Puerto Rico Shipping Order for Warehoused Goods

Description

How to fill out Shipping Order For Warehoused Goods?

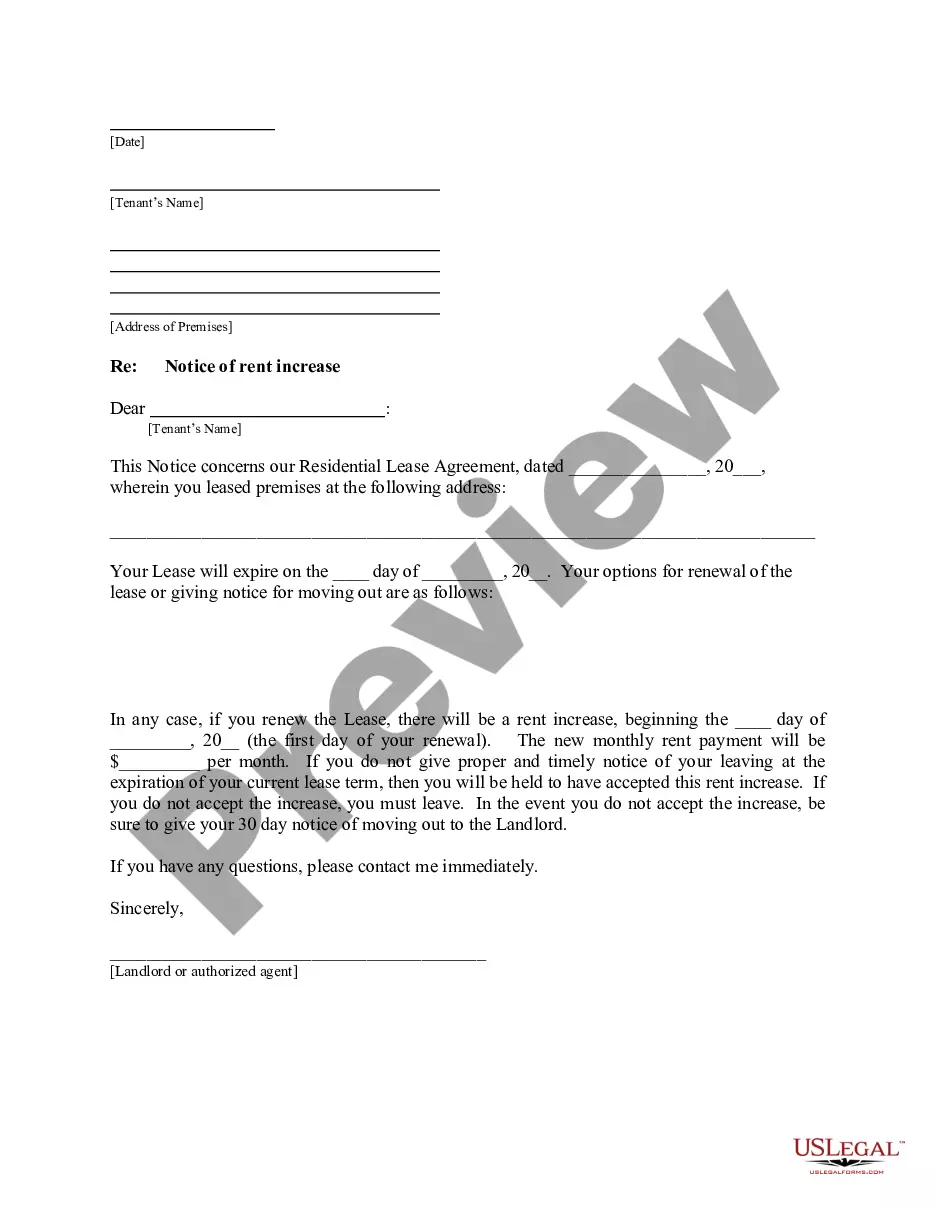

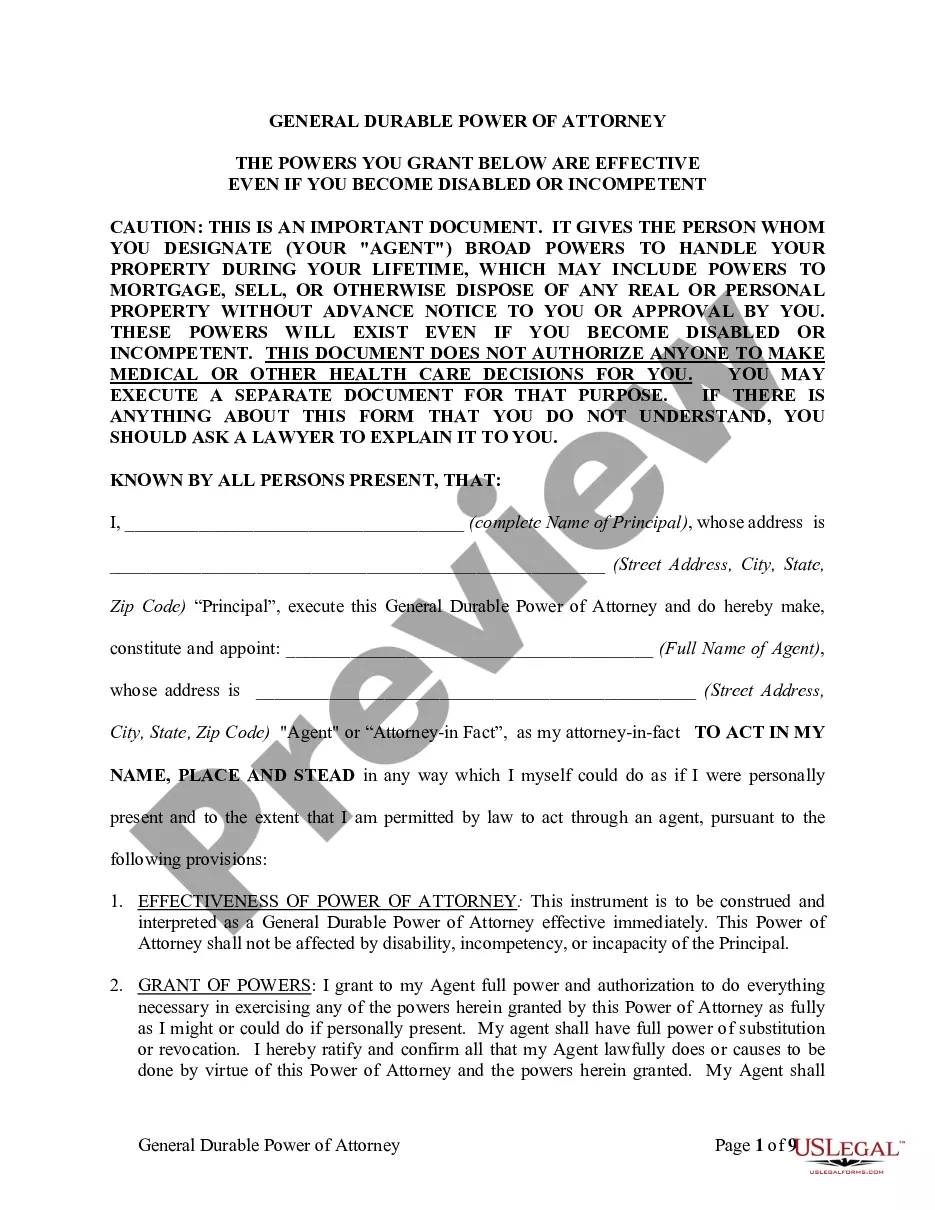

Choosing the right legal file design can be quite a have difficulties. Obviously, there are a lot of templates accessible on the Internet, but how would you get the legal type you require? Make use of the US Legal Forms web site. The support offers 1000s of templates, including the Puerto Rico Shipping Order for Warehoused Goods, which can be used for business and private needs. All the kinds are examined by professionals and fulfill state and federal needs.

Should you be currently listed, log in to the bank account and click on the Down load option to find the Puerto Rico Shipping Order for Warehoused Goods. Make use of bank account to appear from the legal kinds you possess purchased previously. Check out the My Forms tab of your respective bank account and get another version from the file you require.

Should you be a new end user of US Legal Forms, listed here are straightforward guidelines so that you can comply with:

- Very first, make sure you have selected the appropriate type for the city/state. You can examine the form making use of the Review option and browse the form outline to make sure it will be the best for you.

- In the event the type fails to fulfill your requirements, take advantage of the Seach field to get the appropriate type.

- When you are certain that the form is proper, select the Acquire now option to find the type.

- Pick the pricing prepare you need and type in the required information and facts. Make your bank account and purchase the transaction utilizing your PayPal bank account or Visa or Mastercard.

- Pick the document file format and obtain the legal file design to the device.

- Full, change and print and indication the obtained Puerto Rico Shipping Order for Warehoused Goods.

US Legal Forms will be the greatest catalogue of legal kinds that you can see numerous file templates. Make use of the service to obtain professionally-created files that comply with express needs.

