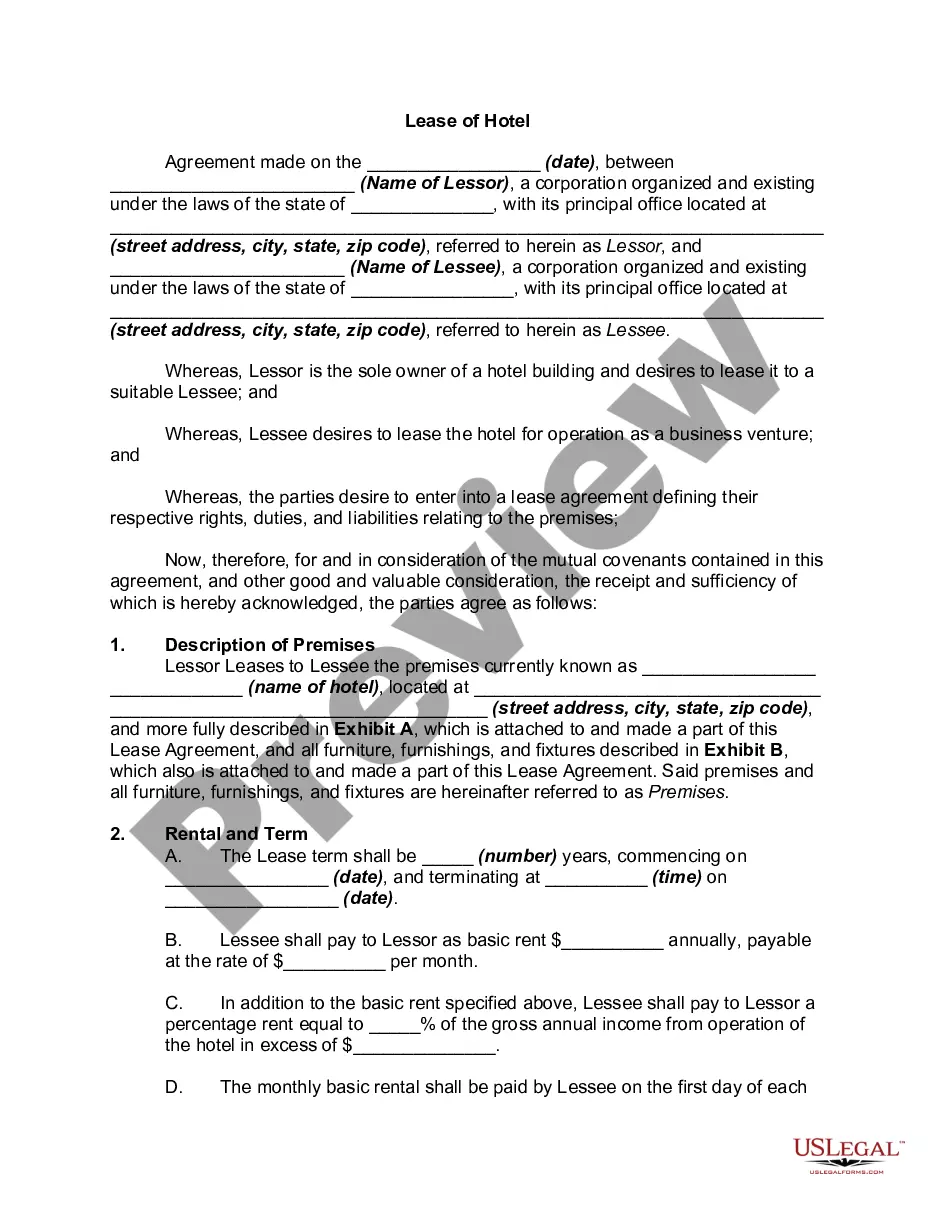

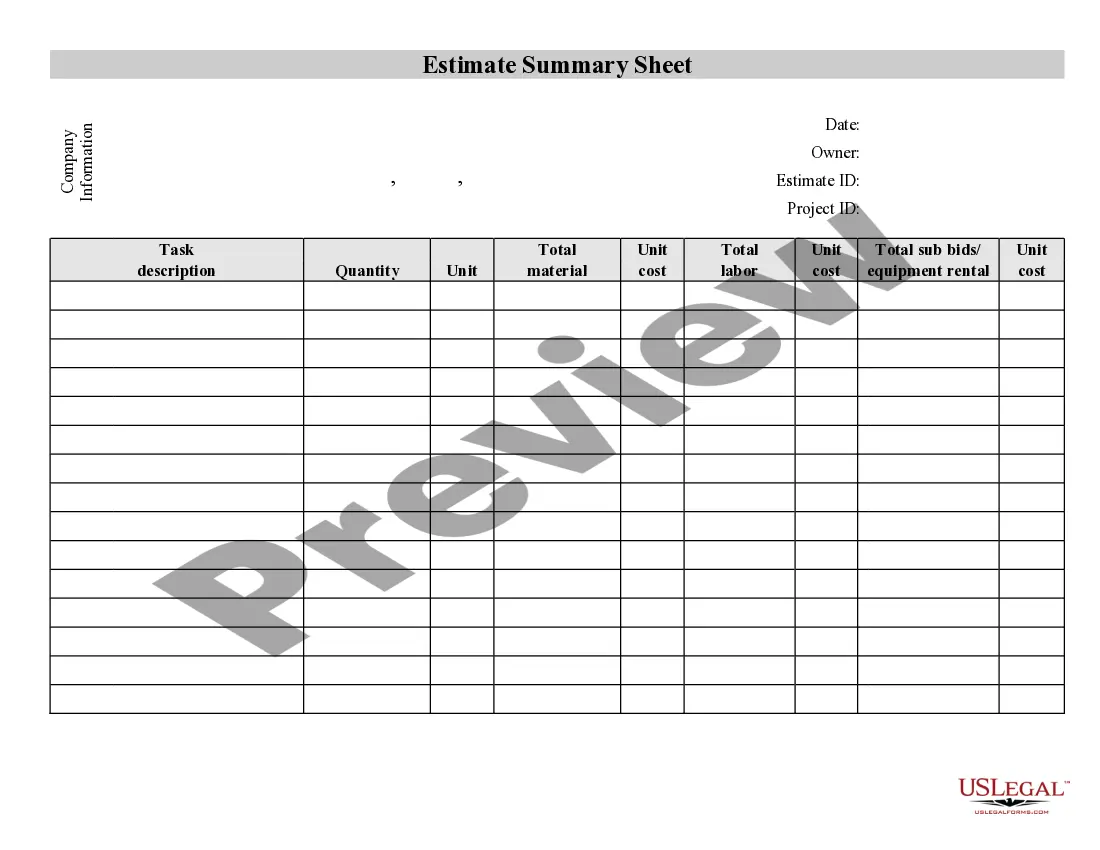

Puerto Rico Contractor's Summary of an Estimate

