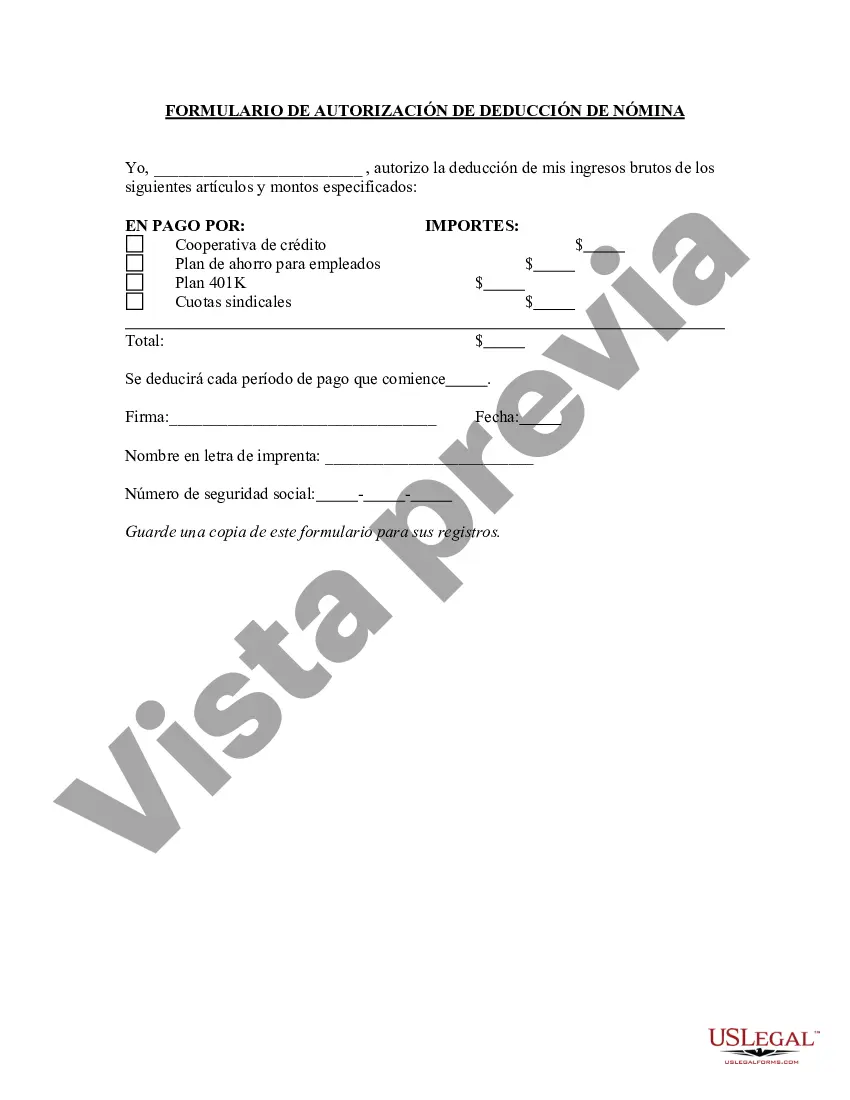

Puerto Rico Payroll Deduction Authorization Form is a legal document used by employers in Puerto Rico to obtain written consent from employees to deduct certain amounts from their wages. It is designed to ensure compliance with specific Puerto Rican labor laws and allows employees to authorize deductions voluntarily for specific purposes. This form serves as a written agreement between the employer and employee, clearly outlining the terms and conditions of the authorized deductions. Keywords: Puerto Rico, Payroll Deduction, Authorization Form, employees, wages, written consent, compliance, labor laws, deductions, voluntary, specific purposes, agreement, terms and conditions. Different types of Puerto Rico Payroll Deduction Authorization Forms can include: 1. Puerto Rico Retirement Savings Deduction Authorization Form: This form enables employees to authorize deductions from their wages for contributions into retirement savings plans such as 401(k) or individual retirement accounts (IRA). 2. Puerto Rico Health Insurance Deduction Authorization Form: Designed to obtain employee consent for deductions to cover health insurance premiums or other healthcare-related expenses. 3. Puerto Rico Charitable Contribution Deduction Authorization Form: This form allows employees to authorize deductions from wages for charitable donations to eligible organizations or causes. 4. Puerto Rico Union Dues Deduction Authorization Form: This form grants employees the option to authorize deductions for union membership dues or fees. 5. Puerto Rico Debt Repayment Deduction Authorization Form: Employees who owe debts to their employer, such as loans or advances, can use this form to authorize wage deductions towards the repayment of the outstanding amounts. These are just a few examples of the various types of Puerto Rico Payroll Deduction Authorization Forms, each catering to specific purposes or deductions that an employee may authorize.

Puerto Rico Payroll Deduction Authorization Form is a legal document used by employers in Puerto Rico to obtain written consent from employees to deduct certain amounts from their wages. It is designed to ensure compliance with specific Puerto Rican labor laws and allows employees to authorize deductions voluntarily for specific purposes. This form serves as a written agreement between the employer and employee, clearly outlining the terms and conditions of the authorized deductions. Keywords: Puerto Rico, Payroll Deduction, Authorization Form, employees, wages, written consent, compliance, labor laws, deductions, voluntary, specific purposes, agreement, terms and conditions. Different types of Puerto Rico Payroll Deduction Authorization Forms can include: 1. Puerto Rico Retirement Savings Deduction Authorization Form: This form enables employees to authorize deductions from their wages for contributions into retirement savings plans such as 401(k) or individual retirement accounts (IRA). 2. Puerto Rico Health Insurance Deduction Authorization Form: Designed to obtain employee consent for deductions to cover health insurance premiums or other healthcare-related expenses. 3. Puerto Rico Charitable Contribution Deduction Authorization Form: This form allows employees to authorize deductions from wages for charitable donations to eligible organizations or causes. 4. Puerto Rico Union Dues Deduction Authorization Form: This form grants employees the option to authorize deductions for union membership dues or fees. 5. Puerto Rico Debt Repayment Deduction Authorization Form: Employees who owe debts to their employer, such as loans or advances, can use this form to authorize wage deductions towards the repayment of the outstanding amounts. These are just a few examples of the various types of Puerto Rico Payroll Deduction Authorization Forms, each catering to specific purposes or deductions that an employee may authorize.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.