- Instant access to the funds via an ATM or check card; - A check can be lost or stolen anywhere between the sender and the intended payee; - Payments made electronically can be less expensive to the payor.

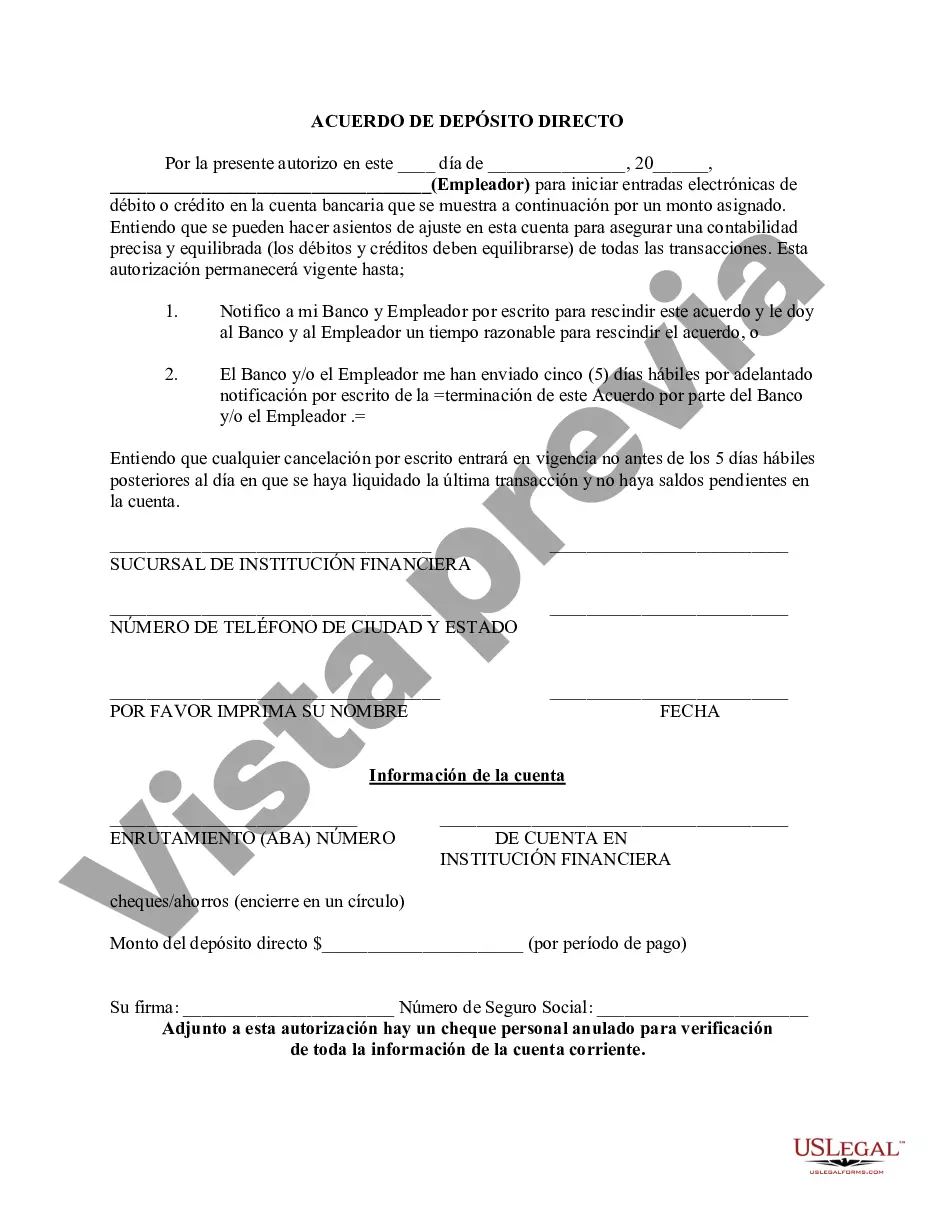

Direct deposit eliminates mailing delays and alleviates the need to go somewhere to cash or deposit your check. The Puerto Rico Direct Deposit Agreement is a contractual agreement between an individual or organization and a financial institution within Puerto Rico, outlining the terms and conditions for electronically depositing funds directly into a designated bank account. Direct deposit is a convenient and secure method for receiving payments, allowing individuals to receive their wages, benefits, tax refunds, and other forms of income directly into their bank account, without the need for a physical check. The agreement typically defines the roles and responsibilities of both parties involved in the direct deposit process. These parties include the account holder (the individual or organization receiving the funds) and the financial institution (the bank or credit union responsible for facilitating the direct deposit). The agreement may include key information such as the account holder's name and bank account details, ensuring accuracy and proper identification. It may specify the types of payments that can be deposited through this method, such as salary, pension, social security, or other government benefits. The agreement may also provide instructions for the account holder to update their direct deposit information in case of any changes. Additionally, the agreement will outline the financial institution's obligations in handling the direct deposit transactions efficiently and securely. It may include details regarding the timeliness of depositing funds, providing electronic notifications or statements, and any fees or charges associated with the direct deposit service. It is important to note that although the Puerto Rico Direct Deposit Agreement generally follows a similar structure, the specific terms and conditions may vary among different financial institutions. Each bank or credit union may have its own agreement that aligns with its policies and procedures. Therefore, it is crucial for individuals or organizations to carefully review and understand the terms of their specific direct deposit agreement with their chosen financial institution.

The Puerto Rico Direct Deposit Agreement is a contractual agreement between an individual or organization and a financial institution within Puerto Rico, outlining the terms and conditions for electronically depositing funds directly into a designated bank account. Direct deposit is a convenient and secure method for receiving payments, allowing individuals to receive their wages, benefits, tax refunds, and other forms of income directly into their bank account, without the need for a physical check. The agreement typically defines the roles and responsibilities of both parties involved in the direct deposit process. These parties include the account holder (the individual or organization receiving the funds) and the financial institution (the bank or credit union responsible for facilitating the direct deposit). The agreement may include key information such as the account holder's name and bank account details, ensuring accuracy and proper identification. It may specify the types of payments that can be deposited through this method, such as salary, pension, social security, or other government benefits. The agreement may also provide instructions for the account holder to update their direct deposit information in case of any changes. Additionally, the agreement will outline the financial institution's obligations in handling the direct deposit transactions efficiently and securely. It may include details regarding the timeliness of depositing funds, providing electronic notifications or statements, and any fees or charges associated with the direct deposit service. It is important to note that although the Puerto Rico Direct Deposit Agreement generally follows a similar structure, the specific terms and conditions may vary among different financial institutions. Each bank or credit union may have its own agreement that aligns with its policies and procedures. Therefore, it is crucial for individuals or organizations to carefully review and understand the terms of their specific direct deposit agreement with their chosen financial institution.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.