Pennsylvania Conflict of Interest Disclosure for Members of Board of Directors of Corporation ensures transparency and integrity in corporate governance. This policy mandates that each board member discloses any potential conflicts of interest to maintain the board's objectivity and protect the corporation's best interests. This detailed description will outline the significance of this policy, its requirements, and the types of conflict of interest disclosures that exist in Pennsylvania. In Pennsylvania, the Conflict of Interest Disclosure is a vital document used by corporations to identify any interests or relationships that could compromise a board member's impartiality or decision-making process. This disclosure is crucial for maintaining the corporation's reputation and ensuring fairness in key decision-making processes. The policy legally obligates every board member to disclose any existing or potential conflicts of interest that they may have with the corporation or its stakeholders. It includes financial interests, relationships, or affiliations that may directly or indirectly influence a board member's judgment or actions. By identifying these conflicts, the corporation can take appropriate measures to mitigate or eliminate potential bias and avoid compromising its fiduciary responsibilities. The Pennsylvania Conflict of Interest Disclosure requires board members to provide specific details regarding their potential conflicts of interest. They must disclose any financial investments, partnerships, consulting agreements, employment, or membership in organizations that may create conflicts. Additionally, board members must reveal any pending litigation or legal issues involving them that could impact their objectivity. In Pennsylvania, there are several types of Conflict of Interest Disclosures for Members of Board of Directors of a Corporation: 1. Financial Interest Disclosure: Board members must disclose any ownership interest, stock holdings, or other financial arrangements that could influence their decision-making. 2. Employment Disclosure: Board members should disclose any current or past employment relationships that may create conflicts or have the potential to influence decision-making processes. 3. Family Relationship Disclosure: If a board member has family members employed by the corporation or its affiliates, this type of disclosure is necessary to avoid any actual or perceived conflicts of interest. 4. Professional Relationship Disclosure: Board members must disclose any professional relationships, such as consulting agreements or partnerships, that could influence their decision-making regarding the corporation. 5. Other Conflict of Interest Disclosures: This category covers any other potential conflicts that do not fall under the aforementioned types, ensuring that corporations have a comprehensive understanding of any interests that may impact the board member's objectivity. Failure to disclose conflicts of interest can lead to detrimental consequences for both the corporation and the individual board member. Legal repercussions, reputational damage, or legal liability may arise if conflicts of interest are not appropriately addressed and managed. Pennsylvania Conflict of Interest Disclosure for Members of Board of Directors of Corporation establishes a framework for accountability and transparency, safeguarding the corporation's best interests and maintaining public trust. By adhering to this policy, corporations in Pennsylvania can ensure ethical corporate governance, unbiased decision-making, and sustained long-term success.

