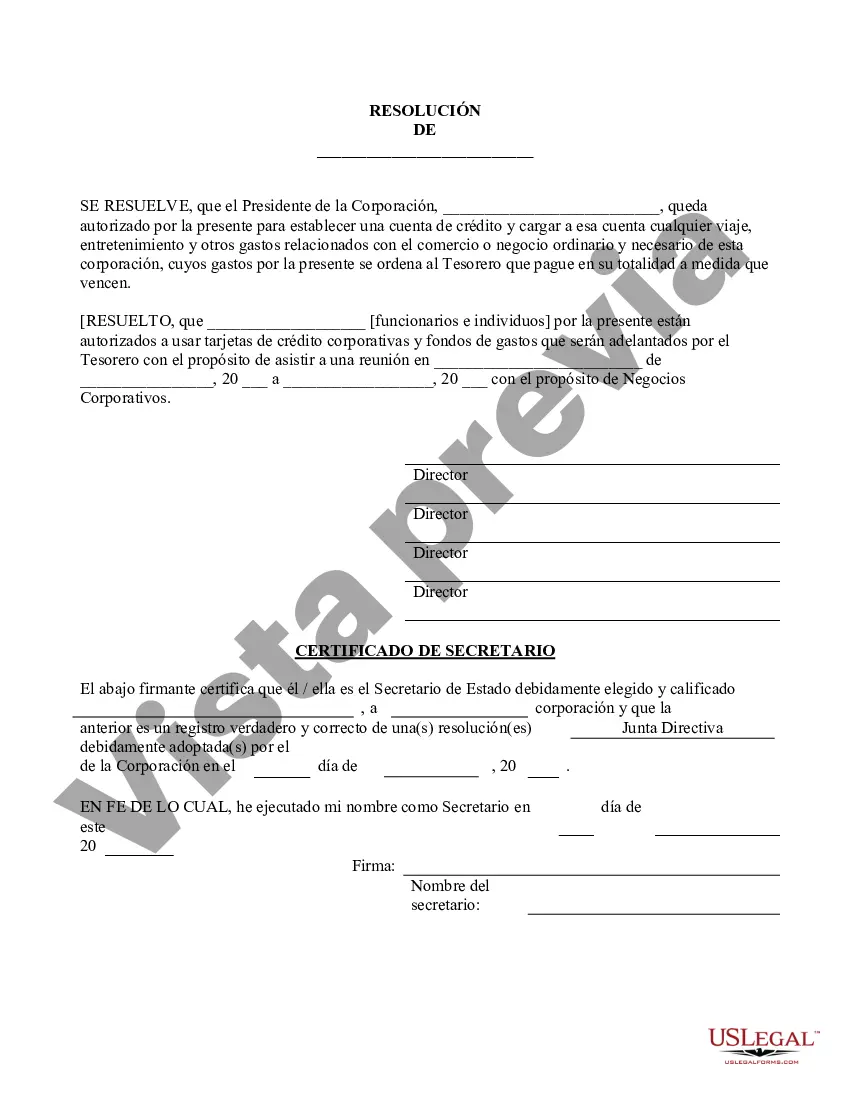

The Puerto Rico Authorization of Travel Expenses Generally or for Specific Event or Meeting — Corporate Resolution Form is a document that allows a corporation or organization to authorize and delegate the responsibility of travel expenses for employees attending a specific event or meeting. This form is specific to Puerto Rico and is used to ensure transparency and accountability in corporate travel arrangements. The form serves as a corporate resolution, which means that it requires the approval and authorization of the company's board of directors or a designated committee. It outlines the purpose of the travel, the specific event or meeting the employee is attending, and the details of the travel expenses that will be covered. The form includes relevant keywords such as "Authorization of Travel Expenses," signifying that it grants permission for the employee to incur necessary travel-related costs. It also emphasizes whether the authorization is generally applicable to all travel expenses or specific to a particular event or meeting. There may be different types of Puerto Rico Authorization of Travel Expenses Generally or for Specific Event or Meeting — Corporate Resolution Forms, depending on the scope of the authorization or the level of detail required. For example, some organizations may have a simplified version that covers general travel expenses without specifying any particular event or meeting. On the other hand, there might be forms that need to be completed for each specific event or meeting, outlining the projected expenses and the maximum reimbursement limits for each category, such as accommodation, transportation, meals, and incidental expenses. Regardless of the specific type, the purpose of the form remains the same: to formalize the authorization and delegation of travel expenses within the organization. This helps ensure that employees adhere to the company's travel policy and that there is a clear record of approved expenses for accounting and auditing purposes.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Puerto Rico Autorización de Gastos de Viaje en General o para Evento o Reunión Específica - Formulario de Resolución Corporativa - Authorization of Travel Expenses Generally or for Specific Event or Meeting - Corporate Resolution Form

Description

How to fill out Puerto Rico Autorización De Gastos De Viaje En General O Para Evento O Reunión Específica - Formulario De Resolución Corporativa?