Description

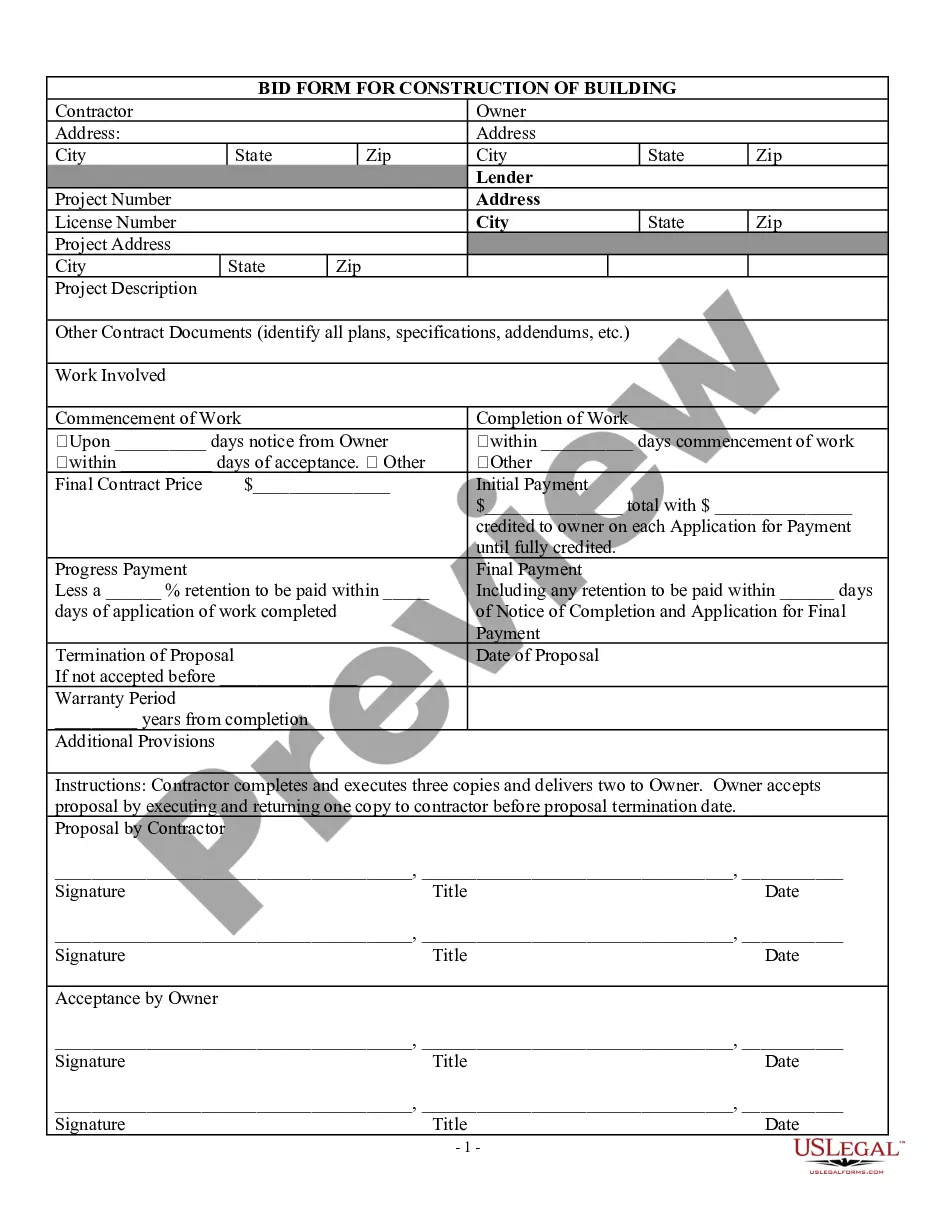

How to fill out Contractor's Summary Of An Estimate?

