Partnerships may be dissolved by acts of the partners, order of a Court, or by operation of law. From the moment of dissolution, the partners lose their authority to act for the firm except as necessary to wind up the partnership affairs or complete transactions which have begun, but not yet been finished.

A partner has the power to withdraw from the partnership at any time. However, if the withdrawal violates the partnership agreement, the withdrawing partner becomes liable to the co-partners for any damages for breach of contract. If the partnership relationship is for no definite time, a partner may withdraw without liability at any time.

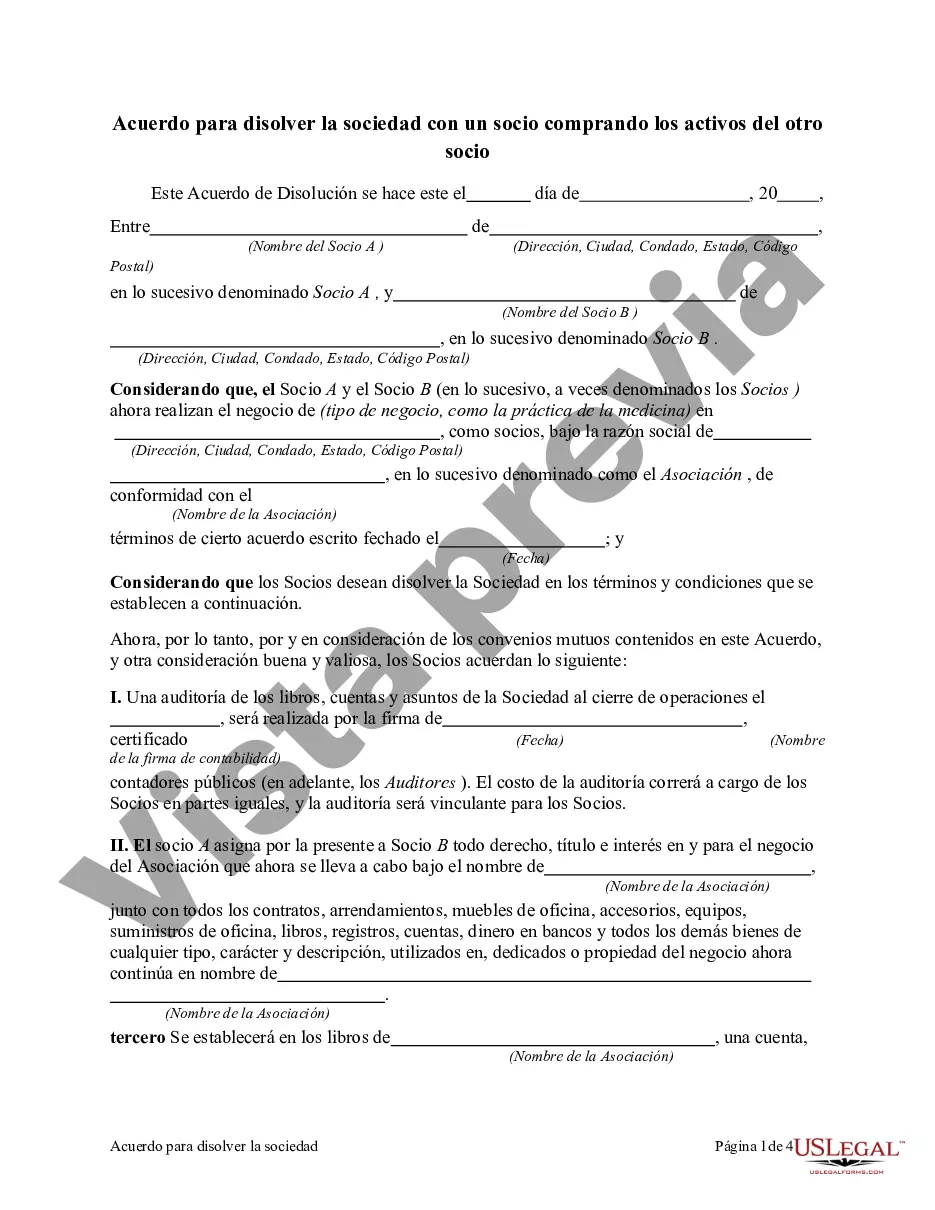

Rhode Island Agreement to Dissolve Partnership with one Partner Purchasing the Assets of the Other Partner In Rhode Island, when two partners decide to dissolve their partnership business, they have the option to enter into an Agreement to Dissolve Partnership with one partner buying out the assets of the other partner. This legal document outlines the terms and conditions for the dissolution of the partnership and the purchase of the assets, safeguarding the interests of both parties involved. The Rhode Island Agreement to Dissolve Partnership with one Partner Purchasing the Assets of the Other Partner contains key provisions that define the purchase price, payment terms, and responsibilities of each partner during the dissolution process. Keywords: Rhode Island, Agreement to Dissolve Partnership, one Partner Purchasing, Assets, Partner, Purchase Price, Payment Terms, Responsibilities, Dissolution Process. Types of Rhode Island Agreement to Dissolve Partnership with one Partner Purchasing the Assets of the Other Partner: 1. "Simple Purchase Agreement": This type of agreement is for partnerships with a straightforward dissolution process, where the partner purchasing the assets buys out the other partner's share at an agreed-upon fixed price. 2. "Installment Purchase Agreement": In cases where the purchasing partner may not have sufficient funds to buy out the other partner's assets outright, an installment purchase agreement may be used. This agreement allows the purchasing partner to pay for the assets in installments over a specified period, including any interest or agreed-upon terms. 3. "Asset Valuation Agreement": Sometimes, determining the value of the partnership assets can be challenging. In such cases, an asset valuation agreement is created, where both partners agree to hire a professional appraiser to determine the fair market value of the assets before the purchase takes place. 4. "Collaborative Dissolution Agreement": This type of agreement focuses on the dissolution process and not just on the purchase of assets. Both partners work collaboratively to settle debts, distribute remaining assets, and finalize any pending business matters. It includes provisions regarding the division of liabilities, customer contracts, employee transfers, and other partnership-related aspects. By using these relevant keywords and understanding the different types of Rhode Island Agreement to Dissolve Partnership with one Partner Purchasing the Assets of the Other Partner, one can gain a comprehensive understanding