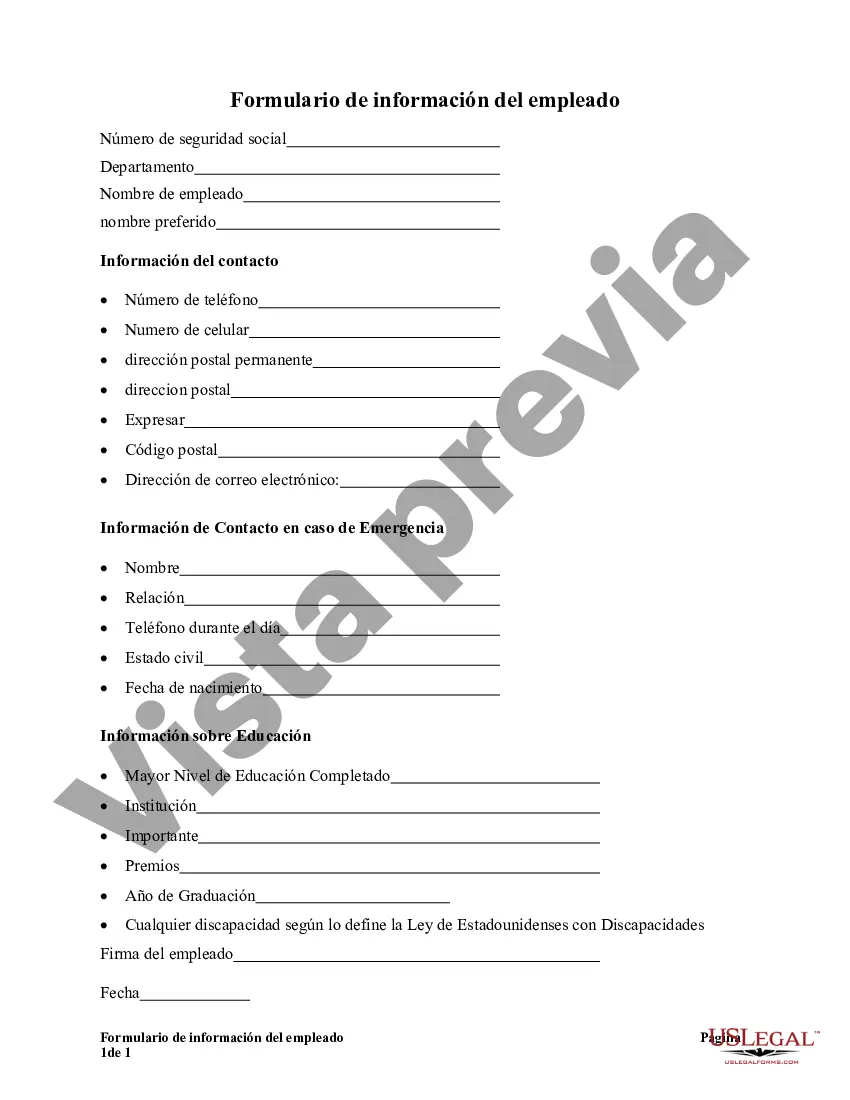

Puerto Rico Employee Information Form is a crucial document that employers in Puerto Rico utilize to gather essential details about their employees. This form serves as a record-keeping tool, ensuring employers have comprehensive information about their workforce for various purposes, such as payroll, benefits administration, tax purposes, and compliance with employment laws. The Puerto Rico Employee Information Form typically includes a variety of fields to capture comprehensive employee data. These fields may include: 1. Personal Information: This section collects basic employee details such as full name, address, contact information, social security number, date of birth, and emergency contact information. These details help to identify and communicate with employees effectively. 2. Employment Information: Employers will require information pertaining to an employee's position, department, employee identification number, start date, and employment status (full-time, part-time, or contract). This section helps in managing and organizing employees within the organization. 3. Tax Information: This section is vital for ensuring proper tax withholding. It includes data such as employee's Puerto Rico tax identification number, filing status (single, married, or head of household), and any additional withholding allowances. Accurate tax information is crucial to facilitate compliant tax deductions and filings. 4. Banking Details: Employers may request information related to an employee's bank account for direct deposit purposes. This includes the bank name, account number, and routing number. Direct deposit allows seamless and secure transfer of wages to employees' bank accounts. 5. Benefits and Deductions: This section collects information about an employee's participation in various benefits programs, such as health insurance, retirement plans, and other voluntary deductions like union dues or charitable contributions. Employers need these details to effectively administer employee benefits and deduct appropriate amounts from their wages. 6. Emergency Contacts: It is essential for employers to have emergency contact information in case of accidents, health emergencies, or unforeseen circumstances. Employees provide names, phone numbers, and relationships of individuals who can be contacted in such situations. Different types of Puerto Rico Employee Information Forms may exist based on the specific requirements of different industries or organizations. Some variations may include sector-specific sections, such as healthcare-related information for medical professionals, industry-specific certifications, or licenses, depending on the type of business. Ultimately, the Puerto Rico Employee Information Form plays a vital role in maintaining accurate and up-to-date records of employee information. It ensures compliance with applicable laws, facilitates smooth payroll processes, and enables effective communication and administration of employee benefits.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Puerto Rico Formulario de información del empleado - Employee Information Form

Description

How to fill out Puerto Rico Formulario De Información Del Empleado?

Are you presently inside a placement where you require paperwork for sometimes company or personal functions almost every day? There are a variety of lawful papers templates available on the net, but getting types you can rely isn`t straightforward. US Legal Forms gives a huge number of develop templates, such as the Puerto Rico Employee Information Form, that are written to meet state and federal demands.

In case you are currently knowledgeable about US Legal Forms web site and get your account, merely log in. Following that, you can down load the Puerto Rico Employee Information Form design.

Unless you have an profile and want to start using US Legal Forms, abide by these steps:

- Discover the develop you will need and make sure it is for the appropriate area/area.

- Make use of the Review key to check the form.

- See the outline to actually have chosen the correct develop.

- When the develop isn`t what you`re looking for, use the Research industry to find the develop that meets your needs and demands.

- Once you discover the appropriate develop, click Get now.

- Pick the pricing plan you need, fill in the required info to create your account, and pay for the transaction making use of your PayPal or Visa or Mastercard.

- Pick a convenient file format and down load your duplicate.

Discover all the papers templates you might have bought in the My Forms menu. You may get a further duplicate of Puerto Rico Employee Information Form at any time, if possible. Just click the necessary develop to down load or print out the papers design.

Use US Legal Forms, probably the most comprehensive variety of lawful varieties, in order to save efforts and stay away from errors. The service gives appropriately made lawful papers templates which can be used for an array of functions. Make your account on US Legal Forms and commence creating your lifestyle a little easier.