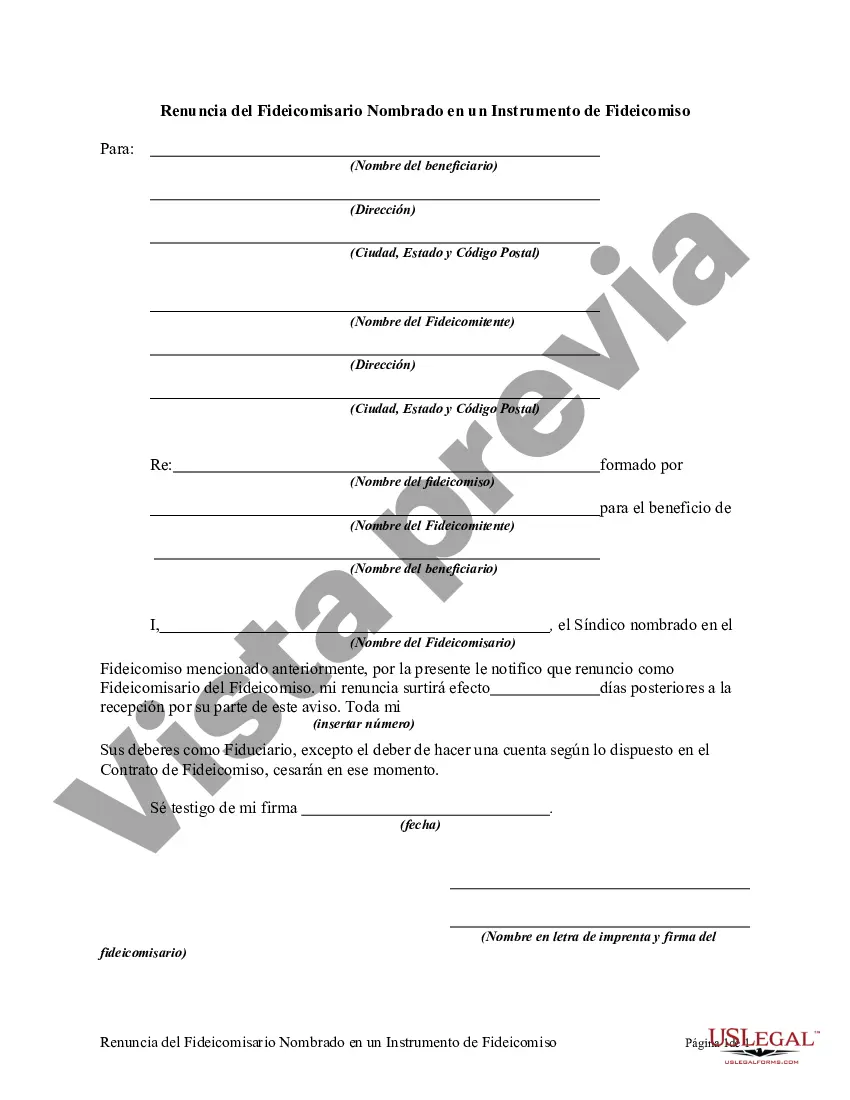

A well drafted trust instrument will generally prescribe the method and manner of substitution, succession, and selection of successor trustees. Such provisions must be carefully followed. A trustee may be given the power to appoint his or her own successor. Also, a trustor may reserve, or a beneficiary may be given, the power to change trustees. This form is a sample of a resignation by the trustee prior to the appointment of a new trustee.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Puerto Rico Resignation by Trustee Named in a Trust Instrument refers to the legal process through which a trustee designated in a trust instrument voluntarily relinquishes their role and responsibilities as a trustee in Puerto Rico. A trustee is an individual or entity appointed to manage and administer assets within a trust for the benefit of designated beneficiaries. In Puerto Rico, there are different types of resignations that can be made by a trustee who is specifically named in a trust instrument. These may include: 1. Voluntary Resignation: This occurs when a trustee chooses to step down from their role voluntarily, without any external pressure or legal obligation. The trustee typically provides written notice to the trust beneficiaries and co-trustees, outlining their intention to resign and the effective date of the resignation. Proper handover and transfer of trust assets and responsibilities are crucial during this transition. 2. Resignation with Court Approval: In some cases, a trustee may seek court approval for their resignation if there are potential conflicts or disputes among the beneficiaries or if the trust instrument itself requires court confirmation for a trustee's resignation. The trustee must convince the court that their resignation is in the best interests of the beneficiaries and that they have fulfilled their fiduciary duties. 3. Resignation due to Incapacity or Death: A trustee named in a trust instrument may need to resign their position if they become incapacitated or pass away. In such circumstances, a successor trustee or an individual authorized by the trust instrument will generally step into the role to ensure the continued administration of the trust. 4. Resignation for Cause: A trustee named in a trust instrument can also resign for cause, which may occur if they breach their fiduciary duties, engage in misconduct, or are unable to fulfill their obligations effectively. In such scenarios, the resignation may be accompanied by legal consequences, and the court may appoint a new trustee to restore trust administration. 5. Partial Resignation: Sometimes, a trustee named in a trust instrument wishes to resign from only certain responsibilities assigned to them under the trust (e.g., investment management), while still maintaining their role in other areas. A partial resignation should be clearly communicated and documented to ensure smooth coordination with any co-trustees and minimize any potential disruption to trust administration. It is essential to consult with an experienced attorney or legal advisor in Puerto Rico to ensure compliance with specific jurisdictional requirements and to address any complexities that may arise during the Puerto Rico Resignation by Trustee Named in a Trust Instrument process.

