With regard to the collection part of this form agreement, the Federal Fair Debt Collection Practices Act prohibits harassment or abuse in collecting a debt such as threatening violence, use of obscene or profane language, publishing lists of debtors who refuse to pay debts, or even harassing a debtor by repeatedly calling the debtor on the phone. Also, certain false or misleading representations are forbidden, such as representing that the debt collector is associated with the state or federal government, stating that the debtor will go to jail if he does not pay the debt. This Act also sets out strict rules regarding communicating with the debtor.

Puerto Rico Agreement for Sale and Purchase of Accounts Receivable of Business with Seller Agreeing to Collect the Accounts Receivable

Description

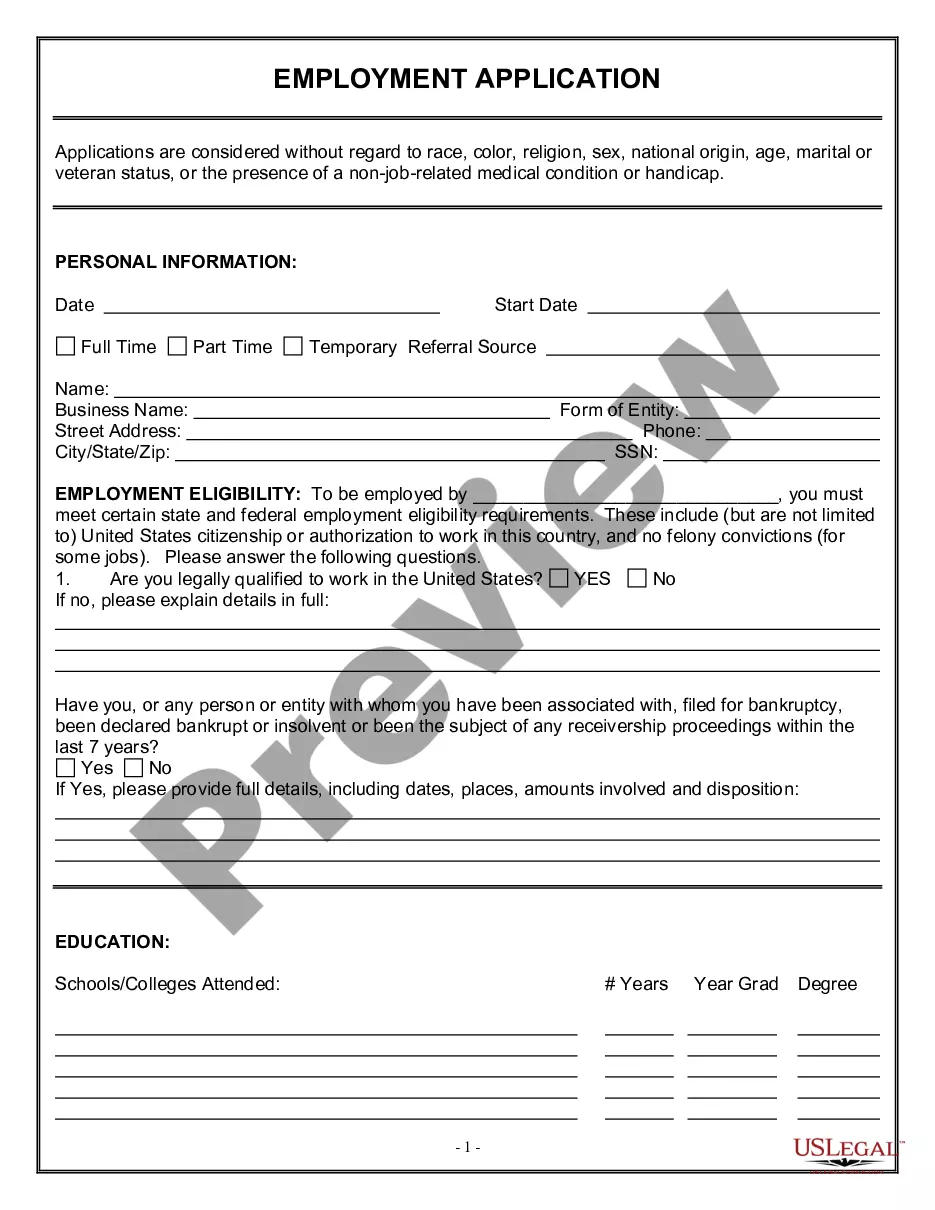

How to fill out Agreement For Sale And Purchase Of Accounts Receivable Of Business With Seller Agreeing To Collect The Accounts Receivable?

You can devote several hours online searching for the sanctioned document template that complies with the federal and state requirements you will need.

US Legal Forms offers a wide array of authorized forms that can be reviewed by specialists.

You can acquire or print the Puerto Rico Agreement for Sale and Purchase of Accounts Receivable of Business with Seller consenting to collect the Accounts Receivable with your assistance.

If available, utilize the Review option to view the document template simultaneously.

- If you already possess a US Legal Forms account, you can Log In and then click the Obtain option.

- Following that, you can complete, modify, print, or sign the Puerto Rico Agreement for Sale and Purchase of Accounts Receivable of Business with Seller consenting to collect the Accounts Receivable.

- Each authorized document template you acquire remains yours forever.

- To obtain another version of any acquired form, navigate to the My documents tab and click the corresponding option.

- If you are visiting the US Legal Forms site for the first time, adhere to the simple guidelines below.

- First, confirm that you have selected the correct document template for the area/town of your choice.

- Review the form description to ensure that you have chosen the correct template.

Form popularity

FAQ

A receivables purchase agreement is a contract between two or more parties, usually a buyer or a customer and a seller. This contract is often a kind of purchase arrangement that outlines the terms and conditions of the sale.

Receivables purchase agreements allow a company to sell off the as-yet-unpaid bills from its customers, or "receivables." The agreement is a contract in which the seller gets cash upfront for the receivables, while the buyer gets the right to collect the receivables.

Otherwise known as the escape clause, the cash out clause gives the seller the right to cancel a sale and purchase agreement if they receive a better offer.

Receivables purchase agreements (RPAs) are financing arrangements that can unlock the value of a company's accounts receivable. Here's how they work: A "Seller" will sell its goods to a customer (1). The customer becomes an "Account Debtor" since it owes the Seller a Debt for those goods (2).

An accounts receivable purchase agreement is a contract between a buyer and seller. The seller sells receivables to get cash up front, and the buyer has the right to collect the receivables from the original customer.

A sales and purchase agreement (SPA) is a binding legal contract between two parties that obligates a transaction between a buyer and a seller. SPAs are typically used for real estate transactions, but they are found in all areas of business.

The primary difference between factoring and bank financing with accounts receivables involves the ownership of the invoices. Factors actually buy your invoices at a discounted rate, while banks require you to pledge or assign the invoices as collateral for a loan.

While you definitely need a lawyer to complete the settlement of your sale, you technically don't need a lawyer to sign a 'Sale and Purchase Agreement'. However, it's wise to speak to your lawyer as soon as you have decided to put your property on the market.

One strategic financing option that is gaining popularity is an accounts receivable (A/R) purchase program. In an A/R purchase program, a bank typically purchases a corporation's receivables as soon as the company delivers goods to its customer and issues an invoice.