The Puerto Rico Agreement to Incorporate by Partners Incorporating Existing Partnership is a legal document that outlines the process of transforming an existing partnership into a corporation in the beautiful Caribbean island of Puerto Rico. This agreement is crucial for partners who seek to establish a corporate entity while preserving the essence of their successful partnership. Partnerships in Puerto Rico can take various forms, including general partnerships, limited partnerships, limited liability partnerships (Laps), and limited liability limited partnerships (Helps). Regardless of the partnership type, partners can choose to adopt the benefits and structure of a corporation through this Agreement to Incorporate. By opting to incorporate, partners gain advantages such as limited liability protection, capital raising capabilities, perpetual existence, and potential tax benefits, among others. This agreement serves as a blueprint for executing the incorporation process smoothly while maintaining the original intent and purpose of the partnership. Keywords: Puerto Rico, Agreement to Incorporate, partners, existing partnership, transforming, corporation, legal document, general partnership, limited partnership, limited liability partnership, limited liability limited partnership, benefits, structure, limited liability protection, capital raising, perpetual existence, tax benefits, incorporation process, blueprint, intent, purpose.

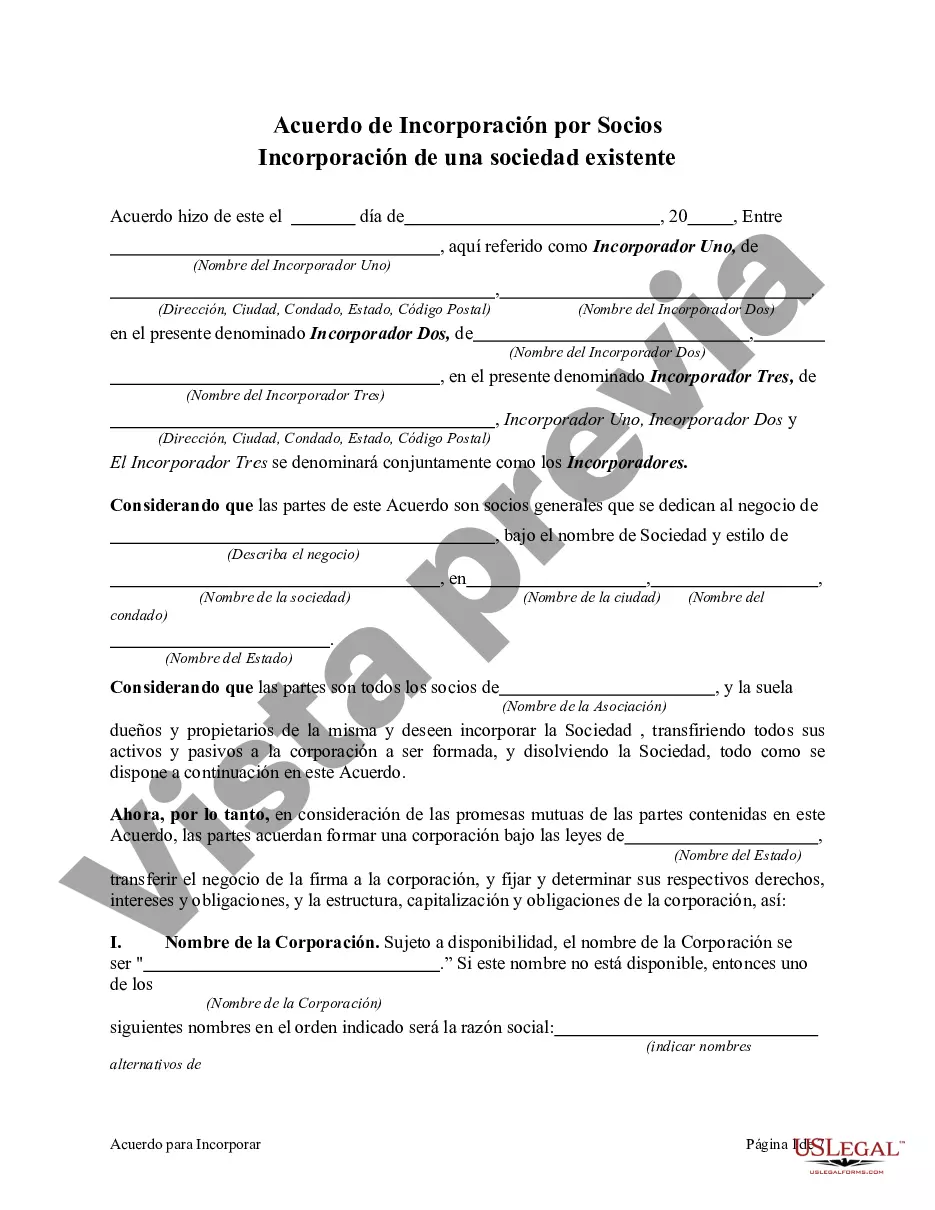

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Puerto Rico Acuerdo para incorporar por socios que incorporan sociedad existente - Agreement to Incorporate by Partners Incorporating Existing Partnership

Description

How to fill out Puerto Rico Acuerdo Para Incorporar Por Socios Que Incorporan Sociedad Existente?

Choosing the right lawful document web template can be quite a have difficulties. Naturally, there are tons of templates accessible on the Internet, but how will you get the lawful kind you will need? Take advantage of the US Legal Forms internet site. The services gives 1000s of templates, including the Puerto Rico Agreement to Incorporate by Partners Incorporating Existing Partnership, which can be used for company and private requirements. Each of the kinds are inspected by pros and meet federal and state needs.

In case you are presently listed, log in to your profile and click on the Obtain option to get the Puerto Rico Agreement to Incorporate by Partners Incorporating Existing Partnership. Utilize your profile to look throughout the lawful kinds you possess purchased formerly. Go to the My Forms tab of your profile and acquire an additional backup of your document you will need.

In case you are a fresh consumer of US Legal Forms, listed here are simple directions that you should comply with:

- Very first, ensure you have selected the proper kind to your city/region. It is possible to check out the form utilizing the Preview option and study the form outline to ensure this is basically the right one for you.

- If the kind does not meet your preferences, utilize the Seach industry to discover the correct kind.

- When you are certain the form is acceptable, go through the Purchase now option to get the kind.

- Pick the costs strategy you need and enter in the needed details. Build your profile and pay money for your order making use of your PayPal profile or credit card.

- Opt for the submit format and obtain the lawful document web template to your product.

- Complete, modify and print and sign the received Puerto Rico Agreement to Incorporate by Partners Incorporating Existing Partnership.

US Legal Forms may be the most significant local library of lawful kinds for which you can see different document templates. Take advantage of the company to obtain expertly-produced papers that comply with express needs.