Locating the appropriate legal document template can be quite challenging. Of course, there are numerous formats accessible online, but how can you find the legal form you require? Utilize the US Legal Forms site. The service offers thousands of formats, including the Puerto Rico Authorization of Travel Expenses Generally or for Specific Event or Meeting - Corporate Resolution Form, that you can utilize for business and personal needs. All the forms are reviewed by professionals and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Obtain button to retrieve the Puerto Rico Authorization of Travel Expenses Generally or for Specific Event or Meeting - Corporate Resolution Form. Use your account to browse through the legal forms you have acquired in the past. Go to the My documents section of your account and download another copy of the document you require.

If you are a new user of US Legal Forms, here are simple instructions that you can follow: First, ensure you have selected the correct form for your region/area. You may view the form using the Preview button and read the form description to confirm it is suitable for you. If the form does not satisfy your requirements, use the Search field to find the appropriate form. When you are sure the form is correct, click the Purchase now button to acquire the form. Select the pricing plan you want and enter the necessary information. Create your account and pay for your order using your PayPal account or credit card. Choose the file format and download the legal document template for your records. Complete, modify, print, and sign the obtained Puerto Rico Authorization of Travel Expenses Generally or for Specific Event or Meeting - Corporate Resolution Form.

- Ensure you choose the correct form for your area.

- Utilize the Preview button to check the form.

- Read the form description for confirmation.

- Search for an appropriate form if needed.

- Click the Purchase now button to acquire.

- Select the pricing plan and make payment.

Form popularity

FAQ

How to File an Annual ReportDetermine If You Need To File an Annual Report.Find Out When the Annual Report is Due.Complete the Annual Report Form.File Annual Report.Repeat the Process for Other States Where You're Registered to Do Business.Set Up Reminders for Your Next Annual Report Deadline.

The corporation will submit what is commonly called a "zero return." To file a corporate tax return with no activity, you'll need to use the regular corporation income tax return known as IRS Form 1120. Form 1120 instructions are the same for profitable companies and companies that are not transacting business.

The Puerto Rico Sales and Use Tax, or the "Impuesto a las Ventas y Uso (IVU)" in Spanish, consists of a 10.5% commonwealth-wide sales and use tax and a 1% local-option sales tax that is distributed to the city in which it is collected.

According to the Tax Foundation - a group of experts based in Washington, D.C. and whose purpose is to monitor the tax and expenditure policy of government agencies - the 11.5 percent IVU on the island is the highest in the United States, followed by Tennessee, Arkansas, Alabama, Louisiana, Washington, Oklahoma, New

An annual report begins with a letter to the shareholders, then a brief description of the business and industry. Following that, the report should include the audited financial statements: balance sheet, income statement, and statement of cash flows.

Sales and use tax: 11.5 percent on most goods and services. 10.5 percent on goods and services not subject to municipal SUT. 4 percent on designated professional services and services rendered to other merchants (Special SUT).

The Puerto Rico Sales and Use Tax (SUT, Spanish: Impuesto a las Ventas y Uso, IVU) is the combined sales and use tax applied to most sales in Puerto Rico. The Sales Tax is the amount that the consumer pays when buying items, services or when attending an entertainment venue, be it sports, recreation or exhibition.

A formal 16-page typical annual report can cost anywhere from $7,500 to $20,000. Having staff take care of internal coordination and writing can lower the price to a $6,000 $10,000 range. If your annual report needs to be bilingual, add 30-40% for producing the second language.

Annual reports must be filed electronically by accessing the Department of State website at . A $150 annual fee is payable when filing the report. The payment method is a major credit card or any other method provided at the Department of State website.

An Annual report is a filing that details a company's activities throughout the prior year. Annual reports are intended to give state governing authorities information regarding the names and addresses of directors or managing members of a corporation or LLC as well as the company and registered agent address.