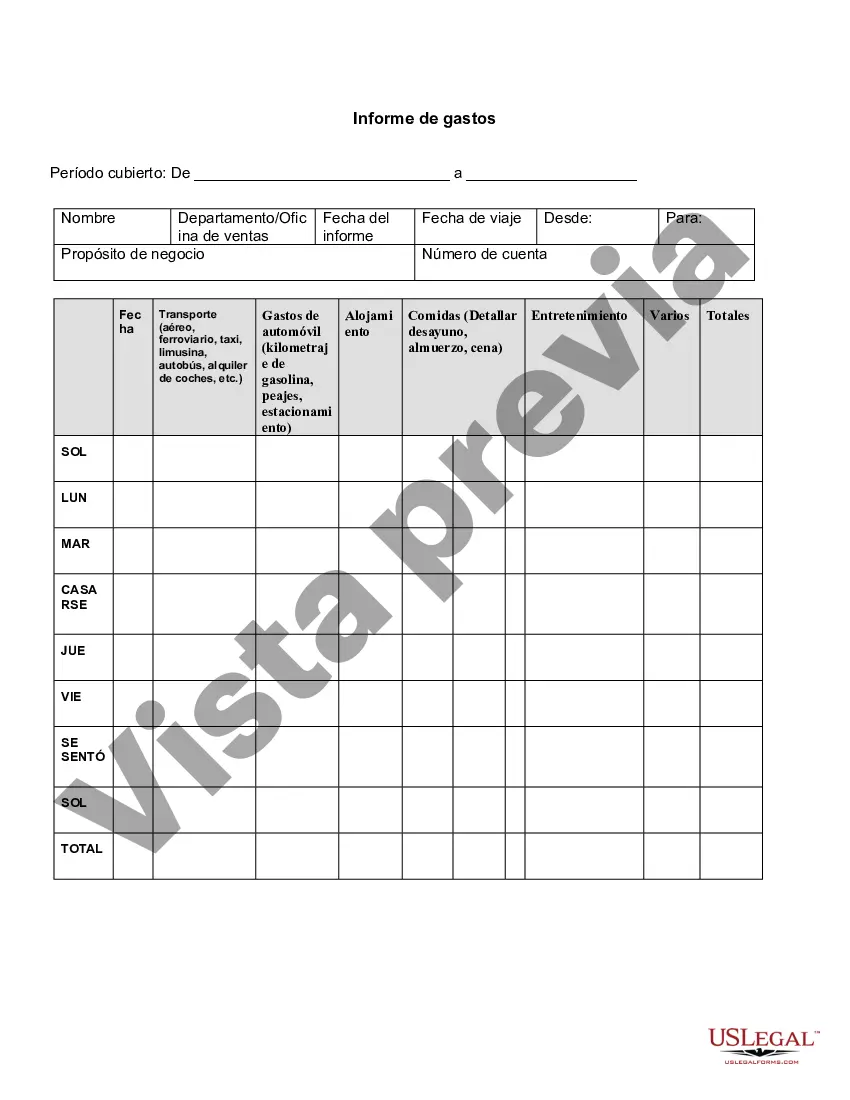

Puerto Rico Expense Report is a comprehensive document that outlines and tracks all the expenses related to a business or personal trip to Puerto Rico. It serves as a detailed record of the costs incurred during the visit to the island, allowing individuals or businesses to properly manage and account for their expenditures. The Puerto Rico Expense Report can be divided into two main types, namely, business expense report and personal expense report. 1. Business Expense Report: This type of report is used by companies or organizations to track and reimburse their employees for any business-related expenses accrued while traveling to Puerto Rico. These expenses may include airfare, accommodation, transportation, meals, client entertainment, conference fees, and other work-related costs. The report provides an itemized breakdown of each expense category, including dates, amounts, and supporting receipts or invoices. 2. Personal Expense Report: Individuals visiting Puerto Rico for personal reasons, such as vacation or family trips, may utilize the personal expense report. This report helps them keep a detailed record of all their personal expenditures during the trip. It covers various expenses like accommodation, transportation, meals, excursions, shopping, and other miscellaneous costs. Similar to the business expense report, it includes specific details of every expense incurred, including dates, amounts, and necessary receipts. Both types of Puerto Rico Expense Reports play a crucial role in budgeting, auditing, and ensuring proper financial management. They are essential tools for businesses to accurately calculate the travel expenses incurred by their employees, determine reimbursements, and evaluate the overall cost-effectiveness of the trip. Similarly, individuals benefit from the personal expense report as it aids in monitoring their spending while vacationing in Puerto Rico. By diligently completing the Puerto Rico Expense Report, whether for business or personal purposes, individuals and companies can maintain transparency, accurately report their expenditures, and efficiently manage their finances. It also helps to ensure compliance with financial regulations, tax obligations, and company policies.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Puerto Rico Informe de gastos - Expense Report

Description

How to fill out Puerto Rico Informe De Gastos?

You are able to commit hours online searching for the lawful document design that fits the state and federal specifications you will need. US Legal Forms provides 1000s of lawful varieties that happen to be evaluated by experts. You can easily acquire or printing the Puerto Rico Expense Report from your service.

If you have a US Legal Forms bank account, you are able to log in and click on the Obtain option. Afterward, you are able to total, revise, printing, or sign the Puerto Rico Expense Report. Each and every lawful document design you purchase is yours forever. To get an additional backup associated with a purchased develop, proceed to the My Forms tab and click on the related option.

Should you use the US Legal Forms website for the first time, stick to the straightforward guidelines listed below:

- Initially, make sure that you have selected the right document design for your area/town of your choice. Look at the develop outline to ensure you have selected the appropriate develop. If readily available, use the Review option to search with the document design at the same time.

- If you would like locate an additional edition of your develop, use the Search field to get the design that suits you and specifications.

- After you have located the design you would like, click on Acquire now to carry on.

- Select the costs prepare you would like, enter your qualifications, and sign up for an account on US Legal Forms.

- Complete the purchase. You may use your Visa or Mastercard or PayPal bank account to fund the lawful develop.

- Select the file format of your document and acquire it to the gadget.

- Make changes to the document if possible. You are able to total, revise and sign and printing Puerto Rico Expense Report.

Obtain and printing 1000s of document layouts using the US Legal Forms Internet site, which provides the most important collection of lawful varieties. Use skilled and express-distinct layouts to take on your business or individual requires.