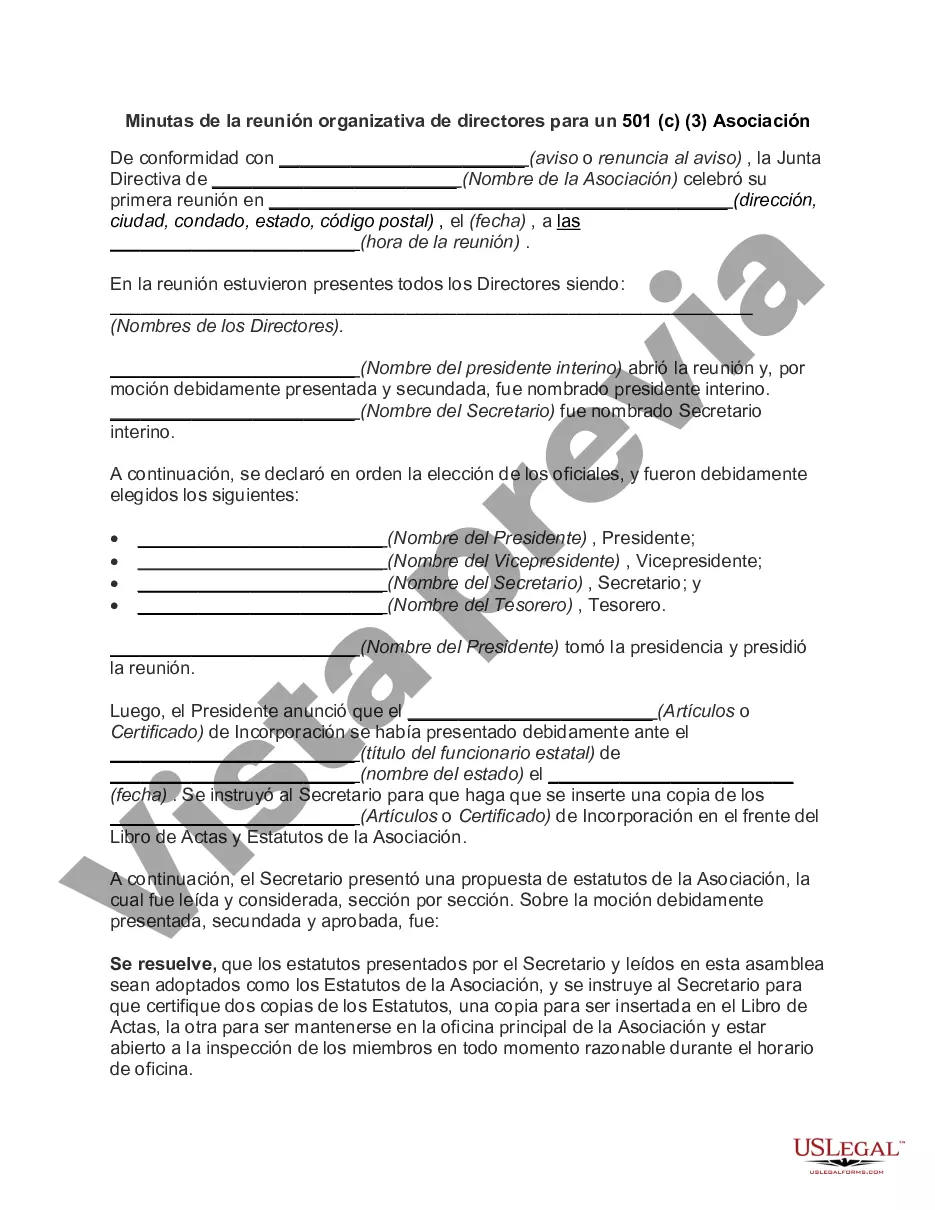

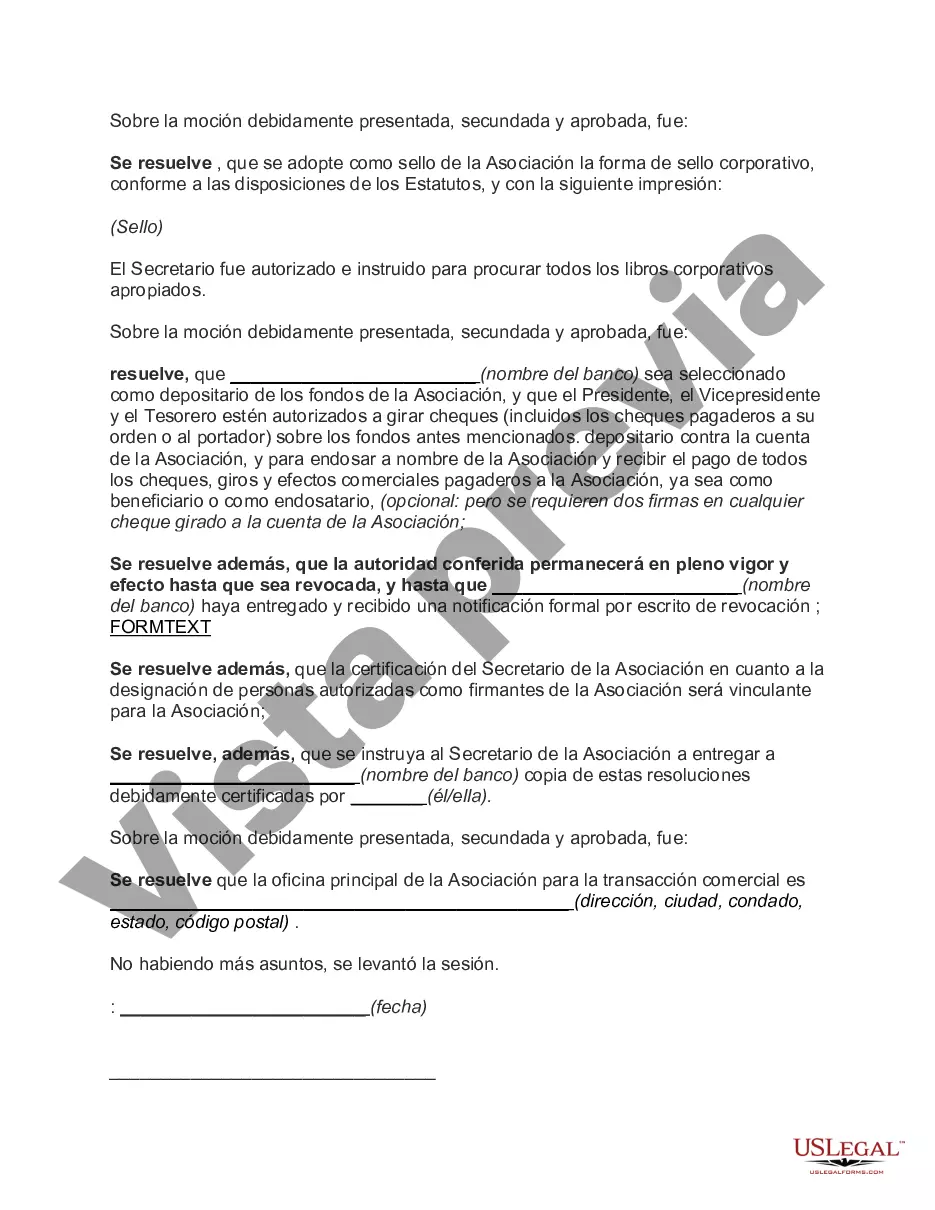

Title: Puerto Rico Minutes of Organizational Meeting of Directors for a 501(c)(3) Association: An Essential Document for Nonprofit Governance Introduction: The Puerto Rico Minutes of Organizational Meeting of Directors for a 501(c)(3) Association serve as a crucial document that outlines the proceedings and decisions made during the initial meeting of the board of directors for a nonprofit organization in Puerto Rico. This detailed description aims to shed light on the significance of these minutes, their components, and any potential variations available under different circumstances. Keywords: Puerto Rico, Minutes, Organizational Meeting, Directors, 501(c)(3) Association, Nonprofit, Governance I. Understanding the Puerto Rico Minutes of Organizational Meeting of Directors: — Definition and Purpose: The minutes refer to a written record summarizing the discussions, resolutions, and actions taken during the first meeting of directors after establishing a 501(c)(3) Association in Puerto Rico. — Legal Compliance: These minutes ensure compliance with local regulations, which may vary slightly compared to other jurisdictions. II. Key Components of the Minutes: 1. Meeting Details: — Date, time, and location of the organizational meeting. — Presence of directors, officers, and any other relevant attendees. — Quorum verification. 2. Approval of Bylaws: — Review, discussion, and approval of the association's bylaws. — Any amendments or additional provisions made during the meeting. 3. Election of Officers: — Nominations, discussions, and voting on the appointment of officers (e.g., president, vice-president, treasurer). — Establishing roles, responsibilities, and terms of office. 4. Adoption of Policies: — Discussion and adoption of key policies governing the association's operations (e.g., conflict of interest policy, financial management policy). 5. Financial Matters: — Decision on opening a bank account for the association and appointment of authorized signatories. — Initial funding sources, fundraising strategies, and investment guidelines. 