An Assignment is a transfer of a property right or title to some particular person under an agreement, usually in writing. Unless an assignment is qualified in some way, it is generally considered to be a transfer of the transferor's entire interest in the estate, personal property, or other thing assigned. An escrow account is held in the borrower's name to pay obligations such as property taxes, insurance premiums, lease payments, hazard insurance, and other associated property payments and expenses when they are due in connection with a mortgage loan.

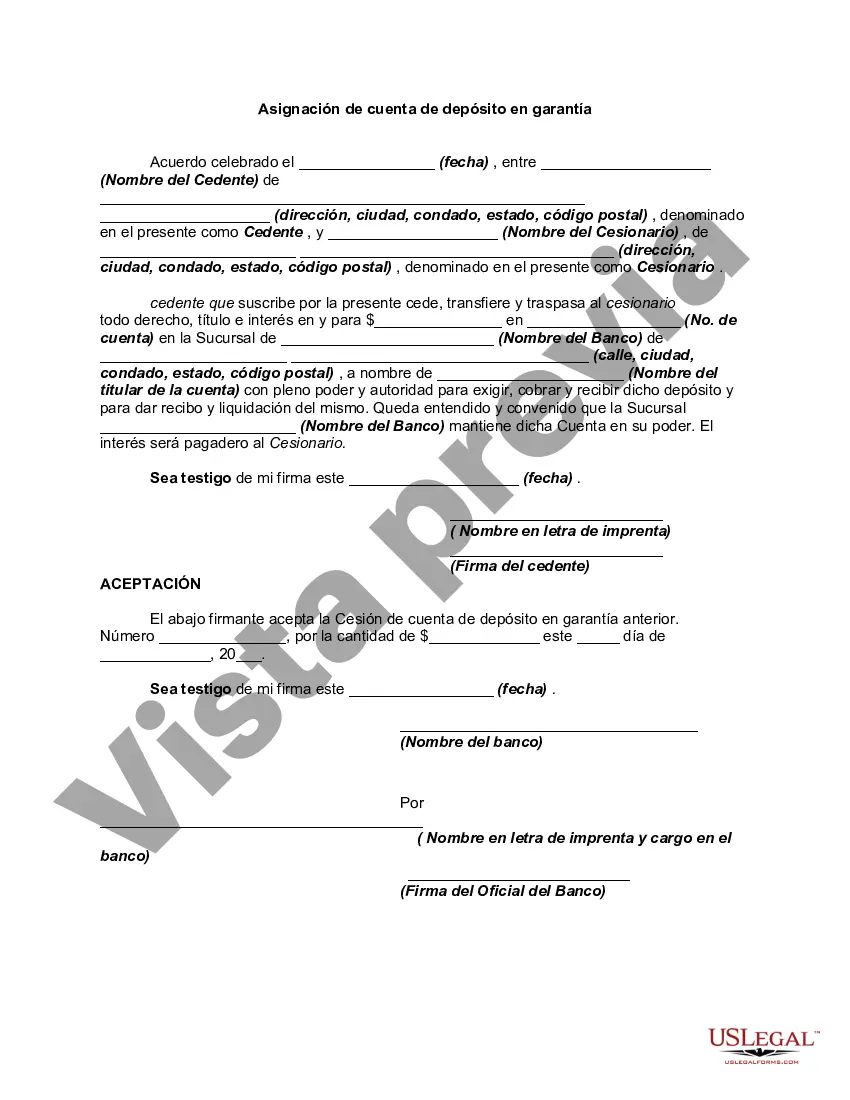

form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Title: Understanding Puerto Rico Assignment of Escrow Account: A Comprehensive Guide Introduction: In Puerto Rico, an assignment of escrow account is a legal contract that allows the transfer of funds or assets from one party (assignor) to another party (assignee) through an escrow account. This article delves into the intricacies of this process, providing a detailed understanding of Puerto Rico's assignment of escrow accounts and its various types. 1. Exploring the Concept of an Assignment of Escrow Account: — Definition: An assignment of escrow account involves the transfer of funds or assets from one party to another, with an escrow account serving as a secure intermediary for holding these assets until specific conditions for their release are met. — Purpose: This legal mechanism ensures the security and control of funds or assets involved in a transaction, promoting trust among parties. — Key Parties Involved: Assignor (the party transferring funds/assets), Assignee (the party receiving funds/assets), and Escrow Agent (a trusted third party responsible for managing the escrow account). 2. Different Types of Puerto Rico Assignment of Escrow Account: a) Purchase and Sale Agreement Escrow: In real estate transactions, this type of escrow account ensures that funds are securely held until all conditions of the purchase and sale agreement are met. The escrow account often involves down payment, property inspections, title search, and other contingencies. b) Deposit Escrow: In deposit escrow accounts, funds or assets are placed into escrow as a deposit to demonstrate commitment or partial payment related to a broader agreement. This type typically occurs in business or contract negotiations. c) Litigation Escrow: In legal disputes, parties can establish an escrow account to hold funds or assets related to the ongoing litigation. This safeguard ensures that funds are available to settle judgments, legal expenses, or other agreed-upon disbursements. d) Construction Escrow: This type of escrow account is commonly used in construction projects to ensure the appropriate disbursement of funds for materials, labor, subcontractors, and other related expenses. 3. Key Considerations in Puerto Rico Assignment of Escrow Account: — Legal Requirements: Parties should adhere to Puerto Rico's laws and regulations governing escrow accounts and ensure compliance with the specific terms and conditions within the assignment agreement. — Escrow Agent Selection: Choosing a reputable and licensed escrow agent is crucial to maintain the integrity of the escrow process. — Release Conditions: Clearly define the conditions that must be met for funds or assets held in the escrow account to be released to the assignee. — Confidentiality and Security: Ensure that all sensitive information related to the assignment of escrow accounts is treated with utmost confidentiality and that appropriate security measures are in place to safeguard the funds or assets. Concluding Thoughts: Understanding the nuances of a