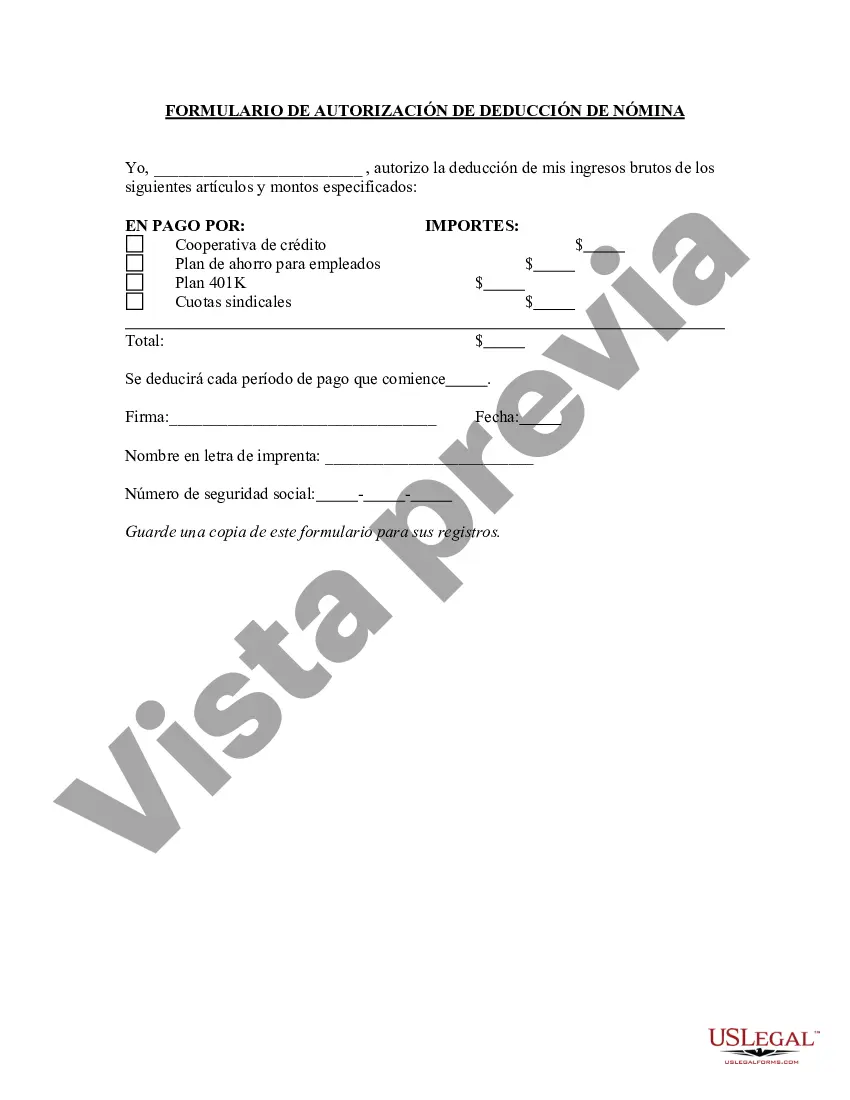

The Pennsylvania Payroll Deduction Authorization Form is a legally binding document that enables employers to withhold specific deductions from their employees' wages. This form plays a vital role in ensuring efficient record-keeping and compliance with payroll regulations in the state of Pennsylvania. One type of Pennsylvania Payroll Deduction Authorization Form is the Pennsylvania Income Execution. This form allows employers to deduct a portion of an employee's wages to satisfy court-ordered debts, such as child support or spousal maintenance. Another type of Pennsylvania Payroll Deduction Authorization Form is the Pennsylvania Wage Garnishment. This form is used when an employee's wages are subject to garnishment due to unpaid taxes, student loans, or other financial obligations. Additionally, the Pennsylvania Payroll Deduction Authorization Form is relevant for employees seeking to make voluntary deductions from their paychecks. These deductions may include contributions to retirement plans, health insurance premiums, and other employee benefits. When completing the Pennsylvania Payroll Deduction Authorization Form, the following information is typically required: employee's name, social security number, employer's name and address, deduction amount, frequency of deduction, and the purpose of the deduction. It is crucial for both employers and employees to understand the provisions outlined in the Pennsylvania Payroll Deduction Authorization Form. Employers must adhere to state and federal laws when deducting wages, while employees should carefully review the form to ensure accurate deductions and proper utilization of funds. In conclusion, the Pennsylvania Payroll Deduction Authorization Form is a crucial document in managing payroll deductions for employees in the state of Pennsylvania. Whether it is for court-ordered debts, voluntary contributions, or wage garnishments, this form ensures proper record-keeping and compliance with state regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Pennsylvania Formulario de Autorización de Deducción de Nómina - Payroll Deduction Authorization Form

Description

How to fill out Pennsylvania Formulario De Autorización De Deducción De Nómina?

Are you currently inside a position in which you need documents for either organization or personal reasons nearly every day? There are tons of authorized document layouts available on the net, but getting types you can rely on is not effortless. US Legal Forms gives a huge number of kind layouts, like the Pennsylvania Payroll Deduction Authorization Form, which can be published to meet state and federal specifications.

When you are presently informed about US Legal Forms website and have a free account, simply log in. After that, you may down load the Pennsylvania Payroll Deduction Authorization Form design.

Unless you come with an bank account and want to begin using US Legal Forms, follow these steps:

- Obtain the kind you will need and make sure it is for your proper city/state.

- Utilize the Review switch to check the shape.

- Look at the explanation to ensure that you have selected the proper kind.

- If the kind is not what you are seeking, take advantage of the Look for area to find the kind that meets your requirements and specifications.

- Whenever you discover the proper kind, click Buy now.

- Select the rates strategy you want, complete the required information and facts to generate your bank account, and purchase the order using your PayPal or Visa or Mastercard.

- Choose a handy paper file format and down load your copy.

Locate each of the document layouts you have purchased in the My Forms food selection. You can aquire a additional copy of Pennsylvania Payroll Deduction Authorization Form at any time, if needed. Just click on the required kind to down load or produce the document design.

Use US Legal Forms, probably the most substantial selection of authorized forms, to save lots of efforts and stay away from mistakes. The assistance gives skillfully created authorized document layouts that you can use for a selection of reasons. Create a free account on US Legal Forms and begin creating your life easier.