Puerto Rico is a United States territory located in the northeastern Caribbean, known for its rich culture, stunning beaches, and vibrant history. The island operates under a unique set of tax laws, including the Puerto Rico Provision Dealing with Changes in Share Ownership of Corporations and Changes in Share Ownership of Partnership. The Puerto Rico Provision Dealing with Changes in Share Ownership of Corporations is a regulation that governs the transfer of shares of corporate entities on the island. It outlines the processes and requirements that must be followed when there is a change in the ownership structure of a Puerto Rico-based corporation. In order to comply with this provision, both the selling and acquiring parties need to adhere to specific guidelines. These may include reporting the change in ownership to the appropriate authorities, obtaining regulatory approvals if necessary, and ensuring any tax implications are properly addressed. The provision also defines the potential tax consequences of transferring shares in a Puerto Rico corporation. Depending on the circumstances, capital gains may be triggered, and certain exemptions or deductions may apply. It is essential for both parties involved to understand and comply with the provision to minimize any potential tax liabilities. Similarly, the Puerto Rico Provision Dealing with Changes in Share Ownership of Partnership addresses changes in the ownership of partnerships on the island. It provides guidelines for both general and limited partnerships, ensuring there is a proper framework in place when ownership interests are transferred. Just like with corporations, compliance with this provision entails notifying relevant authorities about the change in share ownership and addressing any potential tax implications. Partnership agreements may need to be amended, and tax liabilities or benefits resulting from the ownership change should be properly managed. There may be distinct types or variations of the Puerto Rico Provision Dealing with Changes in Share Ownership of Corporations and Changes in Share Ownership of Partnership, such as provisions specific to certain industries or sectors. It is important for individuals or entities engaged in transferring ownership shares in Puerto Rico to consult legal and tax experts to ensure compliance with the relevant provisions and to navigate any complexities specific to their situation. In summary, the Puerto Rico Provision Dealing with Changes in Share Ownership of Corporations and Changes in Share Ownership of Partnership require adhering to specific guidelines when transferring ownership shares in Puerto Rico-based corporations and partnerships. Compliance with these provisions is crucial to ensure proper reporting, regulatory approvals, and managing potential tax implications.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Puerto Rico Disposición que Trata de Cambios en la Propiedad de Acciones de Corporaciones y Cambios en la Propiedad de Acciones de Sociedades - Provision Dealing with Changes in Share Ownership of Corporations and Changes in Share Ownership of Partnership

Description

How to fill out Puerto Rico Disposición Que Trata De Cambios En La Propiedad De Acciones De Corporaciones Y Cambios En La Propiedad De Acciones De Sociedades?