6. Initial Projects and Programs: — Discussion and approval of initial projects or programs. — Allocation of resources and responsibilities. 7. Miscellaneous: — Any other matters discussed during the meeting, not covered under the previous agenda items. — Next meeting date proposal, if applicable. III. Potential Types of Minutes for Different Circumstances: 1. Minutes of Organizational Meeting for Initial Incorporation: — Specific to the first meeting held to establish the association as a legal entity. — Includes additional agenda items such as legal formalities, articles of incorporation, and registration requirements. 2. Minutes of Organizational Meeting for Tax-Exempt Status Application: — Pertains to the meeting held to discuss and initiate the process of obtaining 501(c)(3) status. — Focuses on tax-exempt criteria, activities planning, and necessary documentation. 3. Minutes of Organizational Meeting for Board Restructuring: — Documenting the meeting held to make significant changes in the board's composition or structure (e.g., amendment of bylaws, addition or removal of directors). 4. Minutes of Organizational Meeting for Strategic Planning: — Relates to meetings aimed at setting strategic goals and long-term objectives for the association. — Discusses mission and vision statements, program evaluation, and resource planning. Conclusion: The Puerto Rico Minutes of Organizational Meeting of Directors for a 501(c)(3) Association are essential for maintaining proper governance and legal compliance within the nonprofit sector. Documenting the discussions, resolutions, and actions taken during these meetings ensures transparency and accountability. By tailoring the minutes to the specific circumstances, nonprofit organizations can effectively address their unique needs and facilitate growth in line with their mission and objectives. Keywords: Puerto Rico, Minutes, Organizational Meeting, Directors, 501(c)(3) Association, Nonprofit, Governance, Bylaws, Officers, Policies, Financial Matters, Initial Projects, Programs, Incorporation, Tax-Exempt Status, Board Restructuring, Strategic Planning.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Puerto Rico Minutas de la reunión organizativa de directores de una asociación 501(c)(3) - Minutes of Organizational Meeting of Directors for a 501(c)(3) Association

