Puerto Rico Revocable Trust for Real Estate: A Comprehensive Overview Introduction: A Puerto Rico Revocable Trust for Real Estate is a legal arrangement that allows individuals to transfer ownership of their real estate assets to a trust while maintaining full control over these assets during their lifetime. This trust is revocable, meaning it can be modified or terminated by the granter at any time. It offers several advantages, such as probate avoidance, asset protection, and flexibility in estate planning. In this article, we will delve into the details of Puerto Rico Revocable Trusts for Real Estate, exploring their benefits, types, and key considerations. Benefits of a Puerto Rico Revocable Trust for Real Estate: 1. Probate Avoidance: By transferring real estate assets to a revocable trust, individuals can circumvent the time-consuming and costly probate process, as these assets technically no longer form part of their estates upon their demise. 2. Asset Protection: This type of trust can shield real estate assets from potential creditors or legal judgments, promoting asset preservation and inheritance protection for beneficiaries. 3. Privacy: Unlike probate proceedings that become part of the public record, a revocable trust preserves privacy. The identity of beneficiaries, details of the trust, and real estate holdings remain confidential. 4. Flexibility in Estate Planning: The granter can maintain full control over the trust during their lifetime, allowing them to modify beneficiaries, successor trustees, or even revoke the trust entirely. Types of Puerto Rico Revocable Trusts for Real Estate: 1. Individual Revocable Trust: This type of trust involves a single individual as the granter, who transfers their real estate assets into the trust and retains complete control over them until death or incapacitation. 2. Joint Revocable Trust: Suitable for married couples or business partners, a joint revocable trust allows both parties to transfer their real estate assets into the trust, jointly retaining control. Upon the death of one party, the surviving party maintains full control until their demise. 3. Pour-Over Trust: This trust is often used in conjunction with a will, enabling the granter to transfer any real estate assets not previously transferred into the trust directly to the trust upon their death, ensuring seamless estate planning. Key Considerations for Establishing a Puerto Rico Revocable Trust for Real Estate: 1. Legal Assistance: Consultation with an experienced estate planning attorney is highly recommended when setting up a Puerto Rico Revocable Trust for Real Estate to ensure compliance with local laws and regulations. 2. Funding the Trust: It's crucial to properly fund the trust by re-titling real estate assets in its name and transferring ownership. This step ensures the assets are effectively shielded and managed by the trust. 3. Ongoing Administration: A revocable trust requires active management, including periodic review and potential updates to account for changes in personal circumstances. 4. Tax Implications: While a revocable trust does not provide direct tax benefits, it can help with estate tax planning. Consultation with a tax professional will provide guidance on any potential tax considerations. In conclusion, a Puerto Rico Revocable Trust for Real Estate offers numerous advantages for individuals looking to protect and manage their real estate assets efficiently. By understanding the various types of revocable trusts available and considering key factors, individuals can establish a robust estate planning strategy that ensures seamless asset transfer and protection for future generations.

