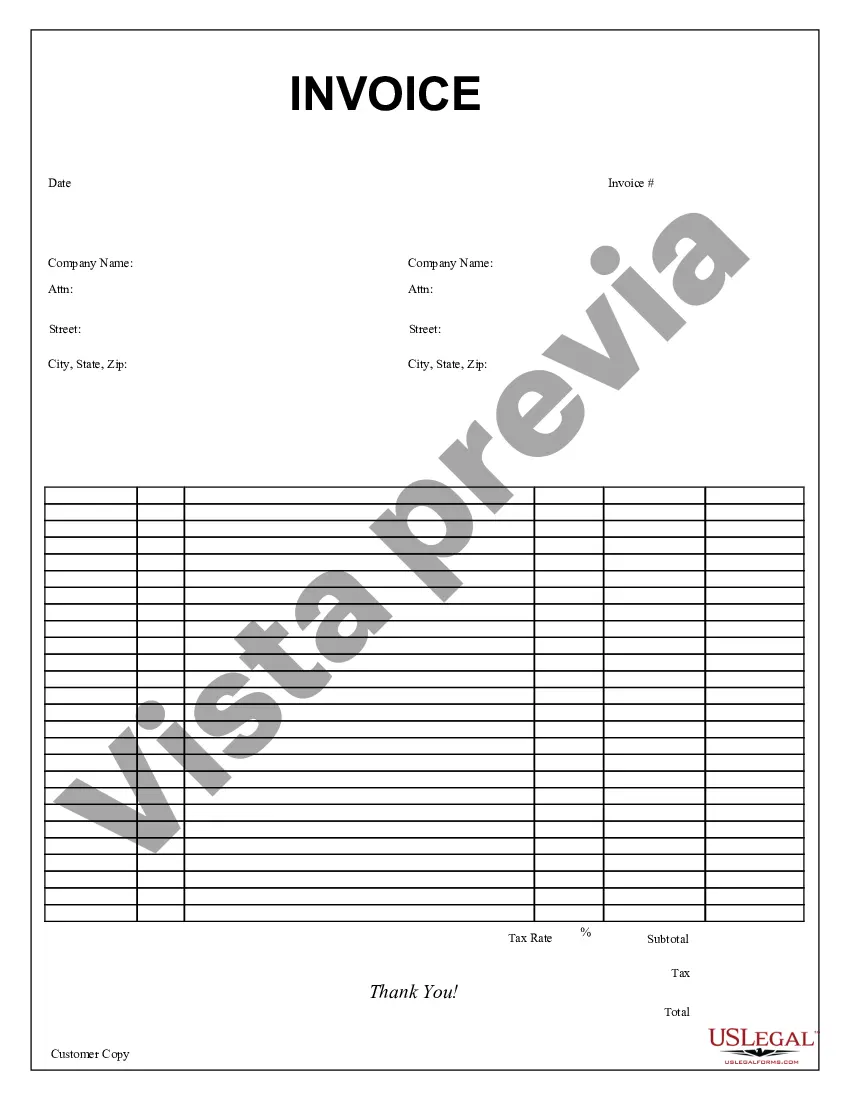

A Puerto Rico Purchase Invoice is a document used in Puerto Rico to record the purchase of goods or services from a vendor. It serves as proof of the transaction between the buyer and the seller, including the details of the items purchased, quantities, prices, and any applicable taxes. The Puerto Rico Purchase Invoice typically includes essential information such as the names and contact details of both the buyer and the seller, the date of the transaction, and a unique invoice number for tracking purposes. Additionally, it may include the seller's tax identification number (known as the Registry de Comerciante), the buyer's tax exemption certificate number (if applicable), and payment terms. Different types of Puerto Rico Purchase Invoices may exist based on the nature of the transaction or specific requirements. For instance, there could be Purchase Invoices for purchases made by individuals for personal use, as well as invoices for business-to-business transactions. When it comes to tax obligations, there are specialized types of invoices to consider. In Puerto Rico, businesses must comply with the Puerto Rico Internal Revenue Code, which includes regulations pertaining to sales and use taxes. As a result, specific types of invoices may be required for taxable and exempt sales. Among the different types of Puerto Rico Purchase Invoices are: 1. Standard Purchase Invoice: This is the most common type used for regular business-to-business or business-to-consumer transactions. It includes the necessary information, such as the seller's details, buyer's details, description of goods or services, quantities, unit prices, total amounts, and any applicable taxes. 2. Exempt Purchase Invoice: For transactions where the buyer is exempt from paying sales tax, an exempt purchase invoice is issued. This type of invoice will include the buyer's tax exemption certificate number, which signifies that the purchase is not subject to tax. 3. Retail Sales Invoice: When selling goods or services directly to consumers, retailers typically issue retail sales invoices. These invoices usually include additional details, such as a breakdown of taxes, any discounts applied, and the total amount due. In summary, a Puerto Rico Purchase Invoice is a crucial document that facilitates transactions between buyers and sellers in Puerto Rico. It provides a detailed record of the purchase and serves as a reference for accounting, tax compliance, and legal purposes. Different types of purchase invoices exist, including standard invoices for regular transactions, exempt invoices for tax-exempt purchases, and retail sales invoices for consumer transactions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Puerto Rico Factura de compra - Purchase Invoice

Description

How to fill out Puerto Rico Factura De Compra?

You may commit hrs on-line searching for the legitimate record template that fits the federal and state requirements you will need. US Legal Forms offers a large number of legitimate kinds which are reviewed by specialists. It is possible to download or print the Puerto Rico Purchase Invoice from the service.

If you currently have a US Legal Forms bank account, you can log in and click the Acquire button. Following that, you can total, revise, print, or indication the Puerto Rico Purchase Invoice. Each and every legitimate record template you buy is yours forever. To get another backup of any acquired kind, check out the My Forms tab and click the corresponding button.

If you are using the US Legal Forms web site the first time, follow the basic recommendations below:

- First, make certain you have selected the right record template for the area/town that you pick. See the kind description to make sure you have picked the proper kind. If accessible, utilize the Review button to look through the record template at the same time.

- If you want to find another edition of the kind, utilize the Look for area to get the template that fits your needs and requirements.

- Upon having identified the template you need, click Get now to continue.

- Find the costs plan you need, type your accreditations, and register for a merchant account on US Legal Forms.

- Full the deal. You can utilize your Visa or Mastercard or PayPal bank account to purchase the legitimate kind.

- Find the formatting of the record and download it for your system.

- Make adjustments for your record if required. You may total, revise and indication and print Puerto Rico Purchase Invoice.

Acquire and print a large number of record web templates while using US Legal Forms site, which offers the largest collection of legitimate kinds. Use professional and state-certain web templates to take on your business or specific needs.