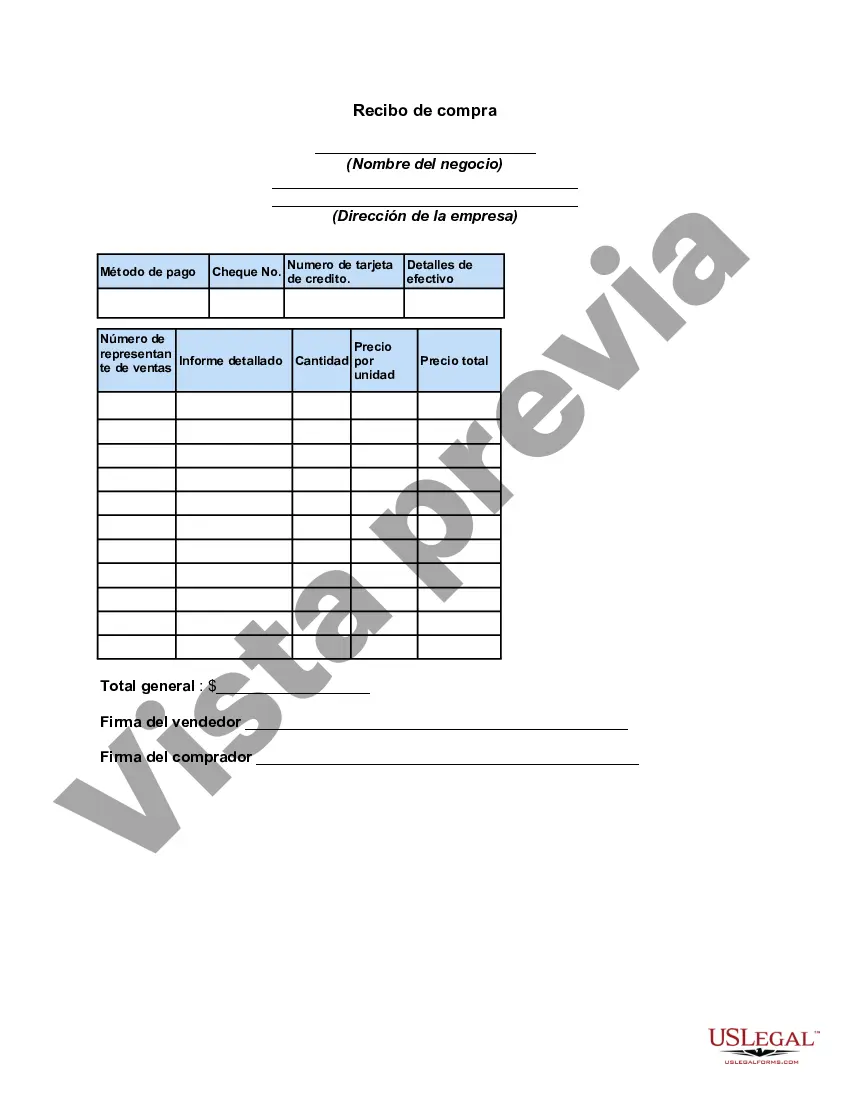

A Pennsylvania sales receipt is a document that serves as proof of purchase for a transaction that occurs in Pennsylvania. It contains important information such as the date, time, and location of the purchase, as well as details about the seller and buyer. A Pennsylvania sales receipt typically includes key elements like the name and address of the seller, the buyer's contact information, a description of the item or service purchased, the quantity or units, the price per unit, the total amount paid, and any applicable taxes or discounts. It may also include the payment method used, such as cash, credit card, or check. In Pennsylvania, there are different types of sales receipts depending on the nature of the transaction. The most common types include: 1. Retail Sales Receipt: This type of receipt is typically issued by retail stores and contains details of the goods or products purchased by a customer. 2. Service Sales Receipt: Service-based businesses often provide service sales receipts to their clients, outlining the specific services rendered and any associated costs. 3. Restaurant or Hospitality Sales Receipt: Restaurants, hotels, and other hospitality establishments issue sales receipts that itemize food, beverages, or accommodation charges for customers. 4. Online Sales Receipt: With the rise of e-commerce, online retailers provide digital sales receipts via email or within the customer's account, confirming the purchase and including pertinent details. 5. Wholesale Sales Receipt: Wholesalers catering to businesses issue sales receipts for bulk purchases made by their customers, including information about the items and quantity bought. 6. Auction Sales Receipt: Auction houses provide sales receipts to buyers who successfully bid on items, detailing the winning bid amount and any additional fees. It is essential to retain sales receipts as they serve as evidence of a legitimate transaction and may be needed for future reference, warranty claims, refunds, or tax purposes. Pennsylvania's businesses, regardless of the type of receipt issued, must ensure the receipts comply with state laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Pennsylvania Recibo de compra - Sales Receipt

Description

How to fill out Pennsylvania Recibo De Compra?

US Legal Forms - one of many largest libraries of legitimate forms in the United States - delivers an array of legitimate document themes you are able to download or print out. While using website, you will get 1000s of forms for company and specific functions, sorted by groups, says, or keywords.You can get the most recent versions of forms such as the Pennsylvania Sales Receipt within minutes.

If you already possess a monthly subscription, log in and download Pennsylvania Sales Receipt from your US Legal Forms catalogue. The Download key will appear on every single kind you look at. You have accessibility to all formerly saved forms in the My Forms tab of the account.

If you would like use US Legal Forms initially, here are straightforward instructions to obtain started off:

- Make sure you have picked the best kind to your city/area. Click the Review key to check the form`s content material. Browse the kind outline to ensure that you have chosen the appropriate kind.

- If the kind doesn`t fit your needs, take advantage of the Research field on top of the display to obtain the one which does.

- If you are happy with the form, confirm your choice by simply clicking the Acquire now key. Then, select the rates prepare you favor and supply your credentials to sign up on an account.

- Method the financial transaction. Utilize your bank card or PayPal account to finish the financial transaction.

- Choose the structure and download the form in your product.

- Make adjustments. Load, edit and print out and indicator the saved Pennsylvania Sales Receipt.

Every format you included with your bank account lacks an expiration particular date which is the one you have eternally. So, if you want to download or print out yet another duplicate, just go to the My Forms portion and click in the kind you require.

Obtain access to the Pennsylvania Sales Receipt with US Legal Forms, probably the most comprehensive catalogue of legitimate document themes. Use 1000s of professional and state-particular themes that fulfill your business or specific demands and needs.