Form popularity

FAQ

A shipment to Puerto Rico doesn't need to go through customs because it is a domestic package. However, you will need a commercial invoice, and if the value of the shipment exceeds $2,500 US you will also need Electronic Export Information.

Currently, Puerto Rico is considered an unincorporated territory of the US. This means that the USPS considers Puerto Rico to be domestic shipping, but some private carriers (like FedEx or UPS) consider Puerto Rico to be international.

As a U.S. territory, shipments to Puerto Rico are not considered exports so duties are not applied.

Though shipments to Puerto Rico do not need to clear customs, they are subject to a sales tax based on the value of the goods (noted on the commercial invoice). Shipments must be declared and released by the Puerto Rico Tax Department before they can be delivered.

An AES filing is required for goods moving from a U.S. FTZ to Puerto Rico as indicated in FTR Section 30.2(a)(1)(ii).

Shipments arriving directly to Puerto Rico from international destinations must first clear U.S. Customs. Then, they'll be subject to the excise tax and clearance by Hacienda, as described above.

USPS considers Puerto Rico to be domestic shipping, but FedEx and UPS consider it to be international.

Does customs check every package? The short answer is yes. Customs checks all inbound international packages and mail. During this process, a customs officer in the country you're shipping to will review the package to make sure it meets the country's laws, regulations and policies.

Puerto Rico is part of the U.S. Customs territory and therefore no customs duties are assessed on products coming from the mainland United States. There is, however, a 11.5 percent excise tax (sales tax) applied on products imported into the island, as well as on those produced locally.

EEI filings are required for shipments from the U.S. mainland and Puerto Rico to the U.S. Virgin Islands, but not for shipments from the U.S. Virgin Islands to the U.S. mainland or Puerto Rico. filing of an EEI.