This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

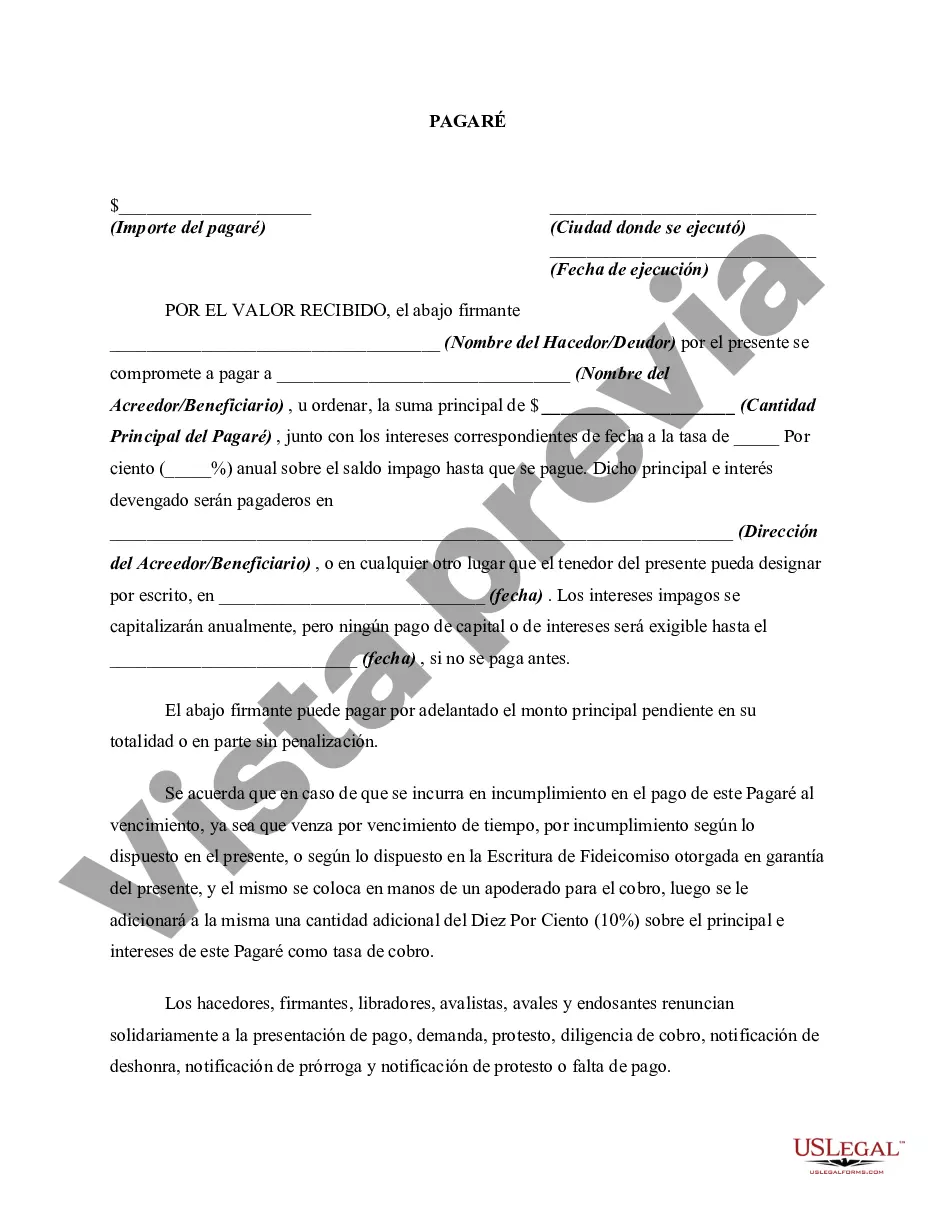

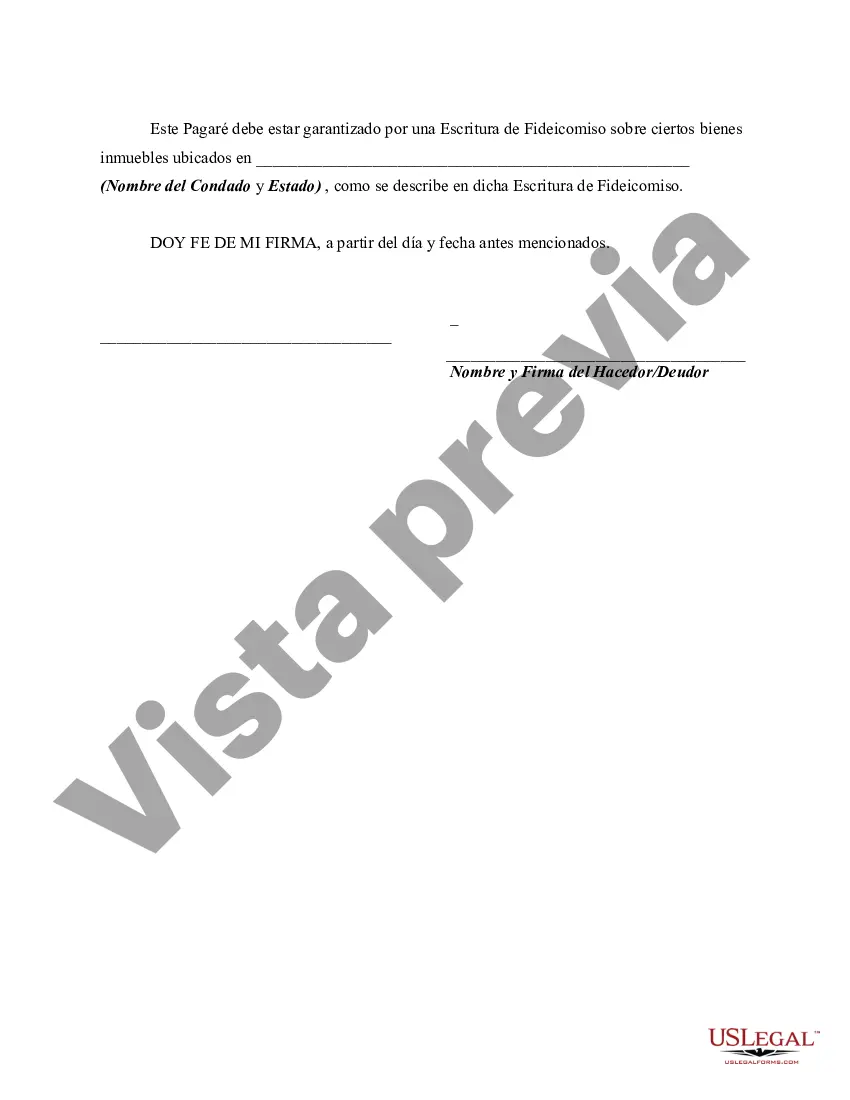

Puerto Rico Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually: A Comprehensive Overview The Puerto Rico Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower in Puerto Rico. This type of promissory note is unique as it allows borrowers to defer their payment obligations until the maturity date, while also incorporating an annual compounding interest feature. Let's explore this financial instrument in detail while incorporating relevant keywords. Key Features: 1. No Payment Due Until Maturity: Unlike traditional promissory notes, the Puerto Rico Promissory Note with no Payment Due Until Maturity allows borrowers to postpone their payment obligations, including principal and interest, until the predetermined maturity date specified in the agreement. 2. Compounding Interest: This type of promissory note includes an annual compounding interest provision. It means that interest accrues on the outstanding loan balance year after year, increasing the overall amount due by the borrower at the maturity date. Types of Puerto Rico Promissory Notes with no Payment Due Until Maturity and Interest to Compound Annually: While the main concept remains the same, there can be variations of this type of promissory note depending on the specific terms agreed upon between the lender and the borrower. Some noteworthy types include: 1. Fixed-Rate Puerto Rico Promissory Note: In this variation, a fixed interest rate is set at the beginning of the loan agreement, which remains constant until the maturity date. This allows borrowers to have predictable repayment terms. 2. Variable-Rate Puerto Rico Promissory Note: Unlike the fixed-rate promissory note, this type has an interest rate that changes periodically based on a specified index or benchmark. The interest rate may fluctuate based on economic conditions, potentially impacting the borrower's repayment amount. 3. Secured Puerto Rico Promissory Note: In cases where a lender requires additional security, a secured promissory note is used. The borrower pledges collateral, such as real estate or valuable assets, to secure the loan. This provides lenders with more protection in case of default. 4. Unsecured Puerto Rico Promissory Note: Unlike the secured promissory note, an unsecured variation does not require collateral. It relies solely on the borrower's creditworthiness, making it a riskier option for lenders. Consequently, unsecured promissory notes may have higher interest rates to compensate for the increased risk. Important Considerations: 1. Borrower's Financial Situation: Before entering into the promissory note agreement, borrowers must carefully assess their financial situation, ensuring that they can meet the payment obligations outlined at the maturity date. The borrowed funds should ideally be used for investments, projects, or ventures that generate sufficient returns to facilitate timely repayment. 