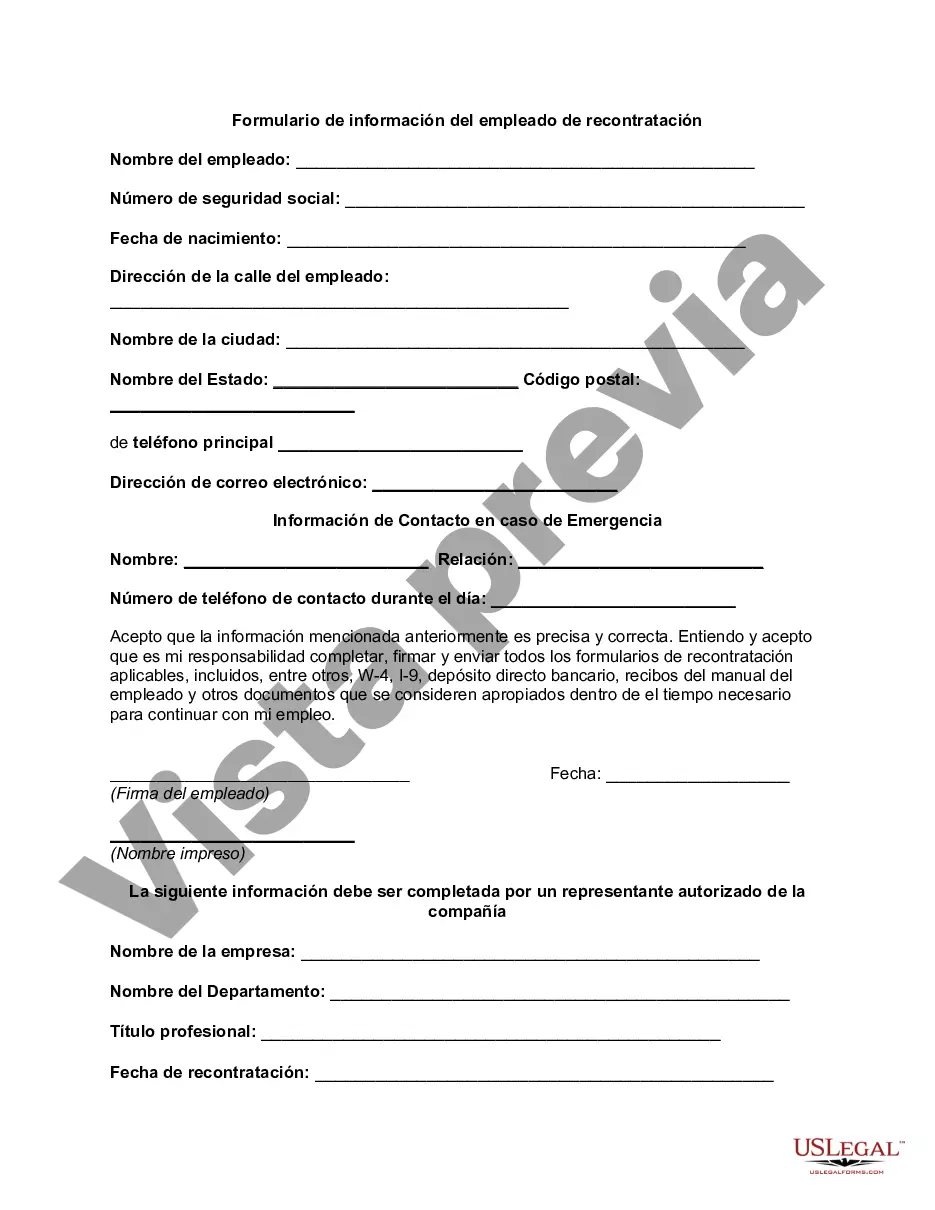

The Pennsylvania Re-Hire Employee Information Form is an essential document that employers use to gather important details about re-hired employees. This form ensures compliance with state and federal regulations and helps employers maintain accurate records for their staff. With the aim of efficiency and accuracy, this form captures all necessary information required to successfully re-onboard employees who were previously employed by the same organization. The Pennsylvania Re-Hire Employee Information Form begins by requesting the employee's basic personal details, such as their full name, social security number, mailing address, contact number, and email address. These details are crucial for establishing the employee's identity and ensuring effective communication. Next, the form goes into the specifics of the re-hire, prompting the employer to indicate the employee's previous job title, department, and the date of their termination or separation. This information helps in re-establishing the employee's position within the organization accurately. To comply with legal requirements and facilitate proper taxation, the form includes sections for the employee's federal tax withholding information, including their filing status, number of allowances claimed, and any additional withholding preferences. This ensures that the employer can accurately calculate the employee's payroll deductions. Furthermore, the Pennsylvania Re-Hire Employee Information Form may include sections for the employee to update their personal information, emergency contacts, and any changes in their direct deposit instructions. Employers find this information invaluable for keeping employee records up to date and enabling smooth communication in case of emergencies. It is important to note that there may be different editions or variations of the Pennsylvania Re-Hire Employee Information Form, depending on the employing organization's unique requirements and practices. However, the primary goal for all these forms remains consistent — to streamline the re-hiring process and gather accurate employee information efficiently. In summary, the Pennsylvania Re-Hire Employee Information Form is a crucial tool for facilitating the re-onboarding of employees. By collecting essential personal details, employment history, tax-related information, and other vital updates, this form helps employers ensure compliance, maintain accurate records, and establish effective communication channels with their re-hired employees.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Pennsylvania Formulario de información del empleado de recontratación - Re-Hire Employee Information Form

Description

How to fill out Pennsylvania Formulario De Información Del Empleado De Recontratación?

Choosing the right lawful record format might be a have difficulties. Naturally, there are tons of templates available on the Internet, but how will you obtain the lawful kind you need? Take advantage of the US Legal Forms website. The support gives 1000s of templates, such as the Pennsylvania Re-Hire Employee Information Form, that can be used for company and personal requires. Every one of the types are inspected by pros and meet up with state and federal demands.

In case you are currently authorized, log in to your bank account and then click the Download key to get the Pennsylvania Re-Hire Employee Information Form. Make use of bank account to check with the lawful types you may have ordered in the past. Visit the My Forms tab of your respective bank account and acquire one more backup in the record you need.

In case you are a brand new customer of US Legal Forms, allow me to share easy directions that you can follow:

- Initial, ensure you have chosen the correct kind to your city/county. You can look over the shape while using Preview key and browse the shape description to guarantee this is basically the best for you.

- If the kind fails to meet up with your requirements, utilize the Seach industry to discover the right kind.

- When you are positive that the shape is proper, go through the Acquire now key to get the kind.

- Choose the pricing plan you would like and enter the necessary details. Make your bank account and purchase the order with your PayPal bank account or bank card.

- Pick the document structure and down load the lawful record format to your gadget.

- Complete, change and print and indicator the obtained Pennsylvania Re-Hire Employee Information Form.

US Legal Forms may be the most significant library of lawful types where you can find various record templates. Take advantage of the company to down load skillfully-produced documents that follow state demands.