A Line of Credit refers to the maximum borrowing power that a lender extends to a borrower. The borrower may draw required amounts from the fixed amount. Usually, it is a credit source extended to any credit-worthy business by a bank or any financial institution. A line of credit includes cash credit, overdraft, demand loan, export packing credit, term loan, discounting or purchase of commercial bills, etc. The borrower may use the line of credit to overcome liquidity problems. Requisite amounts may be withdrawn from the account as and when required. The borrower pays interest only for the amount withdrawn.

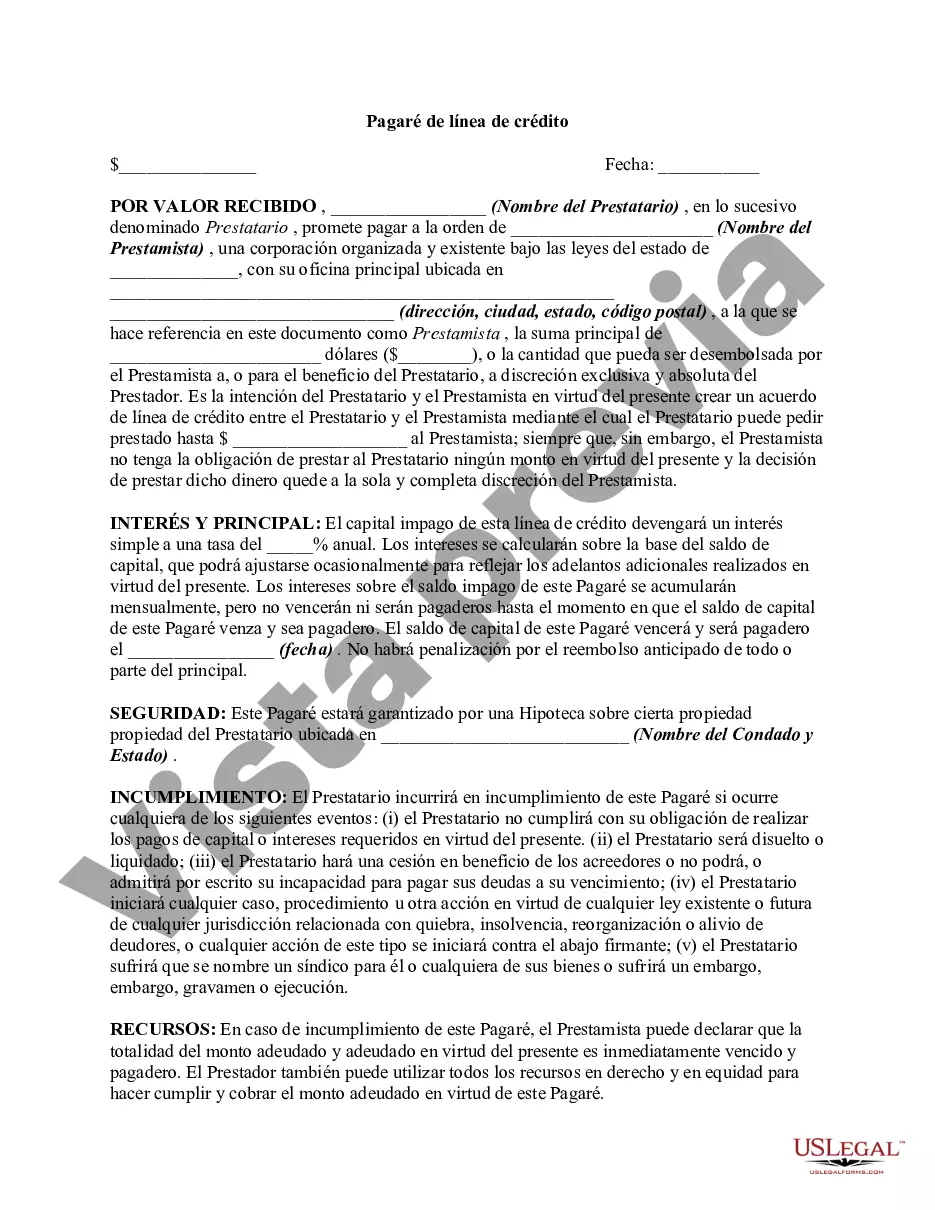

Puerto Rico Line of Credit Promissory Note is a legally binding document that outlines the terms and conditions of a line of credit agreement between a lender and the borrower in Puerto Rico. This promissory note establishes the borrower's promise to repay the borrowed amount plus any accrued interest within a specified period. The Puerto Rico Line of Credit Promissory Note typically contains the following information: 1. Parties Involved: The note identifies the lender (creditor) and the borrower (debtor), including their names, addresses, and contact information. 2. Principal Amount: It specifies the initial amount of credit extended to the borrower, which can be borrowed in full or partially when needed. 3. Interest Rate: The promissory note states the fixed or variable interest rate imposed on the borrowed amount, representing the cost of borrowing. 4. Repayment Terms: It outlines the repayment period, which may range from several months to several years. The borrower agrees to make regular payments, including both principal and interest, on a monthly or quarterly basis. 5. Late Payment and Default: The note states the consequences of late or missed payments, including late fees, penalties, and the potential acceleration of the entire outstanding debt in case of default. 6. Security Collateral: If applicable, the promissory note may require the borrower to provide collateral to secure the line of credit, such as real estate or personal assets. 7. Governing Law: It mentions the jurisdiction and legal framework that govern the promissory note, typically referring to Puerto Rico's laws. Different types of Puerto Rico Line of Credit Promissory Notes may include: 1. Secured Line of Credit Promissory Note: This type of promissory note requires the borrower to pledge specific assets or collateral to secure the line of credit, reducing the lender's risk and potentially lowering the interest rate. 2. Unsecured Line of Credit Promissory Note: In contrast to a secured note, this type does not require collateral but may have a higher interest rate to compensate for the increased risk borne by the lender. 3. Revolving Line of Credit Promissory Note: This note allows the borrower to borrow, repay, and re-borrow funds within the agreed credit limit for a set duration. It offers flexibility and allows businesses to manage their cash flow efficiently. 