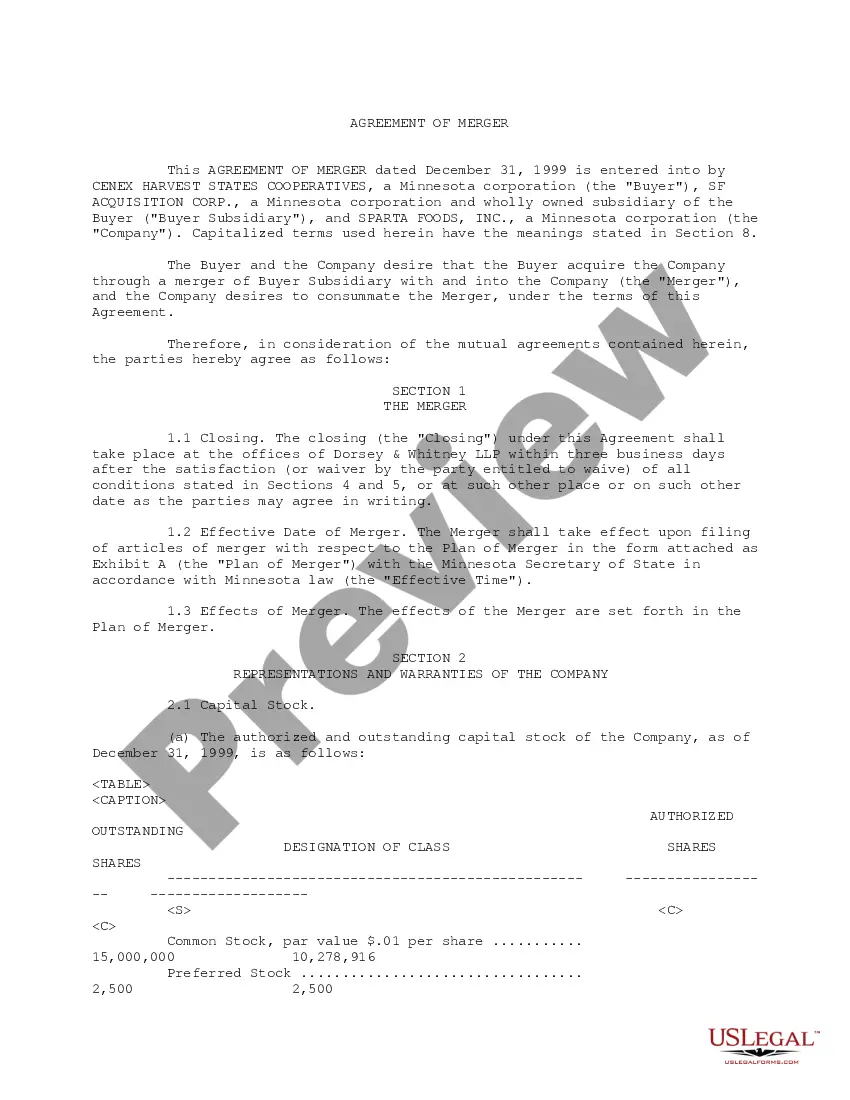

Pennsylvania Merger Agreement between Cenex Harvest States Cooperative, SF Acquisition Corporation and Sparta Foods, Inc.

Description

How to fill out Merger Agreement Between Cenex Harvest States Cooperative, SF Acquisition Corporation And Sparta Foods, Inc.?

