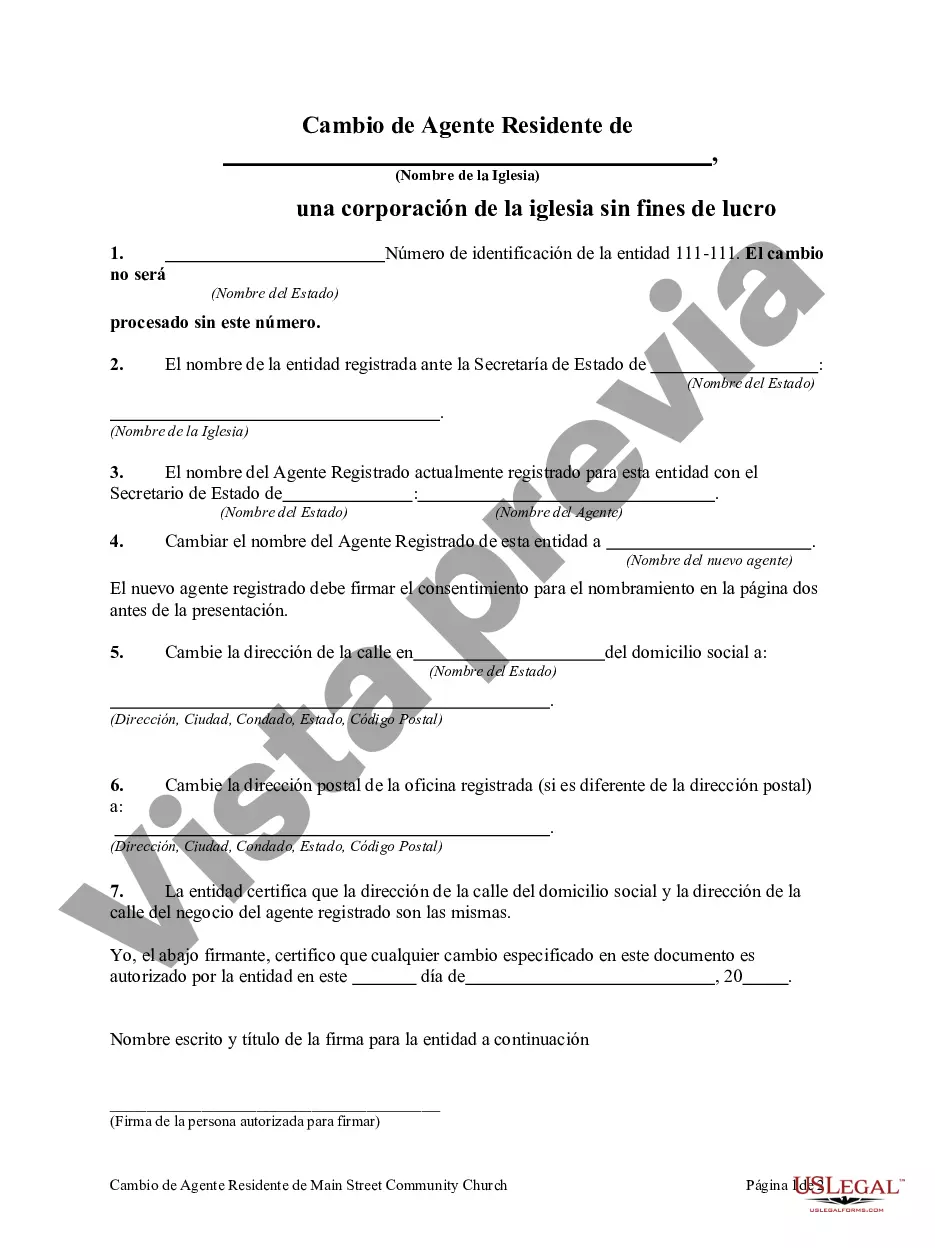

The Pennsylvania Change of Resident Agent of Non-Profit Church Corporation is a legal process that allows non-profit church corporations in the state of Pennsylvania to update their resident agent information. The resident agent is an individual or entity designated to receive important legal and official documents on behalf of the church corporation. When a non-profit church corporation undergoes a change in its resident agent, it is required to file the Pennsylvania Change of Resident Agent form with the appropriate state authorities. This form notifies the state of the new resident agent's details and ensures that future correspondence and legal notifications are properly directed. The process for filing a Pennsylvania Change of Resident Agent for a Non-Profit Church Corporation involves several steps. The church corporation must gather the necessary information about the new resident agent, including their name, address, and contact details. It is important to provide accurate information to ensure that communications from the state are received promptly. There are different types of Pennsylvania Change of Resident Agent forms based on the specific circumstances of the church corporation. For example, if the non-profit church corporation is changing its resident agent for the first time, it would file an initial Pennsylvania Change of Resident Agent form. On the other hand, if the church corporation is updating its resident agent due to a change in leadership or address, it would file an amended Pennsylvania Change of Resident Agent form. An accurate and timely filing of the Pennsylvania Change of Resident Agent form is crucial to maintaining compliance with state regulations. Failure to update the resident agent information can lead to missed notifications, potential legal consequences, and loss of good standing for the church corporation. In conclusion, the Pennsylvania Change of Resident Agent of Non-Profit Church Corporation is a necessary process for updating and maintaining accurate resident agent information for non-profit church corporations in the state. Filing the appropriate form ensures that the corporation receives legal and official communications without any interruptions or delays. It is essential for church corporations to understand the requirements and follow the proper procedure to remain in compliance with Pennsylvania state laws.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Pennsylvania Cambio de Agente Residente de Non-Profit Church Corporation - Change of Resident Agent of Non-Profit Church Corporation

Description

How to fill out Pennsylvania Cambio De Agente Residente De Non-Profit Church Corporation?

US Legal Forms - one of many greatest libraries of lawful types in the United States - provides an array of lawful file themes you are able to down load or printing. While using internet site, you can get thousands of types for business and individual uses, sorted by groups, states, or keywords.You will discover the most recent models of types much like the Pennsylvania Change of Resident Agent of Non-Profit Church Corporation in seconds.

If you have a membership, log in and down load Pennsylvania Change of Resident Agent of Non-Profit Church Corporation in the US Legal Forms catalogue. The Down load key will show up on each and every kind you perspective. You gain access to all formerly downloaded types within the My Forms tab of your own account.

If you want to use US Legal Forms for the first time, listed below are simple directions to help you started off:

- Be sure you have chosen the right kind for your personal area/area. Click the Review key to analyze the form`s articles. Look at the kind description to actually have chosen the correct kind.

- In case the kind doesn`t satisfy your needs, utilize the Search discipline towards the top of the screen to find the one which does.

- Should you be content with the shape, confirm your selection by clicking the Buy now key. Then, choose the prices program you favor and offer your qualifications to sign up on an account.

- Procedure the financial transaction. Make use of credit card or PayPal account to perform the financial transaction.

- Find the file format and down load the shape in your system.

- Make modifications. Load, edit and printing and indication the downloaded Pennsylvania Change of Resident Agent of Non-Profit Church Corporation.

Each web template you added to your account does not have an expiration time and is also your own eternally. So, in order to down load or printing one more duplicate, just check out the My Forms segment and click about the kind you want.

Gain access to the Pennsylvania Change of Resident Agent of Non-Profit Church Corporation with US Legal Forms, the most extensive catalogue of lawful file themes. Use thousands of skilled and condition-certain themes that fulfill your organization or individual requirements and needs.