of the legal framework, options, and considerations involved in such dissolution agreements. It is always recommended consulting with a legal professional to ensure compliance with Rhode Island laws and to tailor the agreement according to the specifics of the partnership and the desired outcomes of both partners.Rhode Island Agreement to Dissolve Partnership with one Partner Purchasing the Assets of the Other Partner In Rhode Island, when two partners decide to dissolve their partnership business, they have the option to enter into an Agreement to Dissolve Partnership with one partner buying out the assets of the other partner. This legal document outlines the terms and conditions for the dissolution of the partnership and the purchase of the assets, safeguarding the interests of both parties involved. The Rhode Island Agreement to Dissolve Partnership with one Partner Purchasing the Assets of the Other Partner contains key provisions that define the purchase price, payment terms, and responsibilities of each partner during the dissolution process. Keywords: Rhode Island, Agreement to Dissolve Partnership, one Partner Purchasing, Assets, Partner, Purchase Price, Payment Terms, Responsibilities, Dissolution Process. Types of Rhode Island Agreement to Dissolve Partnership with one Partner Purchasing the Assets of the Other Partner: 1. "Simple Purchase Agreement": This type of agreement is for partnerships with a straightforward dissolution process, where the partner purchasing the assets buys out the other partner's share at an agreed-upon fixed price. 2. "Installment Purchase Agreement": In cases where the purchasing partner may not have sufficient funds to buy out the other partner's assets outright, an installment purchase agreement may be used. This agreement allows the purchasing partner to pay for the assets in installments over a specified period, including any interest or agreed-upon terms. 3. "Asset Valuation Agreement": Sometimes, determining the value of the partnership assets can be challenging. In such cases, an asset valuation agreement is created, where both partners agree to hire a professional appraiser to determine the fair market value of the assets before the purchase takes place. 4. "Collaborative Dissolution Agreement": This type of agreement focuses on the dissolution process and not just on the purchase of assets. Both partners work collaboratively to settle debts, distribute remaining assets, and finalize any pending business matters. It includes provisions regarding the division of liabilities, customer contracts, employee transfers, and other partnership-related aspects. By using these relevant keywords and understanding the different types of Rhode Island Agreement to Dissolve Partnership with one Partner Purchasing the Assets of the Other Partner, one can gain a comprehensive understanding of the legal framework, options, and considerations involved in such dissolution agreements. It is always recommended consulting with a legal professional to ensure compliance with Rhode Island laws and to tailor the agreement according to the specifics of the partnership and the desired outcomes of both partners.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.