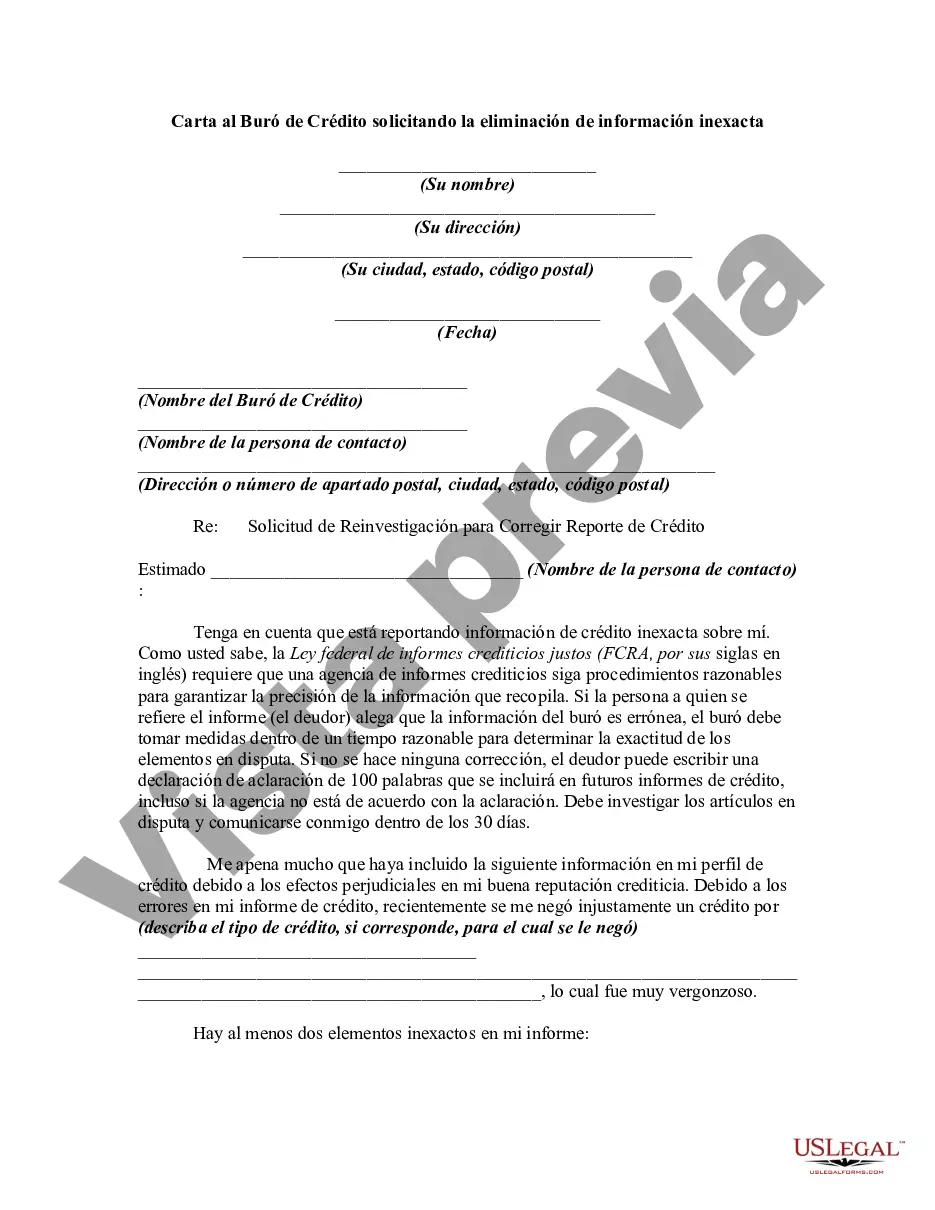

This form is a sample letter requesting the removal of inaccurate information. Always include any copies of proof you may have (e.g., copies of cancelled checks showing timely payments). If the person claims that the information of the bureau is erroneous, the bureau must take steps within a reasonable time to determine the accuracy of the disputed items. If no correction is made, the debtor can write a 100 word statement of clarification which will be included in future credit reports, even it the agency disagrees with clarification.