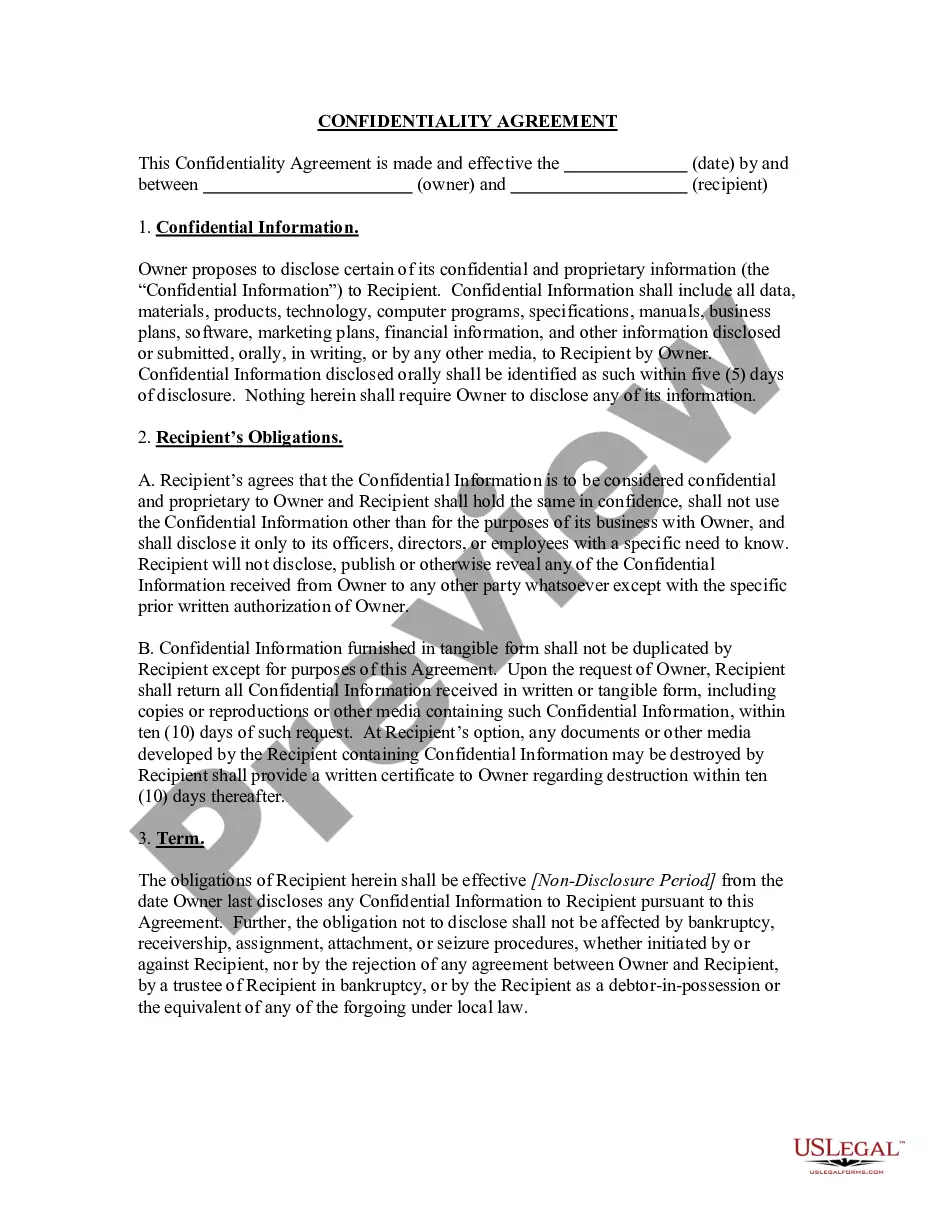

US Legal Forms - one of the largest collections of legal documents in the United States - offers a range of legal form templates that you can obtain or print.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can obtain the latest versions of forms such as the Puerto Rico Contractor's Summary of an Estimate in just moments.

If you already have a monthly subscription, Log In and retrieve the Puerto Rico Contractor's Summary of an Estimate from the US Legal Forms library. The Download button will be visible on each form you view. You can access all previously saved forms in the My documents section of your account.

Complete the purchase. Use your credit card or PayPal account to finalize the purchase.

Select the format and download the form onto your device. Edit it. Complete, modify, and print and sign the saved Puerto Rico Contractor's Summary of an Estimate. Each template you added to your account has no expiration date and is yours indefinitely. Therefore, if you need to download or print another copy, simply visit the My documents section and click on the form you need. Access the Puerto Rico Contractor's Summary of an Estimate with US Legal Forms, the most extensive collection of legal document templates. Utilize a vast selection of professional and state-specific templates that cater to your business or personal needs.

- Ensure you have chosen the correct form for your city/region.

- Click on the Preview button to examine the form's content.

- Review the form summary to confirm you have selected the right form.

- If the form does not meet your requirements, utilize the Search field at the top of the screen to find the one that does.

- Once you are satisfied with the form, finalize your choice by clicking the Purchase now button.

- Next, select the payment plan you prefer and provide your details to create an account.

Form popularity

FAQ

Cost Estimating Format (Tool) for Large Construction Projects. FEMA's Cost Estimating Format (CEF) is a uniform methodology that is applied when determining the cost of eligible permanent work for large construction projects.