Puerto Rico Assignment of Escrow Account is crucial for individuals and businesses engaging in various financial transactions. By comprehending the different types and intricacies, parties can ensure a smoother and more secure transfer of funds or assets in compliance with Puerto Rico's legal framework.Title: Understanding Puerto Rico Assignment of Escrow Account: A Comprehensive Guide Introduction: In Puerto Rico, an assignment of escrow account is a legal contract that allows the transfer of funds or assets from one party (assignor) to another party (assignee) through an escrow account. This article delves into the intricacies of this process, providing a detailed understanding of Puerto Rico's assignment of escrow accounts and its various types. 1. Exploring the Concept of an Assignment of Escrow Account: — Definition: An assignment of escrow account involves the transfer of funds or assets from one party to another, with an escrow account serving as a secure intermediary for holding these assets until specific conditions for their release are met. — Purpose: This legal mechanism ensures the security and control of funds or assets involved in a transaction, promoting trust among parties. — Key Parties Involved: Assignor (the party transferring funds/assets), Assignee (the party receiving funds/assets), and Escrow Agent (a trusted third party responsible for managing the escrow account). 2. Different Types of Puerto Rico Assignment of Escrow Account: a) Purchase and Sale Agreement Escrow: In real estate transactions, this type of escrow account ensures that funds are securely held until all conditions of the purchase and sale agreement are met. The escrow account often involves down payment, property inspections, title search, and other contingencies. b) Deposit Escrow: In deposit escrow accounts, funds or assets are placed into escrow as a deposit to demonstrate commitment or partial payment related to a broader agreement. This type typically occurs in business or contract negotiations. c) Litigation Escrow: In legal disputes, parties can establish an escrow account to hold funds or assets related to the ongoing litigation. This safeguard ensures that funds are available to settle judgments, legal expenses, or other agreed-upon disbursements. d) Construction Escrow: This type of escrow account is commonly used in construction projects to ensure the appropriate disbursement of funds for materials, labor, subcontractors, and other related expenses. 3. Key Considerations in Puerto Rico Assignment of Escrow Account: — Legal Requirements: Parties should adhere to Puerto Rico's laws and regulations governing escrow accounts and ensure compliance with the specific terms and conditions within the assignment agreement. — Escrow Agent Selection: Choosing a reputable and licensed escrow agent is crucial to maintain the integrity of the escrow process. — Release Conditions: Clearly define the conditions that must be met for funds or assets held in the escrow account to be released to the assignee. — Confidentiality and Security: Ensure that all sensitive information related to the assignment of escrow accounts is treated with utmost confidentiality and that appropriate security measures are in place to safeguard the funds or assets. Concluding Thoughts: Understanding the nuances of a Puerto Rico Assignment of Escrow Account is crucial for individuals and businesses engaging in various financial transactions. By comprehending the different types and intricacies, parties can ensure a smoother and more secure transfer of funds or assets in compliance with Puerto Rico's legal framework.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.