Puerto Rico Sample Letter to Include Article Relating to Tax Sales

Description

How to fill out Sample Letter To Include Article Relating To Tax Sales?

Have you ever been in a situation where you need documents for both business or personal purposes almost every day.

There are numerous legal document templates available online, but finding reliable versions is not easy.

US Legal Forms offers thousands of form templates, such as the Puerto Rico Sample Letter to Include Article Relating to Tax Sales, that are designed to meet state and federal requirements.

Utilize US Legal Forms, one of the most comprehensive collections of legal forms, to save time and avoid errors.

The service provides professionally crafted legal document templates that can be used for a variety of purposes. Create an account on US Legal Forms and start making your life easier.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Once logged in, you can download the Puerto Rico Sample Letter to Include Article Relating to Tax Sales template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/county.

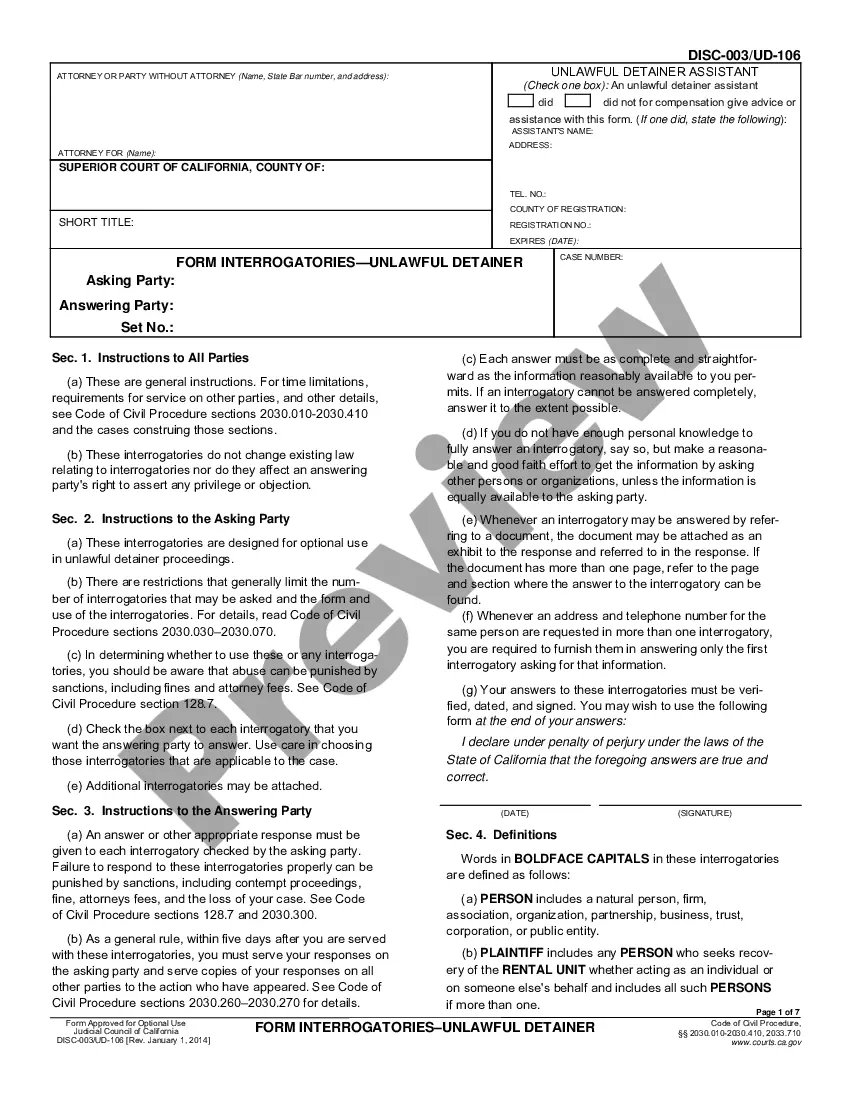

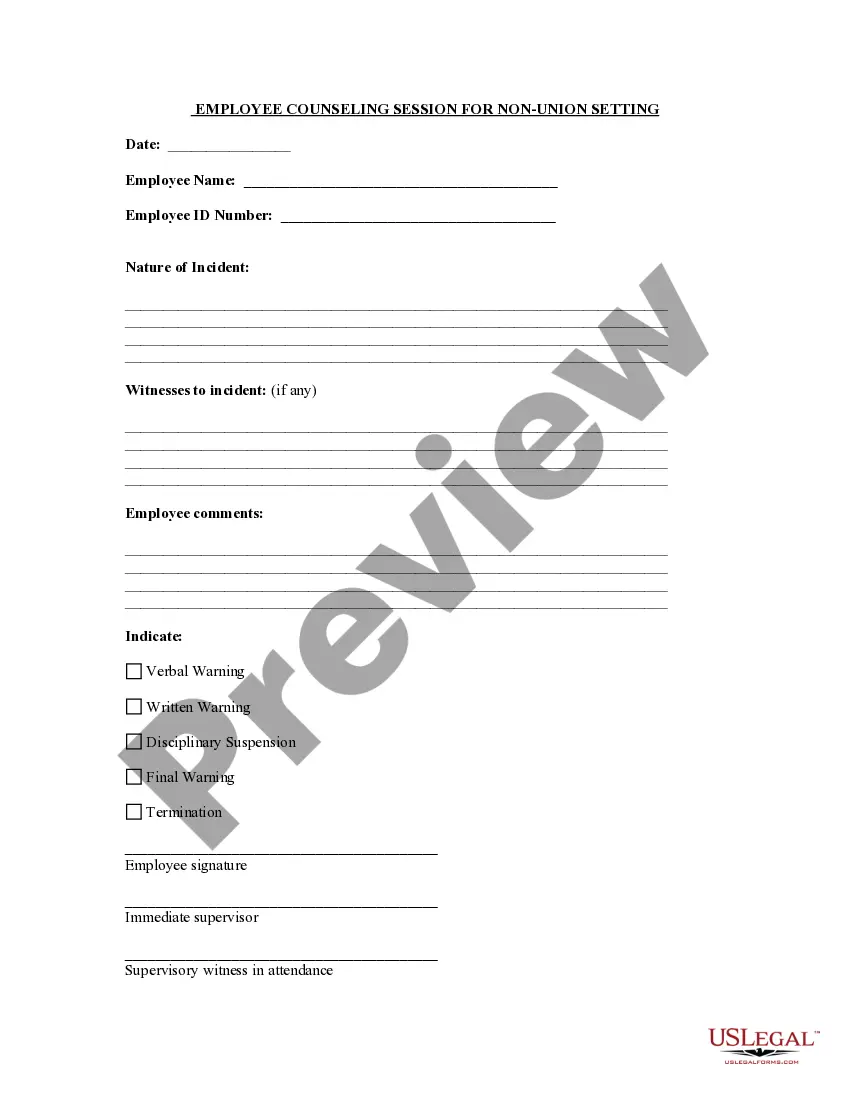

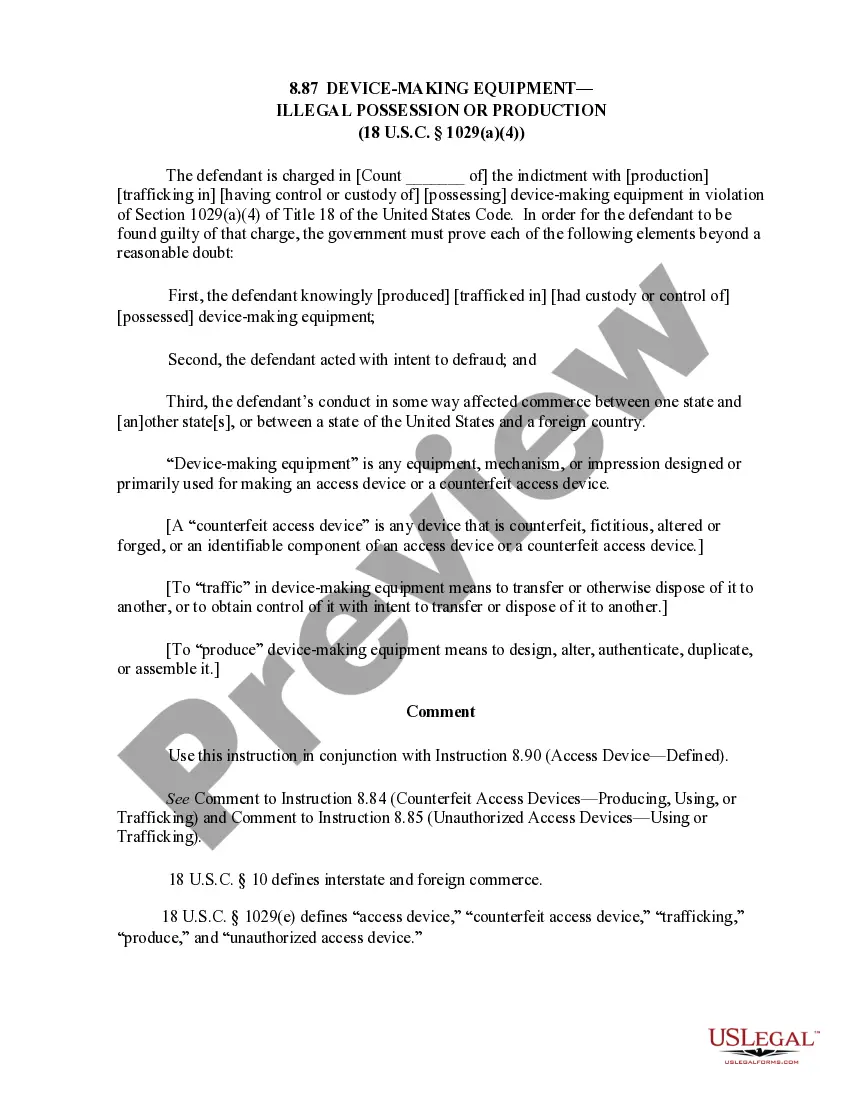

- Utilize the Preview button to review the form.