The minimum wage under the Fair Labor Standards Act (FLSA) is generally applicable to any state, territory, or possession of the United States such as Puerto Rico, the Virgin Islands, Guam, American Samoa, and the Commonwealth of the Northern Mariana Islands (CNMI).

From an employment law perspective, this means federal statutes such as Title VII, FLSA, ADA, ADEA, FMLA, USERRA, OSHA, ERISA, COBRA, among others, apply to Puerto Rico. For stateside employers, that is the easy part.

Even though you may be covered by these laws, your employee may not be. Title VII and the ADA protect any U.S. citizen employed outside of the United States, absent any conflict with foreign law (not a foreign practice, policy, custom or preference) or employed in the U.S. by a foreign employer.

Employment law in Puerto Rico is covered both by U.S. labor law and Puerto Rico's Constitution, which affirms the right of employees to choose their occupation, to have a reasonable minimum salary, a regular workday not exceeding eight hours, and to receive overtime compensation for work beyond eight hours.

As Puerto Rico is subject to US federal law, to qualify as an exempt or "white-collar" employee, an employee must meet the requirements of the Fair Labor Standards Act (FLSA).

Bid Estimates: Contractors prepare bid estimates when bidding to construct the project. Contractors will draw from a number of data points to prepare their estimates, including direct costs, supervision costs, subcontractor quotes, and quantity take-offs.

Section 403 of PROMESA modified Section 6(g) of the Fair Labor Standards Act (FLSA) to allow employers to pay employees in Puerto Rico who are under the age of 25 years a subminimum wage of not less than $4.25 per hour for the first 90 consecutive calendar days after initial employment by their employer.

Puerto Rico is not an 'employment at will' jurisdiction. Thus, an indefinite-term employee discharged without just cause is entitled to receive a statutory discharge indemnity (or severance payment) based on the length of service and a statutory formula.

Section 403 of PROMESA modified Section 6(g) of the Fair Labor Standards Act (FLSA) to allow employers to pay employees in Puerto Rico who are under the age of 25 years a subminimum wage of not less than $4.25 per hour for the first 90 consecutive calendar days after initial employment by their employer.