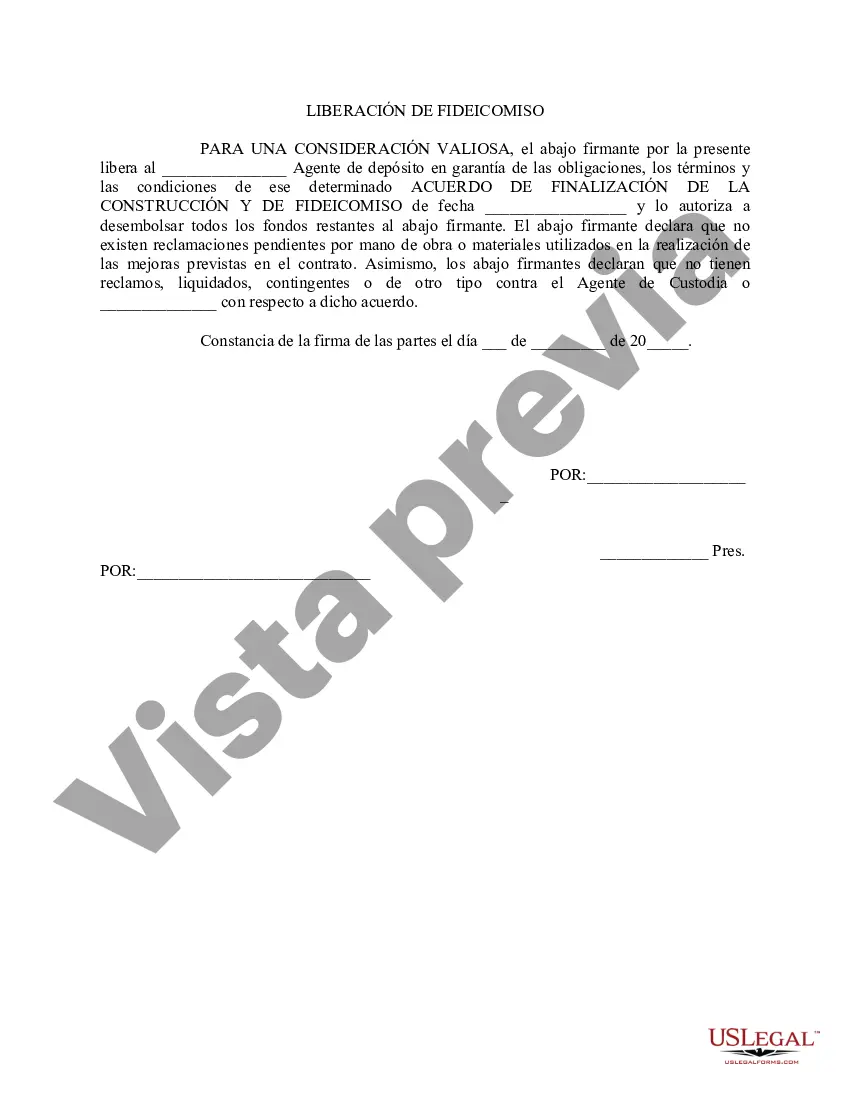

Rhode Island Escrow Release refers to the process of releasing funds held in an escrow account to the intended recipient upon the completion of specific conditions or requirements. An escrow account is established by a third party, typically a neutral escrow agent or a reputable financial institution, to safeguard funds until certain contractual obligations are fulfilled. This process is commonly used in real estate transactions, where a buyer may deposit funds into an escrow account, and the seller is assured that the funds will be released only when certain conditions, such as successful home inspection or title search, are met. Different types of Rhode Island Escrow Releases may vary based on the nature of the transaction or the specific terms agreed upon by the parties involved. Some common types of escrow releases in Rhode Island include: 1. Real Estate Escrow Release: This type of escrow release occurs when buying or selling a property. The buyer will typically deposit the earnest money into an escrow account, and upon fulfilling all contractually agreed conditions, such as passing inspections, obtaining financing, or resolving legal disputes, the escrow agent will release the funds to the seller. 2. Construction Escrow Release: In construction projects, an escrow account may be established to hold funds until certain milestones are achieved. This type of escrow release ensures that contractors or subcontractors are paid upon successful completion of predetermined tasks, such as reaching a designated stage of construction or obtaining necessary permits. 3. Business Escrow Release: When buying or selling a business, an escrow account may be used to hold the purchase price until all contractual obligations are fulfilled. This can involve ensuring the transfer of intellectual property rights, resolving outstanding debts or liabilities, or obtaining necessary licenses or permits. The Rhode Island Escrow Release process is carefully regulated by state laws and typically involves a written agreement that outlines the conditions under which the funds will be released. It provides security and peace of mind to all parties involved, as it ensures that financial commitments are fulfilled before funds are disbursed. Additionally, the use of a neutral third party as an escrow agent helps to minimize the risk of fraud or disputes that may arise during the transaction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Rhode Island Liberación de depósito en garantía - Escrow Release

Description

How to fill out Rhode Island Liberación De Depósito En Garantía?

US Legal Forms - one of several biggest libraries of authorized types in America - gives a variety of authorized file templates you may download or print out. Making use of the internet site, you can find thousands of types for business and person functions, categorized by classes, says, or keywords and phrases.You can get the most recent versions of types such as the Rhode Island Escrow Release within minutes.

If you already possess a membership, log in and download Rhode Island Escrow Release in the US Legal Forms catalogue. The Acquire option will show up on every develop you see. You have access to all in the past delivered electronically types from the My Forms tab of your bank account.

In order to use US Legal Forms the very first time, here are easy guidelines to help you get started off:

- Be sure you have chosen the correct develop for your area/area. Select the Preview option to analyze the form`s articles. See the develop explanation to ensure that you have chosen the proper develop.

- When the develop does not suit your specifications, make use of the Look for field near the top of the monitor to obtain the one who does.

- Should you be happy with the shape, verify your option by clicking on the Get now option. Then, choose the rates plan you want and offer your credentials to register to have an bank account.

- Process the deal. Utilize your charge card or PayPal bank account to complete the deal.

- Find the structure and download the shape on the gadget.

- Make alterations. Load, revise and print out and indication the delivered electronically Rhode Island Escrow Release.

Every design you added to your money lacks an expiry day and is also your own property eternally. So, if you would like download or print out one more backup, just proceed to the My Forms segment and then click on the develop you want.

Gain access to the Rhode Island Escrow Release with US Legal Forms, probably the most substantial catalogue of authorized file templates. Use thousands of skilled and condition-particular templates that meet up with your business or person demands and specifications.