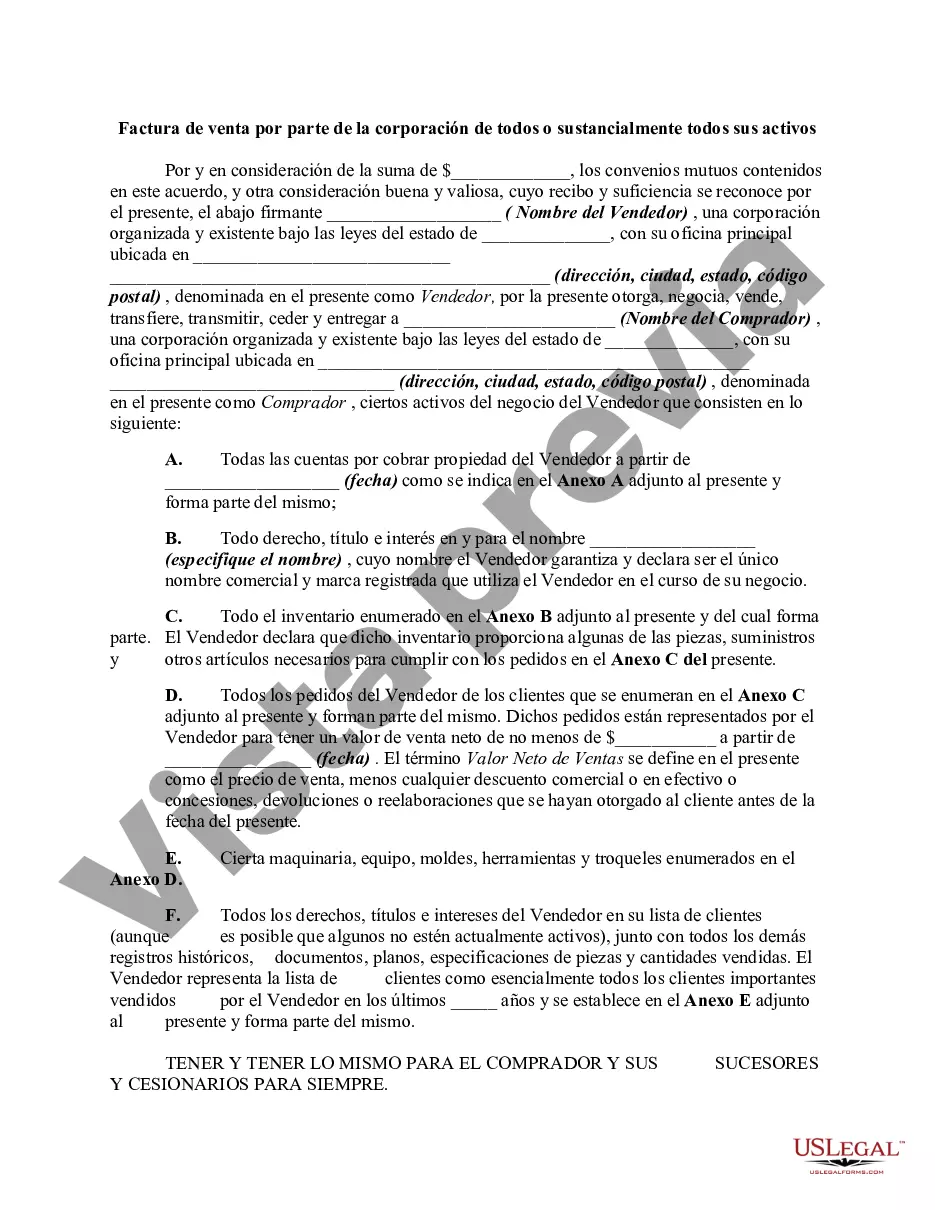

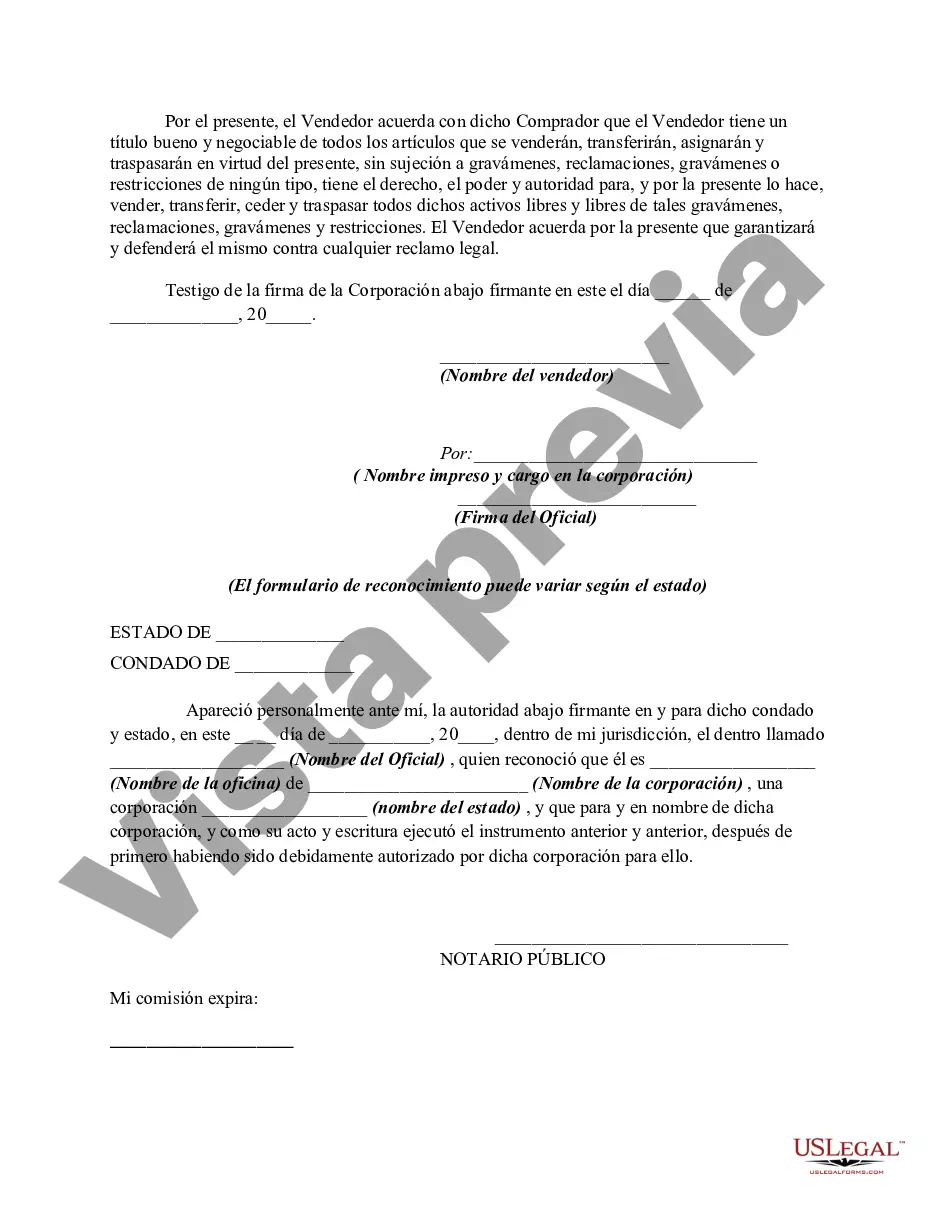

Title: Understanding Puerto Rico Bill of Sale by Corporation of all or Substantially all of its Assets Introduction: In Puerto Rico, when a corporation decides to transfer ownership of all or a significant portion of its assets, a Puerto Rico Bill of Sale by Corporation of all or Substantially all of its Assets is required. This legal document serves as evidence of the transfer, providing protection to both parties involved. In this article, we will delve into the different types of Puerto Rico Bills of Sale and discuss their significance in asset transfers. 1. Definition of Puerto Rico Bill of Sale by Corporation of all or Substantially all of its Assets: A Puerto Rico Bill of Sale by Corporation of all or Substantially all of its Assets is a legal agreement that documents the transfer of ownership of a corporation's entire assets, or a substantial portion thereof, to another party. It outlines the terms and conditions, serving as proof of the transaction's validity. 2. Types of Puerto Rico Bills of Sale by Corporation of all or Substantially all of its Assets: a. General Puerto Rico Bill of Sale: This document encompasses the transfer of all assets owned by the corporation, leaving no restrictions or exemptions. It grants the buyer complete ownership and control over the acquired assets. b. Partial Puerto Rico Bill of Sale: In some cases, a corporation may choose to transfer only a substantial portion of its assets rather than the entirety. This type of bill of sale outlines the specific assets being transferred and excludes those that the corporation wishes to retain. c. Conditional Puerto Rico Bill of Sale: This type of bill of sale is used when the completion of the asset transfer is subject to certain conditions or requirements. It outlines the obligations that both parties must fulfill before the transaction can be finalized. d. Assumption Puerto Rico Bill of Sale: In situations where the assets being transferred include existing debts or liabilities, this bill of sale is employed. It states that the buyer assumes responsibility for these obligations along with the acquired assets. 