4. Non-revolving Line of Credit Promissory Note: Unlike a revolving note, a non-revolving note provides a one-time lump sum credit, not allowing any additional borrowing once the principal is repaid. Understanding the details and terms of a Puerto Rico Line of Credit Promissory Note is essential for both lenders and borrowers, as it governs their financial relationship and helps ensure a transparent and mutually beneficial credit agreement.Puerto Rico Line of Credit Promissory Note is a legally binding document that outlines the terms and conditions of a line of credit agreement between a lender and the borrower in Puerto Rico. This promissory note establishes the borrower's promise to repay the borrowed amount plus any accrued interest within a specified period. The Puerto Rico Line of Credit Promissory Note typically contains the following information: 1. Parties Involved: The note identifies the lender (creditor) and the borrower (debtor), including their names, addresses, and contact information. 2. Principal Amount: It specifies the initial amount of credit extended to the borrower, which can be borrowed in full or partially when needed. 3. Interest Rate: The promissory note states the fixed or variable interest rate imposed on the borrowed amount, representing the cost of borrowing. 4. Repayment Terms: It outlines the repayment period, which may range from several months to several years. The borrower agrees to make regular payments, including both principal and interest, on a monthly or quarterly basis. 5. Late Payment and Default: The note states the consequences of late or missed payments, including late fees, penalties, and the potential acceleration of the entire outstanding debt in case of default. 6. Security Collateral: If applicable, the promissory note may require the borrower to provide collateral to secure the line of credit, such as real estate or personal assets. 7. Governing Law: It mentions the jurisdiction and legal framework that govern the promissory note, typically referring to Puerto Rico's laws. Different types of Puerto Rico Line of Credit Promissory Notes may include: 1. Secured Line of Credit Promissory Note: This type of promissory note requires the borrower to pledge specific assets or collateral to secure the line of credit, reducing the lender's risk and potentially lowering the interest rate. 2. Unsecured Line of Credit Promissory Note: In contrast to a secured note, this type does not require collateral but may have a higher interest rate to compensate for the increased risk borne by the lender. 3. Revolving Line of Credit Promissory Note: This note allows the borrower to borrow, repay, and re-borrow funds within the agreed credit limit for a set duration. It offers flexibility and allows businesses to manage their cash flow efficiently. 4. Non-revolving Line of Credit Promissory Note: Unlike a revolving note, a non-revolving note provides a one-time lump sum credit, not allowing any additional borrowing once the principal is repaid. Understanding the details and terms of a Puerto Rico Line of Credit Promissory Note is essential for both lenders and borrowers, as it governs their financial relationship and helps ensure a transparent and mutually beneficial credit agreement.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.