Puerto Rico Assignment of Interest in Joint Venture

Description

How to fill out Assignment Of Interest In Joint Venture?

If you desire to finish, obtain, or produce legal document templates, utilize US Legal Forms, the finest assortment of legal forms, accessible online.

Employ the site's straightforward and useful search feature to locate the documents you require.

A range of templates for business and personal purposes are organized by categories and jurisdictions, or by keywords.

Every legal document template you purchase is yours indefinitely. You have access to every form you downloaded in your account. Visit the My documents section and select a form to print or download again.

Stay proactive and obtain, as well as print, the Puerto Rico Assignment of Interest in Joint Venture using US Legal Forms. There are countless professional and state-specific forms that you can utilize for your business or personal needs.

- Use US Legal Forms to access the Puerto Rico Assignment of Interest in Joint Venture with just a few clicks.

- If you are currently a US Legal Forms member, Log In to your account and hit the Download button to retrieve the Puerto Rico Assignment of Interest in Joint Venture.

- You can also find forms you previously downloaded from the My documents section of your account.

- If you are utilizing US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

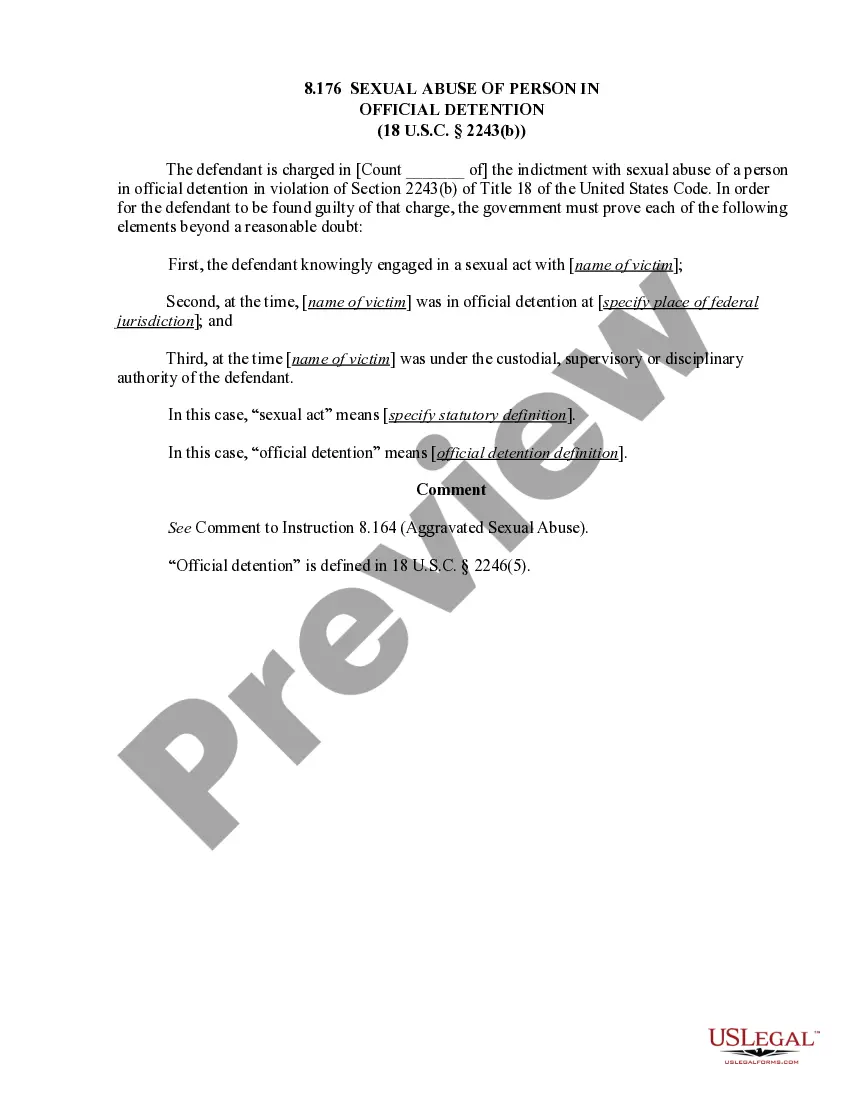

- Step 2. Use the Preview option to review the form's contents. Don't forget to read the details.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other variations of the legal form template.

- Step 4. Once you have identified the form you need, click the Acquire now button. Select your preferred pricing plan and enter your credentials to create an account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Puerto Rico Assignment of Interest in Joint Venture.

Form popularity

FAQ

Puerto Rico corporations are treated as foreign corporations for U.S. income tax purposes.

In a contractual joint venture the parties do not establish any separate entity to carry on the venture. Instead the parties enter into contracts and make their own profits and losses. They pay tax only on their own profits.

An unincorporated joint venture does not lodge a tax return; instead, each joint venturer lodges a separate tax return. For GST purposes separate joint venturers may be allowed to form a single group. Generally, transactions between group members are ignored for GST purposes.

Foreign corporations (including US corporations) desiring to operate in PR must request a certificate of authorization to do business in PR by filing an application at the PR State Department.

Register for a withholding tax account through the Puerto Rico Department of the Treasury. Employers need to complete the application form SC4809 Information of Identification Number Organizations (Employers) (this form is in both Spanish and English and does contain instructions).

Depending on the circumstances, joint ventures may be taxed as a corporation or partnership. Entities that are taxed as corporations are subject to tax at both the corporate and shareholder levels, commonly referred to as double taxation.

Under General Corporation Law, a foreign corporation or a limited liability company must register with the State Department of Puerto Rico before conducting business locally.

To start a corporation in Puerto Rico, you'll need to do three things: appoint a registered agent, choose a name for your business, and file Certificate of Incorporation with the Department of State. You can file online or by mail. The certificate costs $150 to file.

Joint ventures, on the other hand, may be taxed as a corporation or partnership or they may simply be allocated gross receipts of the joint venture based upon their bid. Entities that are taxed as corporations are subject to 'double taxation' whereby both the corporate and shareholder levels are subject to tax.

For federal income tax purposes, an unincorporated joint venture or other contractual or co-ownership arrangement under which several participants conduct a business or investment activity and split the profits is generally treated as a partnership.