3. Key Components of a Puerto Rico Bill of Sale by Corporation of all or Substantially all of its Assets: a. Identification of the corporation: The bill of sale includes the legal name and address of the selling corporation, ensuring clarity regarding the parties involved in the transaction. b. Description of the assets: A comprehensive list or description of the assets being transferred is provided, including any intellectual property, real estate, vehicles, equipment, or goodwill. c. Purchase price and payment terms: The agreed-upon purchase price for the assets, along with the payment terms (e.g., lump sum, installment payments, or assumption of debts), is clearly stated. d. Representations and warranties: The bill of sale may contain representations and warranties regarding the corporation's ownership, title, and condition of the assets being transferred. e. Indemnification and liability provisions: Clauses addressing liability and indemnification for any potential disputes or claims arising from the transfer are included to protect both parties' interests. Conclusion: When a corporation in Puerto Rico decides to transfer all or substantially all of its assets, a Puerto Rico Bill of Sale by Corporation of all or Substantially all of its Assets is crucial. By understanding the different types and essential components of this legal document, both buyers and selling corporations can ensure a smooth and legally protected transaction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Puerto Rico Factura de venta por parte de la corporación de todos o sustancialmente todos sus activos - Bill of Sale by Corporation of all or Substantially all of its Assets

Description

How to fill out Puerto Rico Factura De Venta Por Parte De La Corporación De Todos O Sustancialmente Todos Sus Activos?

