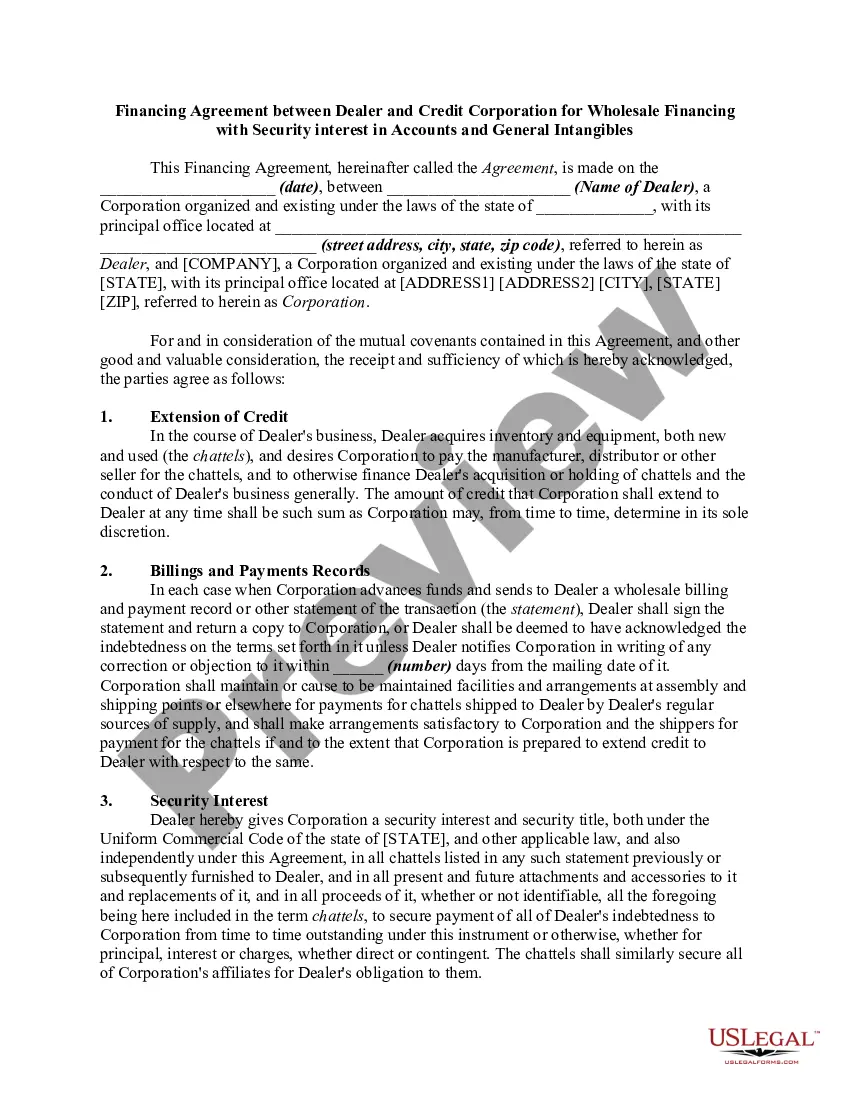

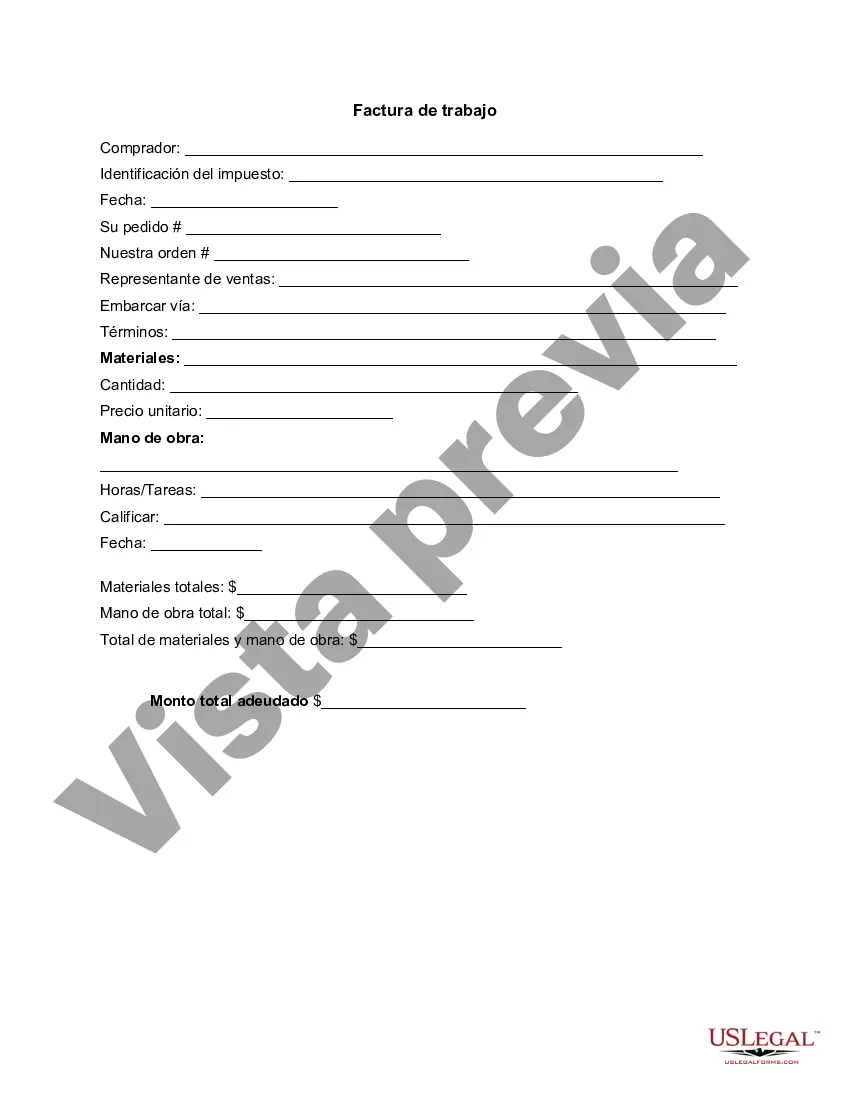

Puerto Rico Invoice Template for Independent Contractor: A Comprehensive Guide Introduction: In Puerto Rico, independent contractors play a vital role in the business landscape. To ensure smooth financial transactions and maintain records for tax purposes, it is crucial to have a well-crafted invoice in place. This article will provide a detailed description of what the Puerto Rico Invoice Template for Independent Contractors entails. We will explore its purpose, key components, and the various types available to cater to different needs. Purpose of a Puerto Rico Invoice Template for Independent Contractors: An invoice is a professional document that serves multiple purposes such as: 1. Request for Payment: It serves as a formal request for payment for goods or services rendered by an independent contractor in Puerto Rico. 2. Record-Keeping: Invoices contain important details like payment terms, due dates, client information, and project descriptions. These records help independent contractors manage their finances effectively and provide necessary information for taxation purposes. Key Components of a Puerto Rico Invoice Template for Independent Contractors: 1. Contractor's Information: The template should include the contractor's name, business name (if any), address, contact details, and Taxpayer Identification Number (TIN). 2. Client's Information: Essential client details such as name, business name (if applicable), mailing address, and contact information should be incorporated. 3. Invoice Number and Date: Each invoice should have a unique identification number and clearly state the date of issuance to facilitate easy tracking and reference. 4. Description of Services: The template should allow for a detailed breakdown of services rendered or products delivered. It should include the type of service, number of hours worked (if applicable), unit price, quantity, and any applicable taxes. 5. Payment Terms: Specify the due date by which payment is expected and any penalties for late payment. Additionally, include the preferred payment methods, bank account details (if necessary), and any terms or conditions. 6. Subtotal and Taxes: Calculate the subtotal by adding up all the services provided and include any relevant taxes, such as the Puerto Rico Sales and Use Tax (ICU). 7. Total Amount Due: Sum up the subtotal and taxes to obtain the final amount the client needs to pay. 8. Additional Information: Provide space for any additional notes, terms, or conditions that may be necessary, such as a confidentiality agreement or specific project instructions. Types of Puerto Rico Invoice Template for Independent Contractors: 1. Basic Invoice Template: This includes the essential components mentioned above and is suitable for independent contractors offering straightforward services or products. 2. Hourly Rate Invoice Template: Specifically tailored for contractors charging an hourly rate, this template allows for easy tracking of worked hours and corresponding charges. 3. Project-Based Invoice Template: Ideal for contractors working on fixed-price projects, this template allows for comprehensive descriptions and pricing of individual project tasks. 