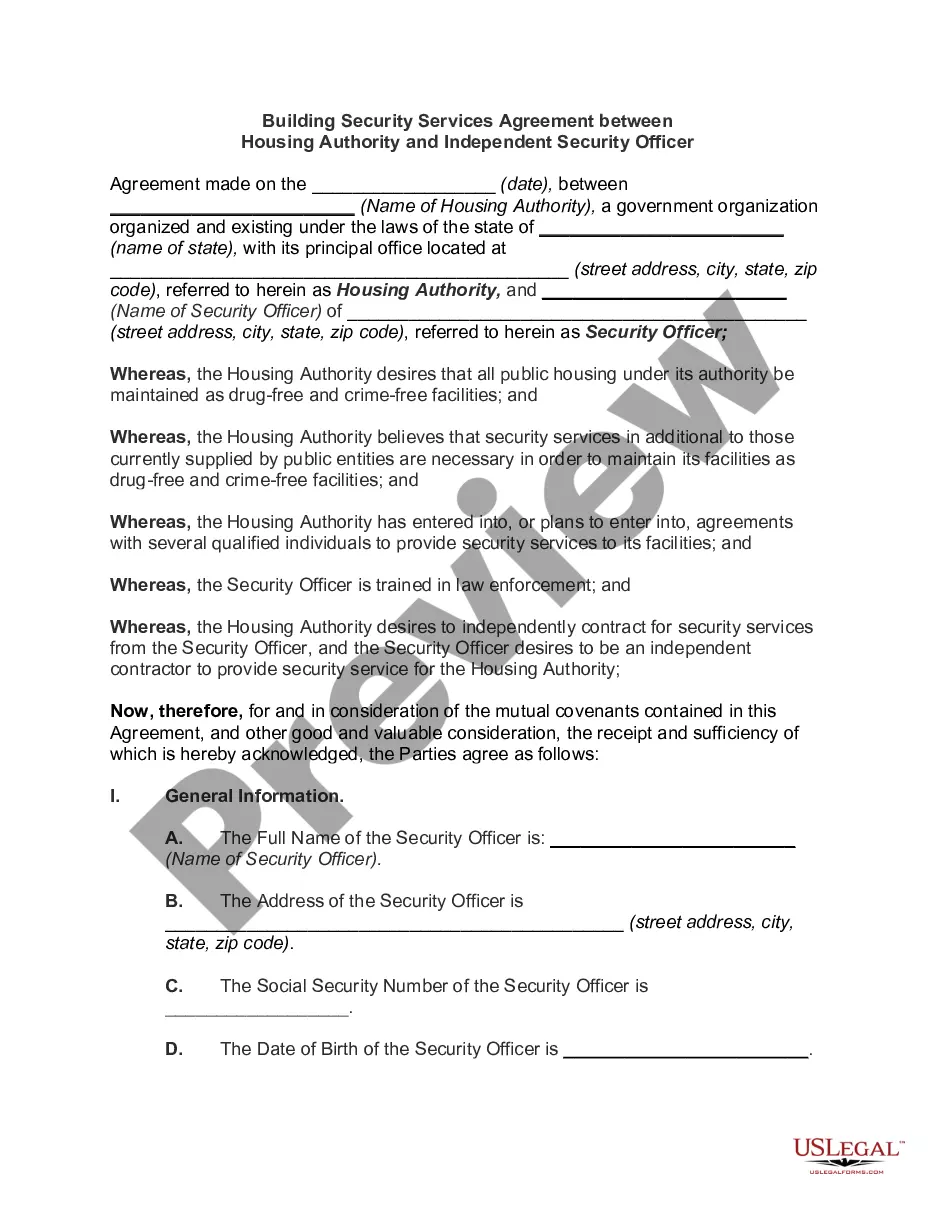

Choosing the best lawful file template can be quite a struggle. Naturally, there are a lot of themes available on the net, but how will you find the lawful develop you require? Use the US Legal Forms website. The support delivers a huge number of themes, for example the Puerto Rico Provision Dealing with Changes in Share Ownership of Corporations and Changes in Share Ownership of Partnership, which can be used for company and personal needs. All the kinds are checked out by professionals and satisfy state and federal requirements.

In case you are previously listed, log in to your profile and then click the Down load button to find the Puerto Rico Provision Dealing with Changes in Share Ownership of Corporations and Changes in Share Ownership of Partnership. Make use of your profile to look from the lawful kinds you have acquired in the past. Visit the My Forms tab of your profile and obtain an additional copy of your file you require.

In case you are a new end user of US Legal Forms, here are simple recommendations that you should stick to:

- Very first, ensure you have selected the proper develop for your town/county. You may examine the shape utilizing the Review button and study the shape description to make sure it will be the best for you.

- In case the develop will not satisfy your expectations, make use of the Seach field to get the correct develop.

- When you are certain that the shape is suitable, go through the Acquire now button to find the develop.

- Choose the pricing strategy you need and enter in the essential info. Design your profile and buy an order making use of your PayPal profile or bank card.

- Pick the document formatting and download the lawful file template to your device.

- Complete, change and produce and signal the obtained Puerto Rico Provision Dealing with Changes in Share Ownership of Corporations and Changes in Share Ownership of Partnership.

US Legal Forms is the largest local library of lawful kinds where you can find different file themes. Use the service to download skillfully-made papers that stick to state requirements.