Pennsylvania Provision of Agreement to Devise or Bequeath Property to Person Performing Personal Services

Description

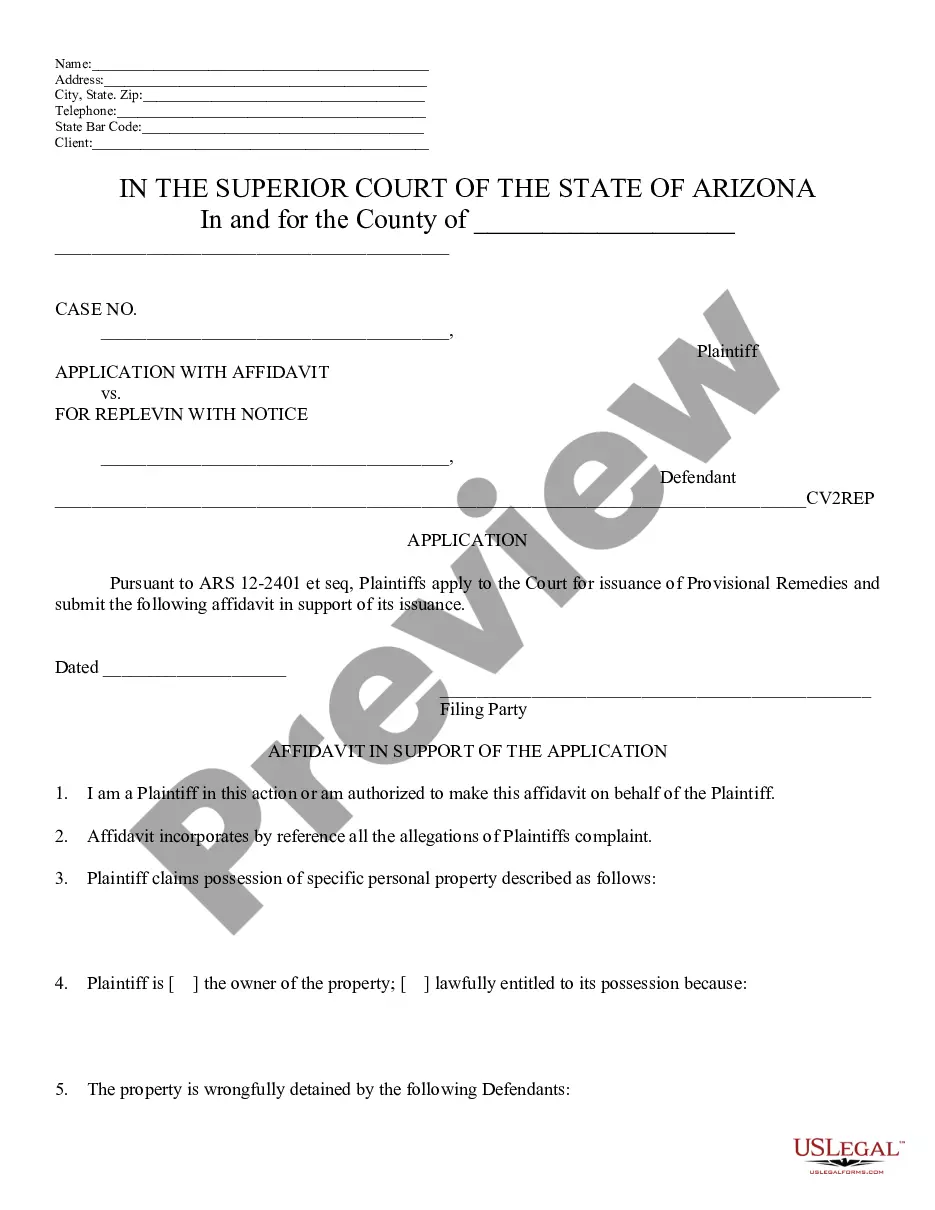

How to fill out Provision Of Agreement To Devise Or Bequeath Property To Person Performing Personal Services?

You can allocate several hours online looking for the authentic document template that meets the state and federal criteria you need.

US Legal Forms offers a multitude of authentic forms that have been evaluated by professionals.

You are able to download or print the Pennsylvania Provision of Agreement to Devise or Bequeath Property to Person Performing Personal Services from my service.

If you wish to find another version of the form, use the Search field to locate the template that suits you and your requirements.

- If you already possess a US Legal Forms account, you may Log In and then click the Acquire button.

- After that, you may fill out, modify, print, or endorse the Pennsylvania Provision of Agreement to Devise or Bequeath Property to Person Performing Personal Services.

- Every authentic document template you purchase is yours permanently.

- To obtain another copy of a purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the county/area of your choice.

- Check the form details to confirm you have chosen the right form.

- If available, utilize the Review button to view the document template simultaneously.

Form popularity

FAQ

In Pennsylvania, an executor does have the authority to sell property, but this process generally requires court approval if all beneficiaries do not consent. If there is a disagreement among beneficiaries, the executor may need to petition the court to authorize the sale. Familiarizing yourself with the Pennsylvania Provision of Agreement to Devise or Bequeath Property to Person Performing Personal Services can provide clarity on the executor’s powers and help streamline this process through proper documentation and support.

1 : to give or leave by will (see will entry 2 sense 1) used especially of personal property a ring bequeathed to her by her grandmother. 2 : to hand down : transmit lessons bequeathed to future generations.

Bequests are assets given in a will or a trust. A bequest might be a specific amount of money or assets, a percentage of those assets, or what is left over after heirs and other obligations are paid from an estate.

THE PROCESS OF ADMINISTERING A DECEDENT'S ESTATE INVOLVES:Collecting all assets.Locating all creditors.Paying all debts.Paying all applicable taxes.Distributing the remaining assets to the persons entitled to inherit.

Leaving Your Property Some Other Way Before you list those specific bequests, you will name a beneficiary or beneficiaries to get "everything else" in your estate-- that is, all of the property that is left over after the specific gifts are distributed.

A bequest is property given by will. Historically, the term bequest was used for personal property given by will and deviser for real property. Today, the two words are used interchangeably. The word bequeath is a verb form for the act of making a bequest.

Legally speaking, heirs differ from beneficiaries, who are designated by a will or other written documents, as the intended recipient of a decedent's assets. The portion of a deceased person's estate that's bequeathed to an heir is known as an inheritance.

Primary tabs. Inheritance refers to property acquired through the laws of descent and distribution. Though sometimes used in reference to property acquired through a will, the legal meaning of inheritance includes only property that descends to an heir through intestacy, when a person has died intestate.

Legacy, also called Bequest, in law, generally a gift of property by will or testament. The term is used to denote the disposition of either personal or real property in the event of death.

A gift given by means of the will of a decedent of an interest in real property.