Puerto Rico Resignation by Trustee Named in a Trust Instrument refers to the legal process through which a trustee designated in a trust instrument voluntarily relinquishes their role and responsibilities as a trustee in Puerto Rico. A trustee is an individual or entity appointed to manage and administer assets within a trust for the benefit of designated beneficiaries. In Puerto Rico, there are different types of resignations that can be made by a trustee who is specifically named in a trust instrument. These may include: 1. Voluntary Resignation: This occurs when a trustee chooses to step down from their role voluntarily, without any external pressure or legal obligation. The trustee typically provides written notice to the trust beneficiaries and co-trustees, outlining their intention to resign and the effective date of the resignation. Proper handover and transfer of trust assets and responsibilities are crucial during this transition. 2. Resignation with Court Approval: In some cases, a trustee may seek court approval for their resignation if there are potential conflicts or disputes among the beneficiaries or if the trust instrument itself requires court confirmation for a trustee's resignation. The trustee must convince the court that their resignation is in the best interests of the beneficiaries and that they have fulfilled their fiduciary duties. 3. Resignation due to Incapacity or Death: A trustee named in a trust instrument may need to resign their position if they become incapacitated or pass away. In such circumstances, a successor trustee or an individual authorized by the trust instrument will generally step into the role to ensure the continued administration of the trust. 4. Resignation for Cause: A trustee named in a trust instrument can also resign for cause, which may occur if they breach their fiduciary duties, engage in misconduct, or are unable to fulfill their obligations effectively. In such scenarios, the resignation may be accompanied by legal consequences, and the court may appoint a new trustee to restore trust administration. 5. Partial Resignation: Sometimes, a trustee named in a trust instrument wishes to resign from only certain responsibilities assigned to them under the trust (e.g., investment management), while still maintaining their role in other areas. A partial resignation should be clearly communicated and documented to ensure smooth coordination with any co-trustees and minimize any potential disruption to trust administration. It is essential to consult with an experienced attorney or legal advisor in Puerto Rico to ensure compliance with specific jurisdictional requirements and to address any complexities that may arise during the Puerto Rico Resignation by Trustee Named in a Trust Instrument process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.