The Rhode Island Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage is a legal document that facilitates the sale of a retail store owned and operated by a single individual (the sole proprietor). This agreement includes specific provisions regarding the transfer of ownership, the sale of goods and fixtures, and the calculation of the purchase price. The use of relevant keywords will help to emphasize the specific elements and types of this agreement. Firstly, the agreement outlines the terms and conditions of the sale, such as the effective date, the identities of the buyer and seller, and details regarding the retail store and its location. This information should be clearly stated in order to establish a mutual understanding between the involved parties. Additionally, the agreement includes a comprehensive description of the goods and fixtures being sold. This involves listing all inventory, merchandise, equipment, furniture, and any other tangible assets associated with the operation of the retail store. These keywords help to highlight the specific elements and assets to be transferred. The "Invoice Cost Plus Percentage" aspect of the agreement refers to the calculation method used to determine the purchase price of the retail store. In this type of agreement, the buyer is typically required to pay the total invoice cost of the goods and fixtures, along with an additional percentage specified in the agreement. This approach ensures that the seller recovers the actual cost of the inventory and fixtures while also accounting for their value and potential profitability. It's worth noting that while the Rhode Island Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage is a general term to describe this type of agreement, there might be different variations or specific subtypes based on individual preferences or unique circumstances. However, there are no widely recognized subcategories or standard names for these variations within the legal context. To summarize, the Rhode Island Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage is a legal document that facilitates the sale of a retail store owned by a sole proprietor. It outlines the terms of the sale, includes detailed descriptions of the goods and fixtures, and specifies the calculation method for determining the purchase price.