You can devote several hours on the web searching for the legitimate file design that fits the federal and state needs you need. US Legal Forms provides a large number of legitimate varieties that happen to be evaluated by pros. It is simple to down load or print out the Puerto Rico Bill of Sale by Corporation of all or Substantially all of its Assets from my service.

If you already have a US Legal Forms accounts, you can log in and click on the Acquire option. Following that, you can comprehensive, change, print out, or sign the Puerto Rico Bill of Sale by Corporation of all or Substantially all of its Assets. Each legitimate file design you purchase is yours eternally. To acquire yet another duplicate of the bought develop, go to the My Forms tab and click on the corresponding option.

If you use the US Legal Forms web site the first time, follow the straightforward guidelines below:

- Initially, make certain you have selected the best file design to the state/city of your choosing. Read the develop information to ensure you have picked out the right develop. If available, utilize the Preview option to search through the file design also.

- If you wish to discover yet another version from the develop, utilize the Lookup discipline to find the design that meets your requirements and needs.

- Upon having discovered the design you desire, just click Buy now to carry on.

- Find the pricing plan you desire, key in your references, and sign up for your account on US Legal Forms.

- Full the purchase. You can use your credit card or PayPal accounts to pay for the legitimate develop.

- Find the formatting from the file and down load it in your device.

- Make adjustments in your file if possible. You can comprehensive, change and sign and print out Puerto Rico Bill of Sale by Corporation of all or Substantially all of its Assets.

Acquire and print out a large number of file layouts utilizing the US Legal Forms website, that provides the largest variety of legitimate varieties. Use expert and status-particular layouts to deal with your business or person requirements.