- Check the description to confirm that you have selected the right form.

- If the form is not what you are looking for, use the Search box to locate the form that meets your needs.

- When you find the appropriate form, click Purchase now.

- Choose the pricing plan you prefer, fill out the required information to create your account, and pay for your order using PayPal or credit card.

- Select a convenient file format and download your copy.

- Access all the document templates you have purchased in the My documents menu. You can obtain another copy of the Puerto Rico Sample Letter to Include Article Relating to Tax Sales anytime, if needed. Just select the desired form to download or print the document template.

Form popularity

FAQ

Registration procedure You can register through the «Suri» ? a unified internal revenue system. To do this, you must provide personal and contact information, as well as information about the company.

A Puerto Rico tax return reporting Puerto Rico income and a U.S. tax return is reflected on Form 1040-NR - FileIT.

What is a W2-PR? The most common withholding statement is the W2-PR. Every employer who has paid wages with income tax withheld in Puerto Rico must submit this form to the Department of Treasury and the Social Security Administration. This form summarizes your income and withholdings for the taxable year.

Puerto Rico (PR) is not a state but a commonwealth. The Puerto Rico sales and use tax rate is 10.5%. Puerto Rico has been an unincorporated territory of the United States since 1898, when it was acquired from Spain in the aftermath of the Spanish American War.

Puerto Rico sales and use tax is in Spanish ?Impuesto a las Ventas y Uso,? aka IVU. The tax rate is 11.5%; the municipality where the sale took place receives 1% of that and the government of Puerto Rico receives the remaining 10.5%.

You can register through the «Suri» ? a unified internal revenue system. To do this, you must provide personal and contact information, as well as information about the company.

The new form?Form AS 2915.1?is effective beginning in October 2021. The Puerto Rico Treasury Department on October 26, 2021, issued Internal Revenue Informative Bulletin No. 21-08, announcing a new form to be used for the monthly reporting of sales and use tax and tax on imports.

As a U.S. territory, shipments to Puerto Rico are not considered exports so duties are not applied. There is, however, a state sales tax of 5.5% and a municipal sales tax that can vary from 0% to 1.5 percent.