Description

How to fill out Puerto Rico Minutas De La Reunión Organizativa De Directores De Una Asociación 501(c)(3)?

Have you been inside a place the place you will need files for either organization or personal functions virtually every time? There are tons of lawful record templates available on the Internet, but discovering types you can rely is not effortless. US Legal Forms provides 1000s of kind templates, such as the Puerto Rico Minutes of Organizational Meeting of Directors for a 501(c)(3) Association, which can be published to satisfy state and federal requirements.

In case you are previously familiar with US Legal Forms web site and also have an account, basically log in. After that, it is possible to obtain the Puerto Rico Minutes of Organizational Meeting of Directors for a 501(c)(3) Association web template.

Unless you come with an account and wish to begin to use US Legal Forms, adopt these measures:

- Discover the kind you need and make sure it is for the appropriate city/region.

- Utilize the Preview button to check the form.

- See the explanation to actually have selected the appropriate kind.

- In the event the kind is not what you are looking for, use the Lookup field to find the kind that meets your needs and requirements.

- Once you get the appropriate kind, click on Get now.

- Opt for the prices program you want, fill in the necessary information and facts to create your account, and pay money for an order utilizing your PayPal or bank card.

- Pick a convenient document structure and obtain your backup.

Discover all of the record templates you possess bought in the My Forms food selection. You can aquire a extra backup of Puerto Rico Minutes of Organizational Meeting of Directors for a 501(c)(3) Association whenever, if needed. Just click the essential kind to obtain or print out the record web template.

Use US Legal Forms, one of the most extensive variety of lawful kinds, to save time and steer clear of errors. The support provides appropriately produced lawful record templates which you can use for a range of functions. Make an account on US Legal Forms and start producing your daily life easier.