4. Recurring Invoice Template: Designed for contractors who provide ongoing services on a regular basis, this template automates the invoicing process and can be scheduled to be sent at specific intervals, like weekly or monthly. Conclusion: The Puerto Rico Invoice Template for Independent Contractors is a valuable tool for managing business finances and maintaining transparent transactions. Whether you opt for a basic template, hourly rate template, project-based template, or recurring template, ensure it encompasses all the necessary components to suit your specific needs. Effective invoicing enhances professionalism, improves cash flow management, and helps maintain fruitful client relationships.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Puerto Rico Plantilla de factura para contratista independiente - Invoice Template for Independent Contractor

Description

How to fill out Puerto Rico Plantilla De Factura Para Contratista Independiente?

US Legal Forms - one of the most significant libraries of legitimate kinds in the States - offers a variety of legitimate file themes it is possible to obtain or print out. While using internet site, you can get a huge number of kinds for business and person functions, categorized by groups, claims, or search phrases.You can get the most recent models of kinds like the Puerto Rico Invoice Template for Independent Contractor in seconds.

If you already have a monthly subscription, log in and obtain Puerto Rico Invoice Template for Independent Contractor in the US Legal Forms collection. The Down load option can look on every form you see. You get access to all formerly delivered electronically kinds inside the My Forms tab of your profile.

If you wish to use US Legal Forms the very first time, allow me to share simple recommendations to get you began:

- Ensure you have selected the right form to your area/county. Click on the Preview option to analyze the form`s content. Browse the form information to actually have chosen the appropriate form.

- In case the form does not suit your requirements, take advantage of the Research field near the top of the monitor to find the one that does.

- When you are satisfied with the form, validate your selection by clicking the Buy now option. Then, choose the rates prepare you like and give your qualifications to register for an profile.

- Procedure the transaction. Make use of your credit card or PayPal profile to perform the transaction.

- Pick the format and obtain the form on your own system.

- Make modifications. Load, change and print out and signal the delivered electronically Puerto Rico Invoice Template for Independent Contractor.

Every single web template you added to your account does not have an expiration day and is yours for a long time. So, if you want to obtain or print out one more copy, just go to the My Forms section and click on the form you require.

Get access to the Puerto Rico Invoice Template for Independent Contractor with US Legal Forms, probably the most extensive collection of legitimate file themes. Use a huge number of specialist and condition-specific themes that fulfill your organization or person requirements and requirements.