The Pennsylvania Returned Items Report is a comprehensive document that provides detailed information about returned items within the state of Pennsylvania. This report is crucial for businesses, financial institutions, and individuals to keep track of returned checks and other payment-related issues. It serves as an essential tool for maintaining financial records and identifying potential risks. The Pennsylvania Returned Items Report includes various types of returned items, such as bounced checks, rejected electronic payments, and unsuccessful direct deposits. It captures the essential details of each returned transaction, including the date, amount, payment method, reason for return, and additional accompanying information. This report enables accurate record-keeping and helps in identifying recurring issues or patterns in returned items. Pennsylvania Returned Items Report plays a vital role in assisting financial institutions in reducing losses related to returned payments. By identifying customers or account holders frequently experiencing payment return issues, financial institutions can take necessary measures to prevent or rectify potential problems. It also enables businesses to identify and address any recurring issues with their customers' payments, thus maintaining healthy customer relationships and optimizing financial management. Different types of Pennsylvania Returned Items Reports can be categorized based on the payment method, such as paper checks, electronic payments, or direct deposits. Each type of report focuses on capturing specific details relevant to the respective payment method. By segmenting the reports, businesses and financial entities can efficiently analyze and address the challenges associated with a particular payment type, enabling targeted solutions to improve payment processing and minimize returned items. Some relevant keywords for Pennsylvania Returned Items Report include: — Returned itemtrackingin— - Payment return analysis — Bounced checkreportor— - Rejected electronic payments — Pennsylvania payment return— - Failed direct deposits — Financial record-keepin— - Risk identification — Loss preventio— - Recurring payment issues — Customer paymenmanagementen— - Account holder payment analysis — Paymenreconciliationio— - Payment processing optimization — Pennsylvania financial institutions.

The Pennsylvania Returned Items Report is a comprehensive document that provides detailed information about returned items within the state of Pennsylvania. This report is crucial for businesses, financial institutions, and individuals to keep track of returned checks and other payment-related issues. It serves as an essential tool for maintaining financial records and identifying potential risks. The Pennsylvania Returned Items Report includes various types of returned items, such as bounced checks, rejected electronic payments, and unsuccessful direct deposits. It captures the essential details of each returned transaction, including the date, amount, payment method, reason for return, and additional accompanying information. This report enables accurate record-keeping and helps in identifying recurring issues or patterns in returned items. Pennsylvania Returned Items Report plays a vital role in assisting financial institutions in reducing losses related to returned payments. By identifying customers or account holders frequently experiencing payment return issues, financial institutions can take necessary measures to prevent or rectify potential problems. It also enables businesses to identify and address any recurring issues with their customers' payments, thus maintaining healthy customer relationships and optimizing financial management. Different types of Pennsylvania Returned Items Reports can be categorized based on the payment method, such as paper checks, electronic payments, or direct deposits. Each type of report focuses on capturing specific details relevant to the respective payment method. By segmenting the reports, businesses and financial entities can efficiently analyze and address the challenges associated with a particular payment type, enabling targeted solutions to improve payment processing and minimize returned items. Some relevant keywords for Pennsylvania Returned Items Report include: — Returned itemtrackingin— - Payment return analysis — Bounced checkreportor— - Rejected electronic payments — Pennsylvania payment return— - Failed direct deposits — Financial record-keepin— - Risk identification — Loss preventio— - Recurring payment issues — Customer paymenmanagementen— - Account holder payment analysis — Paymenreconciliationio— - Payment processing optimization — Pennsylvania financial institutions.

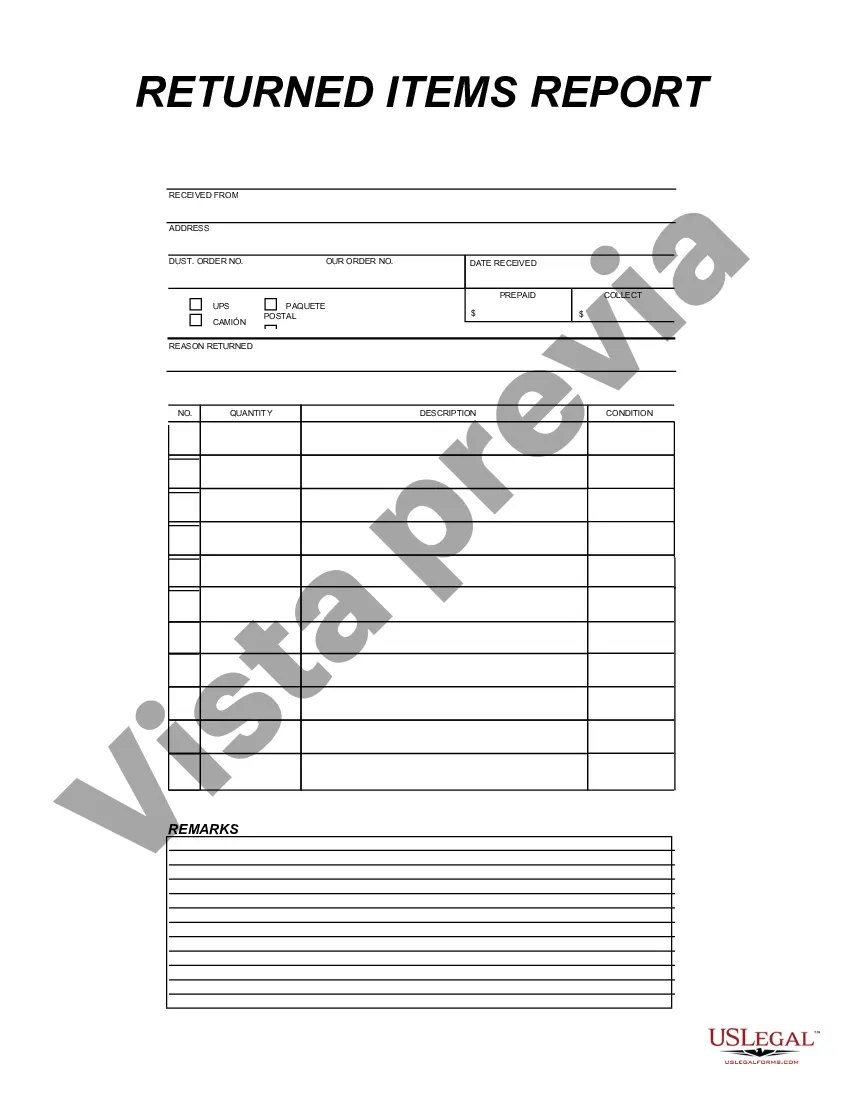

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.