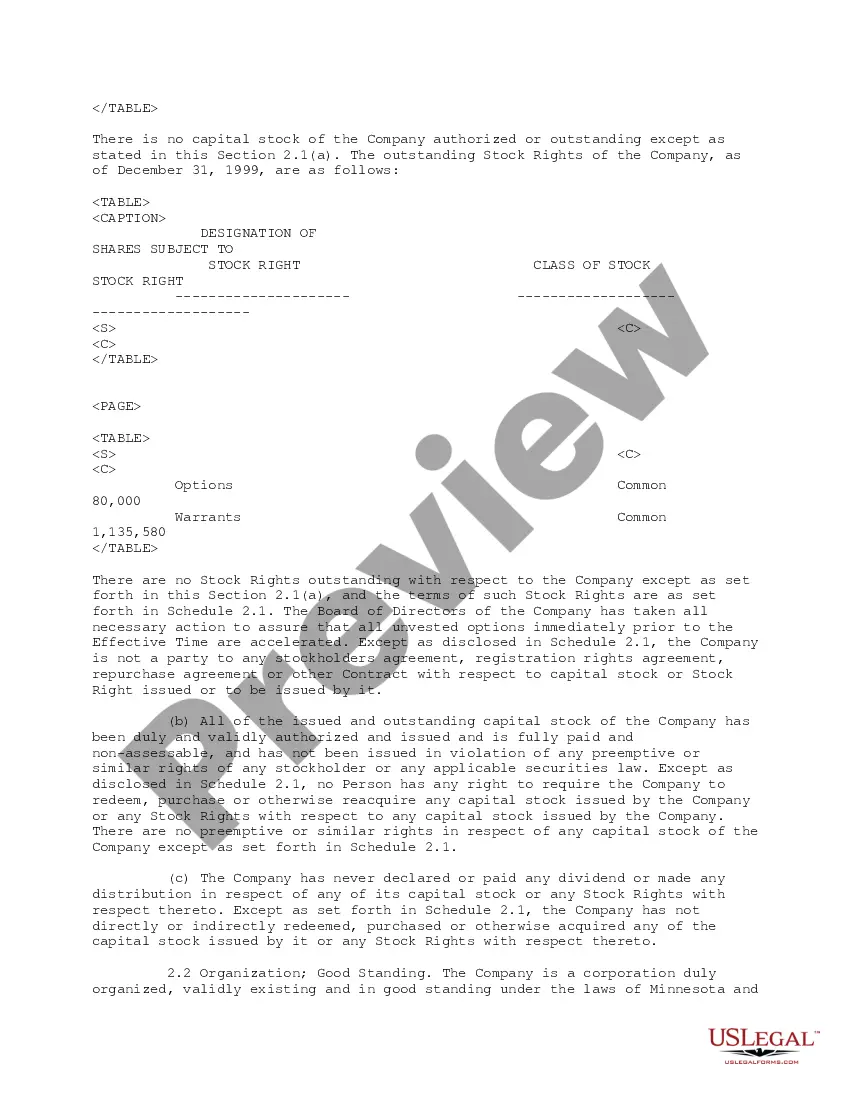

Are you in a placement the place you need to have papers for sometimes business or person uses almost every day? There are plenty of legal document themes available on the Internet, but locating ones you can trust isn`t effortless. US Legal Forms delivers a huge number of develop themes, just like the Pennsylvania Merger Agreement between Cenex Harvest States Cooperative, SF Acquisition Corporation and Sparta Foods, Inc., which are composed to fulfill federal and state needs.

If you are presently acquainted with US Legal Forms internet site and also have an account, basically log in. Afterward, you can acquire the Pennsylvania Merger Agreement between Cenex Harvest States Cooperative, SF Acquisition Corporation and Sparta Foods, Inc. web template.

If you do not provide an bank account and need to begin using US Legal Forms, abide by these steps:

- Discover the develop you need and make sure it is for the appropriate metropolis/area.

- Make use of the Review button to examine the shape.

- Look at the explanation to ensure that you have chosen the correct develop.

- In the event the develop isn`t what you`re looking for, make use of the Search industry to get the develop that meets your needs and needs.

- Once you discover the appropriate develop, just click Get now.

- Select the pricing plan you need, fill in the necessary information to generate your money, and buy the transaction with your PayPal or Visa or Mastercard.

- Choose a convenient file file format and acquire your duplicate.

Discover all the document themes you have bought in the My Forms food selection. You can obtain a more duplicate of Pennsylvania Merger Agreement between Cenex Harvest States Cooperative, SF Acquisition Corporation and Sparta Foods, Inc. anytime, if necessary. Just select the required develop to acquire or printing the document web template.

Use US Legal Forms, by far the most comprehensive variety of legal forms, to save time as well as prevent errors. The assistance delivers expertly produced legal document themes that you can use for a variety of uses. Produce an account on US Legal Forms and initiate making your way of life easier.