2. Legal Expertise: Both parties should consider seeking legal advice to ensure the promissory note adheres to Puerto Rico's laws and regulations. Expert guidance helps in drafting well-structured agreements and understanding the associated rights and responsibilities of each party involved. 3. Default Consequences: It is crucial for borrowers to understand the potential consequences of defaulting on the promissory note. Defaulting can have severe implications, including damage to the borrower's credit score, legal action by the lender, and potential loss of pledged collateral. In conclusion, the Puerto Rico Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually is a financial instrument that provides flexibility to borrowers by deferring payment obligations until the maturity date. With an annual compounding interest feature, borrowers need to carefully assess their repayment capacity while considering their financial goals and objectives. Seeking legal advice and understanding the different variations mentioned earlier ensures both parties are adequately protected throughout the loan term.Puerto Rico Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually: A Comprehensive Overview The Puerto Rico Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower in Puerto Rico. This type of promissory note is unique as it allows borrowers to defer their payment obligations until the maturity date, while also incorporating an annual compounding interest feature. Let's explore this financial instrument in detail while incorporating relevant keywords. Key Features: 1. No Payment Due Until Maturity: Unlike traditional promissory notes, the Puerto Rico Promissory Note with no Payment Due Until Maturity allows borrowers to postpone their payment obligations, including principal and interest, until the predetermined maturity date specified in the agreement. 2. Compounding Interest: This type of promissory note includes an annual compounding interest provision. It means that interest accrues on the outstanding loan balance year after year, increasing the overall amount due by the borrower at the maturity date. Types of Puerto Rico Promissory Notes with no Payment Due Until Maturity and Interest to Compound Annually: While the main concept remains the same, there can be variations of this type of promissory note depending on the specific terms agreed upon between the lender and the borrower. Some noteworthy types include: 1. Fixed-Rate Puerto Rico Promissory Note: In this variation, a fixed interest rate is set at the beginning of the loan agreement, which remains constant until the maturity date. This allows borrowers to have predictable repayment terms. 