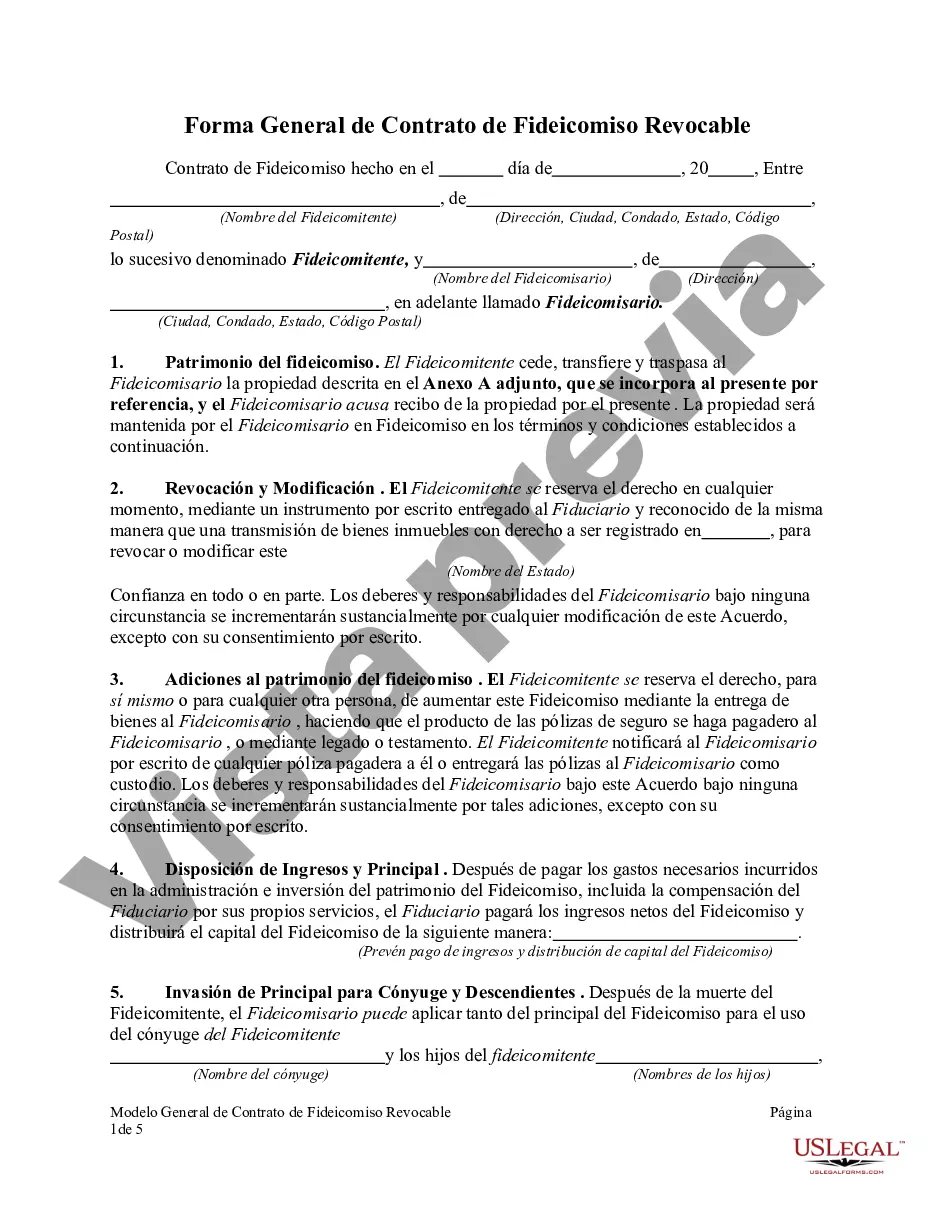

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Puerto Rico Fideicomiso Revocable para Bienes Raíces - Revocable Trust for Real Estate

Description

How to fill out Puerto Rico Fideicomiso Revocable Para Bienes Raíces?

It is possible to commit hrs online trying to find the legal record format that meets the federal and state specifications you will need. US Legal Forms supplies a huge number of legal forms that are examined by specialists. You can actually acquire or print out the Puerto Rico Revocable Trust for Real Estate from the service.

If you currently have a US Legal Forms accounts, you can log in and click the Acquire option. Next, you can comprehensive, revise, print out, or sign the Puerto Rico Revocable Trust for Real Estate. Each and every legal record format you acquire is your own property for a long time. To obtain another backup associated with a obtained kind, go to the My Forms tab and click the related option.

If you work with the US Legal Forms site for the first time, stick to the simple instructions below:

- First, make sure that you have selected the right record format for that region/town of your choosing. Browse the kind explanation to make sure you have picked out the correct kind. If readily available, use the Review option to check from the record format too.

- If you wish to get another model of your kind, use the Look for field to obtain the format that meets your requirements and specifications.

- Once you have found the format you desire, click on Acquire now to carry on.

- Pick the prices program you desire, type in your accreditations, and register for a merchant account on US Legal Forms.

- Complete the purchase. You may use your Visa or Mastercard or PayPal accounts to purchase the legal kind.

- Pick the formatting of your record and acquire it for your system.

- Make changes for your record if needed. It is possible to comprehensive, revise and sign and print out Puerto Rico Revocable Trust for Real Estate.

Acquire and print out a huge number of record themes using the US Legal Forms site, that provides the biggest variety of legal forms. Use expert and condition-specific themes to tackle your business or individual requirements.