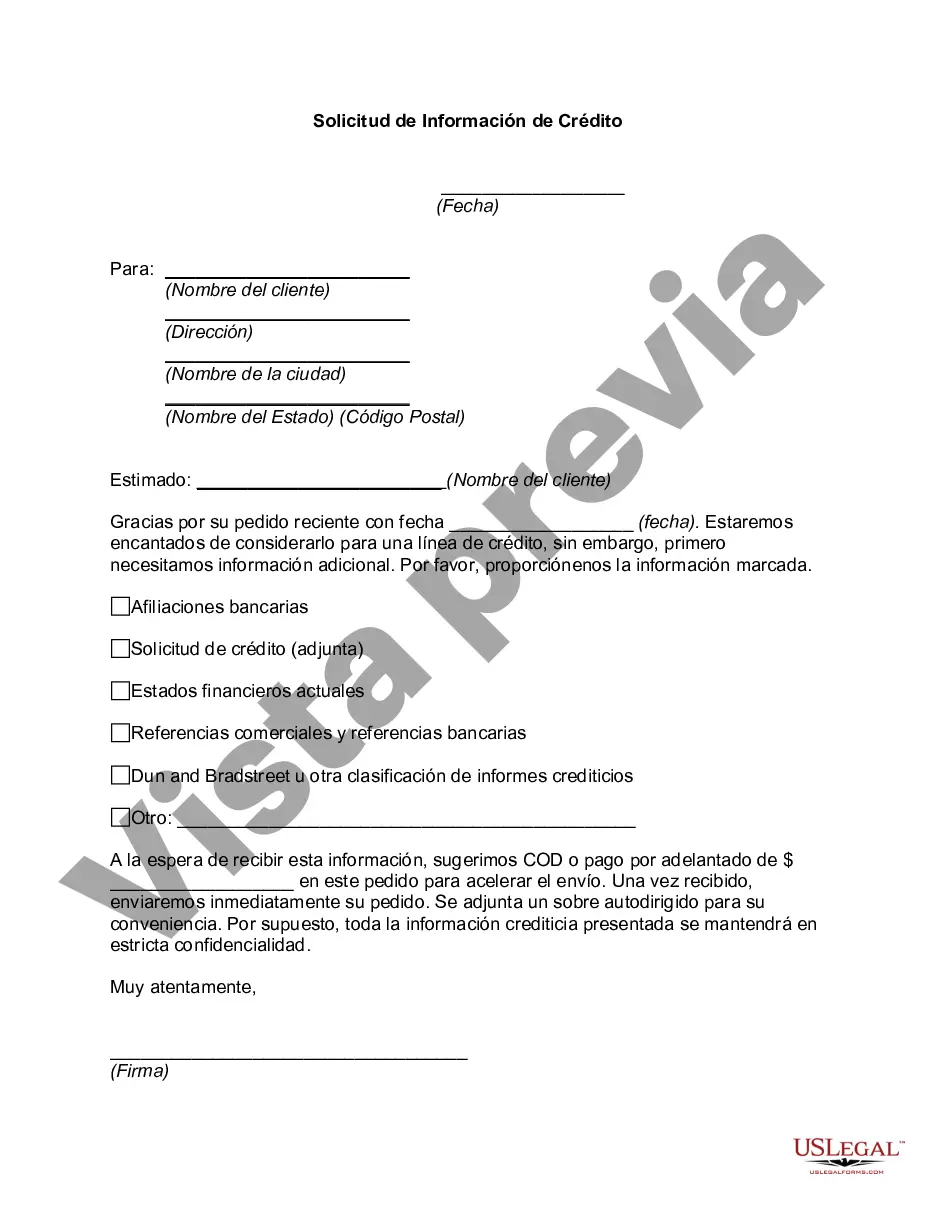

Puerto Rico Credit Information Request is a formal procedure for individuals or businesses in Puerto Rico to obtain access to their credit reports and credit-related information. This process enables individuals to assess their creditworthiness and ensure the accuracy of the information contained in their credit files. It is an essential step for anyone planning to apply for credit, loans, mortgages, or any financial transaction involving credit evaluation. The Puerto Rico Credit Information Request is usually initiated by submitting a request either through designated credit bureaus or online platforms specializing in credit reporting services. Key information required for the request typically includes personal identification details like name, address, social security number, and any additional information required for verification purposes. Once the request is processed, individuals can receive comprehensive credit reports containing detailed information about their credit history, including account balances, payment history, credit inquiries, and any negative records such as late payments, defaults, or bankruptcies. These credit reports provide an overview of an individual's creditworthiness and play a crucial role in determining the likelihood of being approved for credit or obtaining favorable terms. Apart from the standard Puerto Rico Credit Information Request, there may be specific types of credit request variations tailored to certain purposes or situations. These specialized credit information requests are designed to cater to unique needs and circumstances, ensuring individuals have access to the most relevant credit information. Some examples of these variations may include: 1. Puerto Rico Business Credit Information Request: Specifically designed for businesses, this type of credit information request involves assessing the credit history, financial stability, and payment behaviors of a company or organization. It provides insights into the creditworthiness of the entity, helping potential lenders or suppliers evaluate the risk associated with business transactions. 2. Puerto Rico Mortgage Credit Information Request: Aimed at individuals seeking mortgage financing, this type of credit request focuses on evaluating credit history, debt-to-income ratios, and overall financial stability. Lenders use this information to determine the interest rate, loan amount, and terms for mortgage applications. 3. Puerto Rico Consumer Credit Information Request: This is the most common type of credit information request, covering personal credit histories. It encompasses details regarding credit cards, personal loans, student loans, auto loans, and other credit-related activities undertaken by an individual. Regardless of the variation, the Puerto Rico Credit Information Request helps individuals and businesses gain access to their credit reports, empowering them to take appropriate steps to manage and improve their creditworthiness. By identifying potential errors, rectifying inaccuracies, and monitoring credit progress, individuals can work towards achieving financial goals, maintaining a healthy credit profile, and securing better borrowing opportunities in Puerto Rico.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Puerto Rico Solicitud de Información de Crédito - Credit Information Request

Description

How to fill out Puerto Rico Solicitud De Información De Crédito?

Are you currently within a position that you require documents for sometimes organization or person reasons virtually every day? There are a variety of lawful papers web templates accessible on the Internet, but locating kinds you can rely isn`t simple. US Legal Forms gives a large number of develop web templates, just like the Puerto Rico Credit Information Request, that are written to satisfy federal and state requirements.

When you are already informed about US Legal Forms website and also have a merchant account, simply log in. After that, you can download the Puerto Rico Credit Information Request template.

Should you not offer an bank account and wish to begin to use US Legal Forms, adopt these measures:

- Obtain the develop you want and ensure it is for the proper area/area.

- Utilize the Preview key to review the form.

- See the explanation to ensure that you have selected the correct develop.

- If the develop isn`t what you are looking for, utilize the Look for industry to find the develop that suits you and requirements.

- When you discover the proper develop, click Buy now.

- Pick the rates strategy you want, fill in the required information and facts to make your money, and pay for the transaction utilizing your PayPal or credit card.

- Decide on a practical document structure and download your version.

Get all of the papers web templates you may have purchased in the My Forms menu. You can aquire a further version of Puerto Rico Credit Information Request at any time, if needed. Just select the essential develop to download or produce the papers template.

Use US Legal Forms, probably the most substantial collection of lawful kinds, to conserve time and prevent faults. The service gives appropriately manufactured lawful papers web templates which you can use for a variety of reasons. Produce a merchant account on US Legal Forms and commence generating your lifestyle easier.