Once a debt collector receives written notice from a consumer that the consumer refuses to pay the debt or wants the collector to stop further collection efforts, the debt collector must cease communications with the consumer except:

To advise the consumer that they are terminating their debt collecting efforts;

To notify the consumer that the debt collector or creditor may invoke specified remedies which they ordinarily invoke; and

To notify the consumer that the debt collector or creditor intends to invoke a specified remedy.

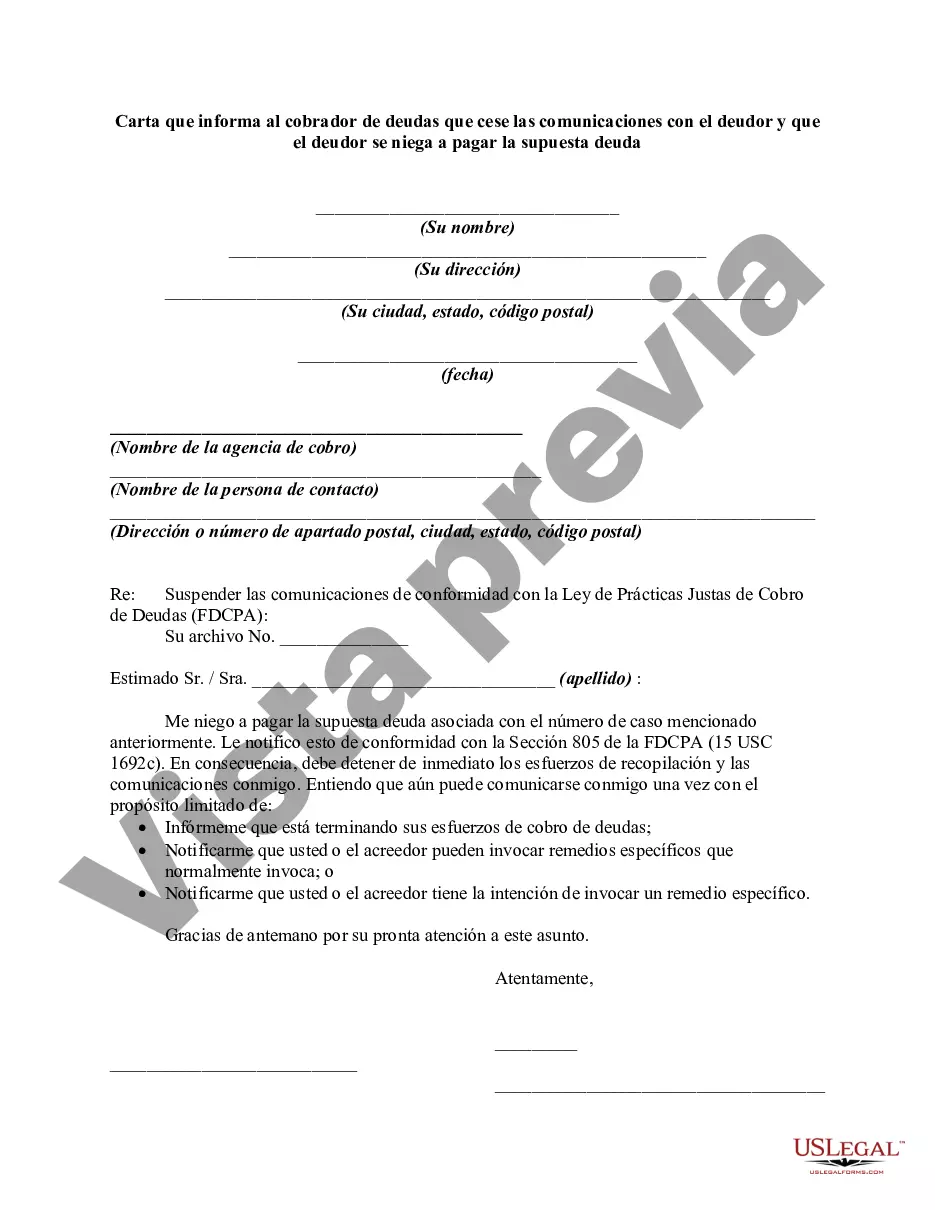

Dear [Debt Collector's Name], RE: CEASE COMMUNICATION AND ALLEGED DEBT NOTICE — Puerto Rico I am writing to inform you, as a debt collector, about the cessation of all further communications regarding the alleged debt associated with the individual named [Debtor's Name]. Please take note that this letter serves as a formal request, according to the Fair Debt Collection Practices Act (FD CPA), to cease all future communications with the debtor regarding this alleged debt, as well as any other associated parties. Firstly, it is important to clarify the nature of this communication. This letter specifically pertains to Puerto Rico, an unincorporated territory of the United States. Puerto Rico is a unique jurisdiction with certain legal distinctions and regulations that must be considered within the context of debt collection. Moving on, please be advised that the debtor, [Debtor's Name], categorically denies the existence of any liability or obligation pertaining to the alleged debt. There is no legal basis or supporting documentation provided to substantiate the validity of this claimed debt. Therefore, the alleged debt is hereby disputed. It is essential that all future communications from your agency regarding this matter cease immediately and that you update your records accordingly. Any further contact, whether written or verbal, with [Debtor's Name], their family members, colleagues, or references will be considered a violation of their rights as provided under the FD CPA. Furthermore, please note that the debtor wishes to exercise their rights under the FD CPA and requests that you provide validation of the alleged debt as per Section 809(b) of the Act. This validation should include: 1. Documentation providing evidence of the debt, including the original creditor's information, date of the original debt, and any subsequent assignments or transfers. 2. Verification of your authority to collect the alleged debt. 3. A complete payment history, including all fees, charges, and interest applied. 4. Copies of any written agreements or contracts related to the alleged debt. 5. Proof that the statute of limitations on this debt has not expired. 6. Verification that you are licensed to practice debt collection in Puerto Rico, as required by local laws and regulations. Unless you can provide sufficient documentation to validate the debt, any future communication or attempts to collect this alleged debt will be considered harassment and an infringement of the debtor's rights. Additionally, we hereby request that all relevant records and documents related to this alleged debt be preserved within your agency's database. This includes call recordings, letters, and any other communications related to the debtor. We anticipate your immediate compliance with this request and expect written confirmation, via return mail, that you have ceased all communications regarding this alleged debt. Failure to do so will result in legal action being pursued to protect the debtor's rights under the FD CPA, as well as any other applicable state and local laws. Thank you for your attention to this matter. Sincerely, [Your Name] [Your Address] [City, State, ZIP Code] [Phone Number] [Email Address]

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.