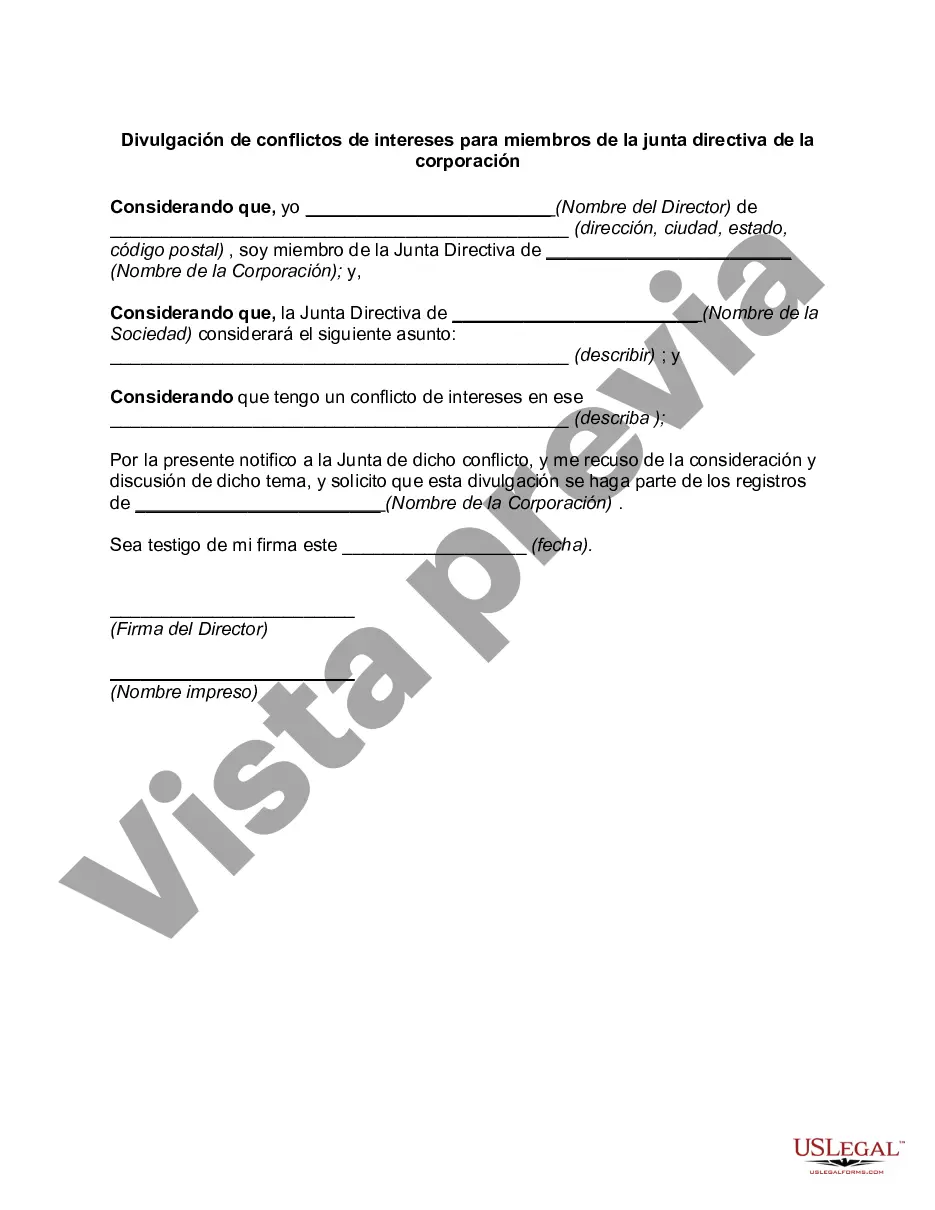

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Pennsylvania Divulgación de conflictos de intereses para miembros de la junta directiva de la corporación - Conflict of Interest Disclosure for Member of Board of Directors of Corporation

Description

How to fill out Pennsylvania Divulgación De Conflictos De Intereses Para Miembros De La Junta Directiva De La Corporación?

Finding the right legitimate document format can be quite a battle. Obviously, there are plenty of layouts accessible on the Internet, but how can you get the legitimate kind you need? Take advantage of the US Legal Forms web site. The services offers a huge number of layouts, for example the Pennsylvania Conflict of Interest Disclosure for Member of Board of Directors of Corporation, that can be used for organization and private requirements. Each of the kinds are examined by pros and fulfill state and federal needs.

If you are currently signed up, log in for your account and click the Obtain key to get the Pennsylvania Conflict of Interest Disclosure for Member of Board of Directors of Corporation. Utilize your account to check with the legitimate kinds you have ordered previously. Check out the My Forms tab of the account and obtain one more version of your document you need.

If you are a whole new user of US Legal Forms, allow me to share easy guidelines so that you can follow:

- First, be sure you have chosen the right kind for your personal town/area. You can check out the form utilizing the Preview key and look at the form explanation to ensure it is the right one for you.

- If the kind will not fulfill your needs, utilize the Seach field to obtain the appropriate kind.

- Once you are certain the form would work, click the Buy now key to get the kind.

- Choose the rates plan you want and type in the required info. Design your account and pay for the order making use of your PayPal account or bank card.

- Opt for the submit formatting and acquire the legitimate document format for your gadget.

- Full, change and print and indicator the attained Pennsylvania Conflict of Interest Disclosure for Member of Board of Directors of Corporation.

US Legal Forms is the most significant library of legitimate kinds where you can find a variety of document layouts. Take advantage of the company to acquire professionally-manufactured documents that follow status needs.