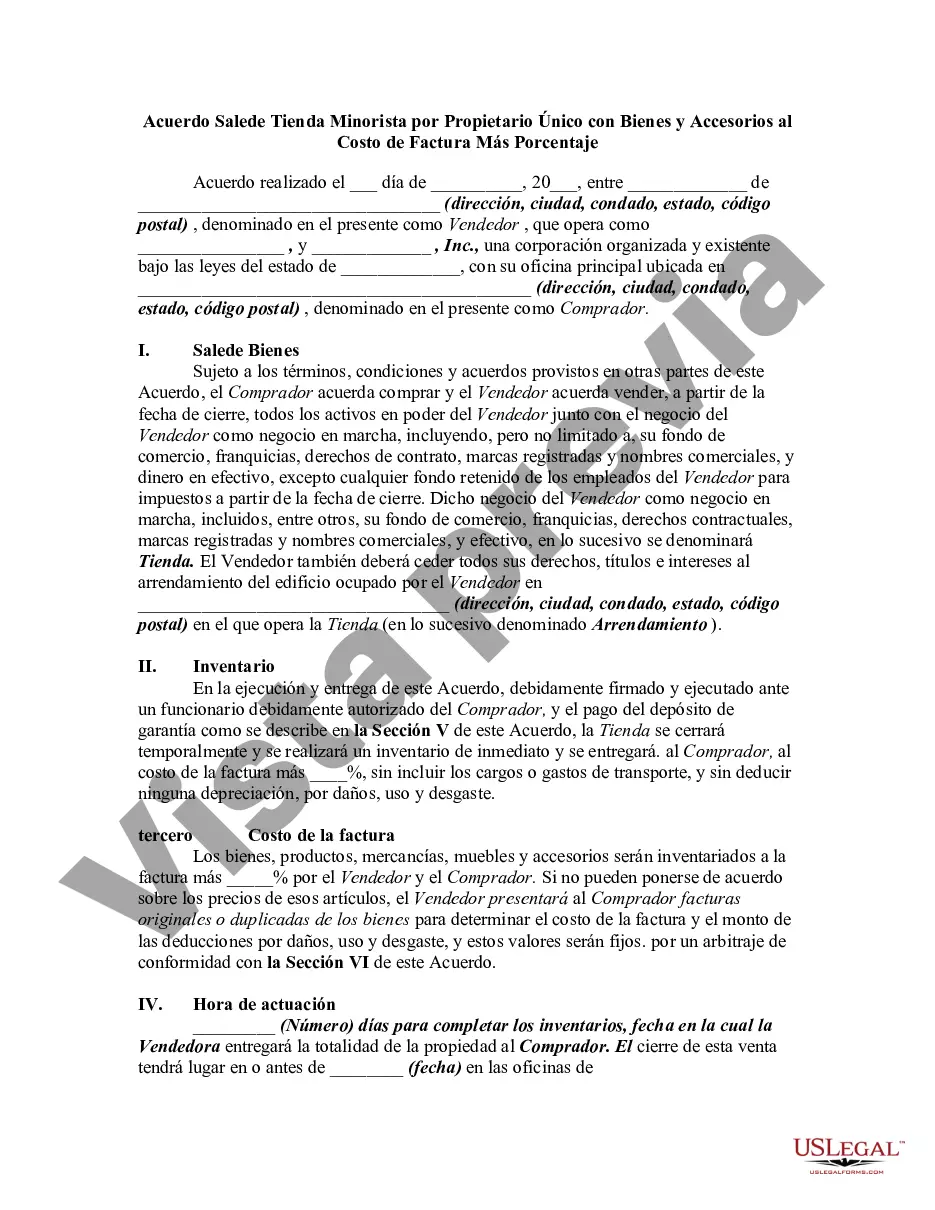

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Rhode Island Acuerdo para la Venta de Tienda Minorista por Propietario Único con Bienes y Accesorios al Costo de Factura Más Porcentaje - Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage

State:

Multi-State

Control #:

US-00869BG

Format:

Word

Instant download

Description

This form is used to document an agreement of the sale of a business. Particular statutory requirements may have to be complied with in the sale of certain businesses. If the statutory requirements are not met, the sale is void as against the seller's creditors, and the buyer may be personally liable to them.

Free preview

How to fill out Rhode Island Acuerdo Para La Venta De Tienda Minorista Por Propietario Único Con Bienes Y Accesorios Al Costo De Factura Más Porcentaje?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a broad selection of legal form templates that you can download or print.

Utilizing the website, you can access thousands of forms for business and personal use, organized by categories, states, or keywords.

You can find the latest versions of forms such as the Rhode Island Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage in just moments.

Review the form details to ensure you have selected the correct form.

If the form does not meet your needs, utilize the Search field at the top of the screen to find the one that does.

- If you already have a monthly subscription, Log In and download the Rhode Island Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage from the US Legal Forms library.

- The Download button will appear on each form you view.

- You have access to all previously saved forms within the My documents tab of your account.

- If you are using US Legal Forms for the first time, here are simple instructions to get started.

- Make sure you have selected the correct form for your city/state.

- Click the Review button to examine the content of the form.

Form popularity

Interesting Questions

More info

building. The contract states the property owner will reimburse the contractor for the cost of materials used and labor costs, plus 15%.104 pagesMissing: Island ? Must include: Island

? building. The contract states the property owner will reimburse the contractor for the cost of materials used and labor costs, plus 15%. The sale of a digital product is subject to the general rate of tax if theretailer shall add the amount of the tax to the sale price and may state the.241 pages

The sale of a digital product is subject to the general rate of tax if theretailer shall add the amount of the tax to the sale price and may state the.However, some vendors have good reason to include the sales tax in the posted price of the item. Perhaps you've set up a booth at a craft show ... Sales taxes in the United States are taxes placed on the sale or lease of goods and services in the United States. Sales tax is governed at the state level ... And local taxes that affect business and individual taxpayers.you owe use tax at the rate of 2% of the purchase price. Examples of items not requiring ...74 pages

and local taxes that affect business and individual taxpayers.you owe use tax at the rate of 2% of the purchase price. Examples of items not requiring ... Businesses must submit to the Division of Revenue the Business Registration Form (NJ-REG) and if applicable, the Public Records Filing for New Business Entity ...47 pages

Businesses must submit to the Division of Revenue the Business Registration Form (NJ-REG) and if applicable, the Public Records Filing for New Business Entity ... It is up to you whether you want to include a stated provision in your contract for the payment of sales taxes. However, when you negotiate a contract with a ... Read this tax guide designed for contractors in Iowa with questions about tax filing. Read our common questions if you have additional questions. Purchase in an open market, Contractor agrees to reimburse Region 4 ESC,Office Depot or OfficeMax retail locations or customers can opt to save time ... Taxpayers MUST complete Part V of their periodic and annual general excise/use tax returns to assign their taxes to each county, or may be subject to a 10% ...

Us Help Search Help Menu Help Phone Fax Contact Us.

Us Help Search Help Menu Help Phone Fax Contact Us.