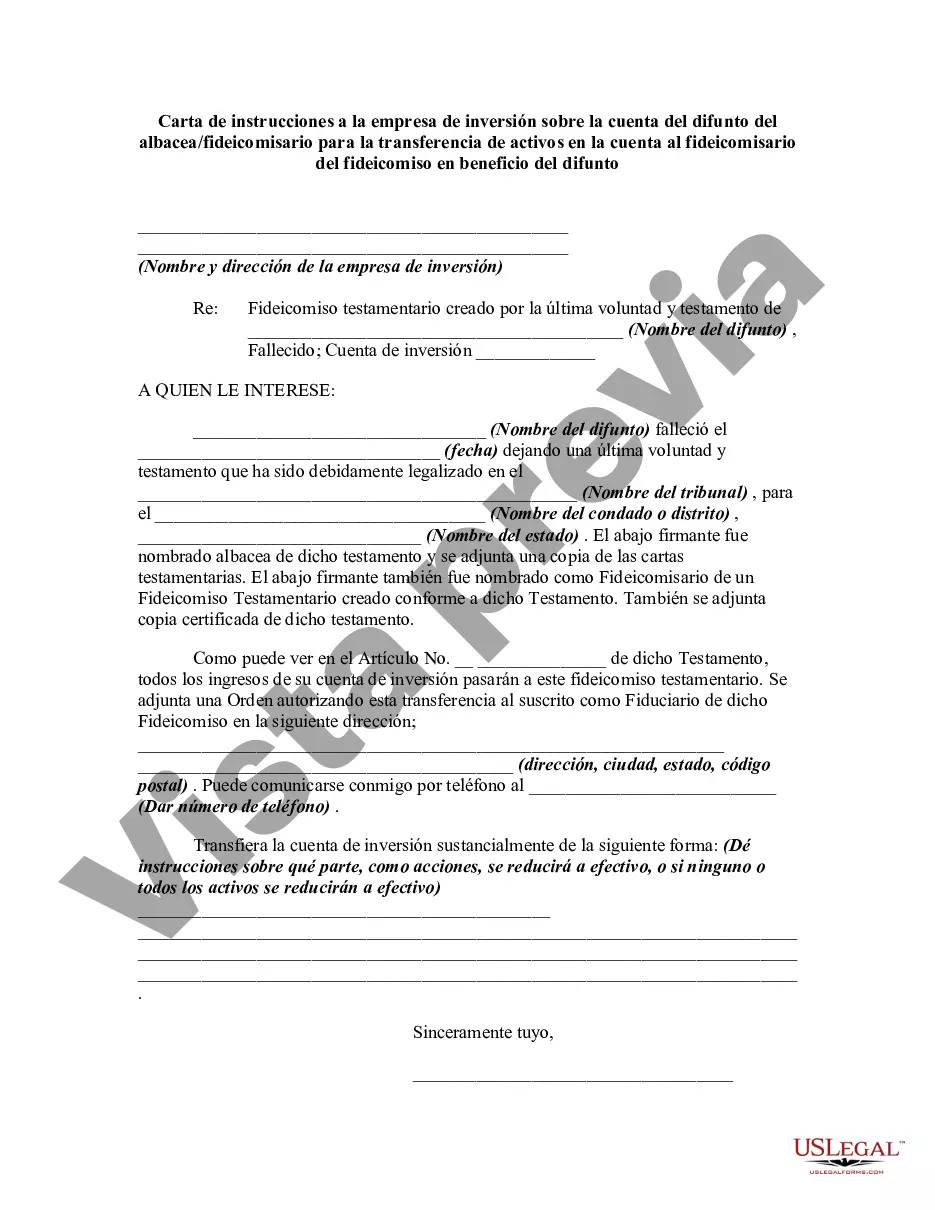

This form anticipates that a decedent left a will directing that all assets in a certain investment account be transferred to a trust. This form is a sample request to the investment firm from the trustee/executor for the assets.

A Rhode Island Letter of Instruction to an Investment Firm Regarding the Account of a Decedent from Executor/Trustee for the Transfer of Assets in the Account to a Trustee of a Trust for the Benefit of the Decedent is a legal document that outlines the specific instructions given by the executor or trustee to the investment firm regarding the transfer of assets from the decedent's account to a trust account established for the benefit of the decedent. Such a letter is typically written when there is a need to transfer the assets held in the decedent's account to a trust account as per the wishes of the decedent or as directed by the probate court. It provides clear guidance to the investment firm on how to handle the transfer process and ensures that the assets are distributed in accordance with the decedent's estate plan. Relevant keywords for this topic may include: — Rhode Islanprobateat— - Investment firm instructions — Decedent's accountransferfe— - Executor/Trustee responsibilities — Trustee of trust for the benefit of the decedent — Assetdistributionio— - Estate planning - Probate court directives — Legal documentation There may not be different types of Rhode Island Letters of Instruction to an Investment Firm Regarding the Account of a Decedent from Executor/Trustee for the Transfer of Assets in the Account to a Trustee of a Trust for the Benefit of the Decedent, as the content and purpose of this document remain relatively consistent across cases. However, variations in specific instructions and asset types may exist based on individual circumstances, making each letter unique.A Rhode Island Letter of Instruction to an Investment Firm Regarding the Account of a Decedent from Executor/Trustee for the Transfer of Assets in the Account to a Trustee of a Trust for the Benefit of the Decedent is a legal document that outlines the specific instructions given by the executor or trustee to the investment firm regarding the transfer of assets from the decedent's account to a trust account established for the benefit of the decedent. Such a letter is typically written when there is a need to transfer the assets held in the decedent's account to a trust account as per the wishes of the decedent or as directed by the probate court. It provides clear guidance to the investment firm on how to handle the transfer process and ensures that the assets are distributed in accordance with the decedent's estate plan. Relevant keywords for this topic may include: — Rhode Islanprobateat— - Investment firm instructions — Decedent's accountransferfe— - Executor/Trustee responsibilities — Trustee of trust for the benefit of the decedent — Assetdistributionio— - Estate planning - Probate court directives — Legal documentation There may not be different types of Rhode Island Letters of Instruction to an Investment Firm Regarding the Account of a Decedent from Executor/Trustee for the Transfer of Assets in the Account to a Trustee of a Trust for the Benefit of the Decedent, as the content and purpose of this document remain relatively consistent across cases. However, variations in specific instructions and asset types may exist based on individual circumstances, making each letter unique.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.