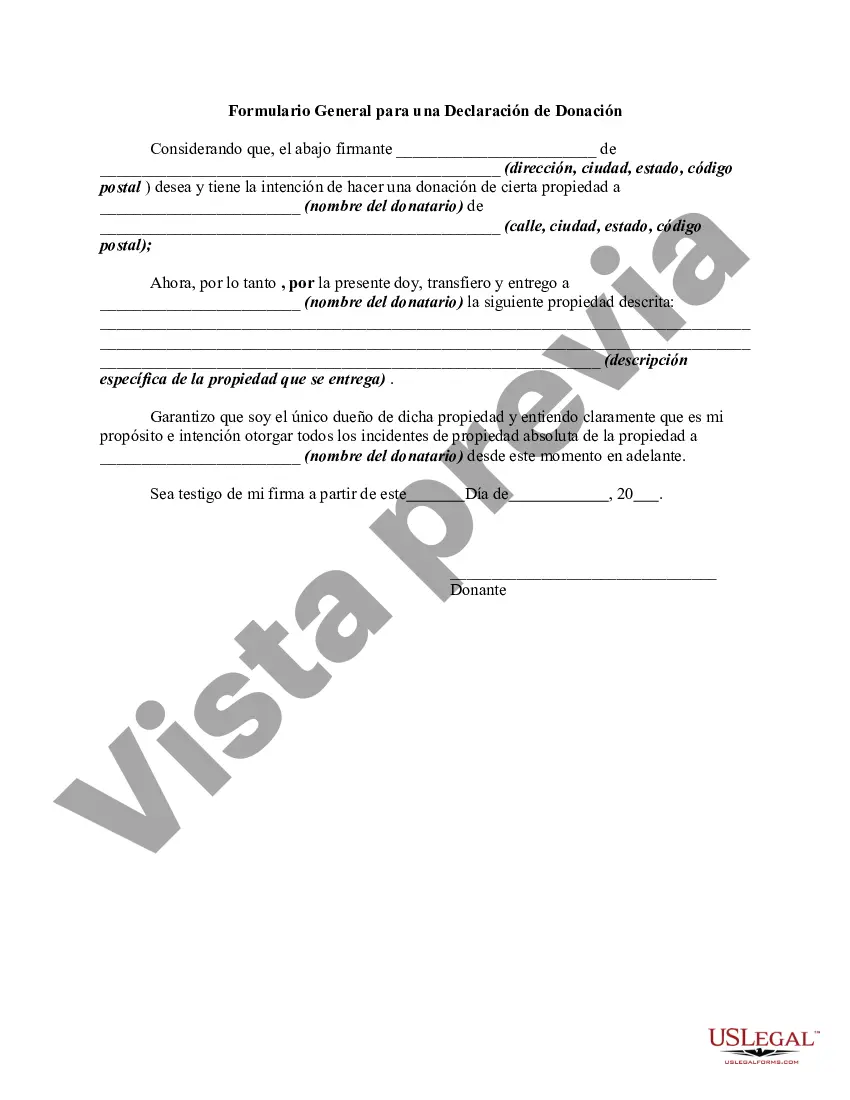

The following form is a general form for a declaration of a gift of property.

Puerto Rico Declaration of Gift is a legal document that establishes the intention of transferring ownership of a gift from one party to another within the jurisdiction of Puerto Rico. It serves as an official declaration, ensuring the proper record and recognition of the gift transaction. The declaration is regulated under Puerto Rico's civil code and must comply with specific requirements for its validity. The Puerto Rico Declaration of Gift typically includes essential information, such as the identification of the donor (person giving the gift) and the recipient (person receiving the gift), a detailed description of the gift itself, and the intent of the transfer. The declaration also captures any conditions or restrictions attached to the gift, if applicable. It is crucial to draft the declaration with accuracy and clarity to avoid any potential legal disputes or uncertainty. Various types of Puerto Rico Declaration of Gifts may exist, depending on the nature of the gift and its characteristics. Some common types include: 1. Real Estate Gift Declaration: This type of declaration revolves around the transfer of ownership of a real property, such as land, buildings, or a combined asset, from the donor to the recipient as a gift. It includes details like property description, location, and any liens or encumbrances. 2. Vehicle Gift Declaration: This form of declaration applies to the gifting of motor vehicles, including cars, motorcycles, or boats. It entails providing details such as the vehicle's make, model, year, identification number, and registration information. 3. Monetary Gift Declaration: In the case of a cash gift, a monetary gift declaration is used. It specifies the exact amount given by the donor, and both parties' identities to formalize the transaction and eliminate any potential tax or legal implications. 4. Personal Property Gift Declaration: Personal property declarations cover gifts of tangible movable assets like jewelry, artwork, furniture, or any other possessions. The document should describe the properties in detail to accurately establish their transfer. It is important to note that engaging the assistance of an attorney or notary public familiar with Puerto Rican laws and regulations can streamline the process of drafting and executing a Puerto Rico Declaration of Gift. Expert advice ensures adherence to the specific requirements for each type of gift declaration, thus safeguarding the legal rights of both the donor and recipient.Puerto Rico Declaration of Gift is a legal document that establishes the intention of transferring ownership of a gift from one party to another within the jurisdiction of Puerto Rico. It serves as an official declaration, ensuring the proper record and recognition of the gift transaction. The declaration is regulated under Puerto Rico's civil code and must comply with specific requirements for its validity. The Puerto Rico Declaration of Gift typically includes essential information, such as the identification of the donor (person giving the gift) and the recipient (person receiving the gift), a detailed description of the gift itself, and the intent of the transfer. The declaration also captures any conditions or restrictions attached to the gift, if applicable. It is crucial to draft the declaration with accuracy and clarity to avoid any potential legal disputes or uncertainty. Various types of Puerto Rico Declaration of Gifts may exist, depending on the nature of the gift and its characteristics. Some common types include: 1. Real Estate Gift Declaration: This type of declaration revolves around the transfer of ownership of a real property, such as land, buildings, or a combined asset, from the donor to the recipient as a gift. It includes details like property description, location, and any liens or encumbrances. 2. Vehicle Gift Declaration: This form of declaration applies to the gifting of motor vehicles, including cars, motorcycles, or boats. It entails providing details such as the vehicle's make, model, year, identification number, and registration information. 3. Monetary Gift Declaration: In the case of a cash gift, a monetary gift declaration is used. It specifies the exact amount given by the donor, and both parties' identities to formalize the transaction and eliminate any potential tax or legal implications. 4. Personal Property Gift Declaration: Personal property declarations cover gifts of tangible movable assets like jewelry, artwork, furniture, or any other possessions. The document should describe the properties in detail to accurately establish their transfer. It is important to note that engaging the assistance of an attorney or notary public familiar with Puerto Rican laws and regulations can streamline the process of drafting and executing a Puerto Rico Declaration of Gift. Expert advice ensures adherence to the specific requirements for each type of gift declaration, thus safeguarding the legal rights of both the donor and recipient.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.