2. Variable-Rate Puerto Rico Promissory Note: Unlike the fixed-rate promissory note, this type has an interest rate that changes periodically based on a specified index or benchmark. The interest rate may fluctuate based on economic conditions, potentially impacting the borrower's repayment amount. 3. Secured Puerto Rico Promissory Note: In cases where a lender requires additional security, a secured promissory note is used. The borrower pledges collateral, such as real estate or valuable assets, to secure the loan. This provides lenders with more protection in case of default. 4. Unsecured Puerto Rico Promissory Note: Unlike the secured promissory note, an unsecured variation does not require collateral. It relies solely on the borrower's creditworthiness, making it a riskier option for lenders. Consequently, unsecured promissory notes may have higher interest rates to compensate for the increased risk. Important Considerations: 1. Borrower's Financial Situation: Before entering into the promissory note agreement, borrowers must carefully assess their financial situation, ensuring that they can meet the payment obligations outlined at the maturity date. The borrowed funds should ideally be used for investments, projects, or ventures that generate sufficient returns to facilitate timely repayment. 2. Legal Expertise: Both parties should consider seeking legal advice to ensure the promissory note adheres to Puerto Rico's laws and regulations. Expert guidance helps in drafting well-structured agreements and understanding the associated rights and responsibilities of each party involved. 3. Default Consequences: It is crucial for borrowers to understand the potential consequences of defaulting on the promissory note. Defaulting can have severe implications, including damage to the borrower's credit score, legal action by the lender, and potential loss of pledged collateral. In conclusion, the Puerto Rico Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually is a financial instrument that provides flexibility to borrowers by deferring payment obligations until the maturity date. With an annual compounding interest feature, borrowers need to carefully assess their repayment capacity while considering their financial goals and objectives. Seeking legal advice and understanding the different variations mentioned earlier ensures both parties are adequately protected throughout the loan term.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.