Rhode Island residents who are facing inaccuracies on their credit reports can take appropriate action by writing a Rhode Island Letter to Credit Bureau Requesting the Removal of Inaccurate Information. This formal letter serves as a legal tool to address credit reporting errors and helps individuals maintain accurate and reliable credit information. The content below explains the purpose, components, and steps involved in drafting such a letter. Title: Rhode Island Letter to Credit Bureau Requesting the Removal of Inaccurate Information: Steps and Guidelines Introduction: The introduction of the letter should clearly state the purpose of the communication: to address and rectify inaccurate credit information which might include errors related to personal details, payment histories, late fees, or any other incorrect entries on the credit report. Outline the Inaccurate Information: Within the body of the letter, provide a detailed description of the inaccurate information found on the credit report. Enumerate the specific items that need correction or removal, allowing the credit bureau to identify the discrepancies accurately. Mention Relevant Laws: Under Rhode Island law, it is essential to cite existing provisions that protect consumers' rights in bringing attention to inaccurate credit reporting. The Rhode Island Fair Credit Reporting Act ensures that credit bureaus accurately report consumer information, including prompt investigation and correction of errors. Supporting Documents: Attach copies of any supporting documents that serve as evidence to support the claim of inaccuracies. This can include payment receipts, bank statements, correspondence between the consumer and the creditor, or any other relevant proof to substantiate the dispute. Request for Investigation: Clearly state the request for the credit bureau to conduct a thorough investigation into the inaccuracies mentioned. Emphasize the urgency of the matter and request their prompt action in rectifying the errors and issuing a corrected credit report. Contact Information: Include personal details such as full name, address, phone number, and email address to facilitate communication with both the credit bureau and the consumer. Furnish updated contact information to ensure proper correspondence throughout the dispute resolution process. Send via Certified Mail: To ensure a formal record of communication, send the letter via certified mail with a return receipt requested. This way, the sender obtains proof of delivery and can track the progress of their dispute. Types of Rhode Island Letter to Credit Bureau Requesting the Removal of Inaccurate Information: 1. Rhode Island Letter to Credit Bureau Requesting the Removal of Incorrect Personal Information 2. Rhode Island Letter to Credit Bureau Disputing Late Payment Entries 3. Rhode Island Letter to Credit Bureau Requesting Removal of Unauthorized Accounts 4. Rhode Island Letter to Credit Bureau Requesting Correction of Limit/Credit Line Errors 5. Rhode Island Letter to Credit Bureau Requesting Removal of Duplicate Accounts By using the Rhode Island Letter to Credit Bureau Requesting the Removal of Inaccurate Information effectively, individuals can rectify errors that may harm their creditworthiness. It serves as a crucial step towards maintaining an accurate credit history and ensuring financial well-being.Rhode Island residents who are facing inaccuracies on their credit reports can take appropriate action by writing a Rhode Island Letter to Credit Bureau Requesting the Removal of Inaccurate Information. This formal letter serves as a legal tool to address credit reporting errors and helps individuals maintain accurate and reliable credit information. The content below explains the purpose, components, and steps involved in drafting such a letter. Title: Rhode Island Letter to Credit Bureau Requesting the Removal of Inaccurate Information: Steps and Guidelines Introduction: The introduction of the letter should clearly state the purpose of the communication: to address and rectify inaccurate credit information which might include errors related to personal details, payment histories, late fees, or any other incorrect entries on the credit report. Outline the Inaccurate Information: Within the body of the letter, provide a detailed description of the inaccurate information found on the credit report. Enumerate the specific items that need correction or removal, allowing the credit bureau to identify the discrepancies accurately. Mention Relevant Laws: Under Rhode Island law, it is essential to cite existing provisions that protect consumers' rights in bringing attention to inaccurate credit reporting. The Rhode Island Fair Credit Reporting Act ensures that credit bureaus accurately report consumer information, including prompt investigation and correction of errors. Supporting Documents: Attach copies of any supporting documents that serve as evidence to support the claim of inaccuracies. This can include payment receipts, bank statements, correspondence between the consumer and the creditor, or any other relevant proof to substantiate the dispute. Request for Investigation: Clearly state the request for the credit bureau to conduct a thorough investigation into the inaccuracies mentioned. Emphasize the urgency of the matter and request their prompt action in rectifying the errors and issuing a corrected credit report. Contact Information: Include personal details such as full name, address, phone number, and email address to facilitate communication with both the credit bureau and the consumer. Furnish updated contact information to ensure proper correspondence throughout the dispute resolution process. Send via Certified Mail: To ensure a formal record of communication, send the letter via certified mail with a return receipt requested. This way, the sender obtains proof of delivery and can track the progress of their dispute. Types of Rhode Island Letter to Credit Bureau Requesting the Removal of Inaccurate Information: 1. Rhode Island Letter to Credit Bureau Requesting the Removal of Incorrect Personal Information 2. Rhode Island Letter to Credit Bureau Disputing Late Payment Entries 3. Rhode Island Letter to Credit Bureau Requesting Removal of Unauthorized Accounts 4. Rhode Island Letter to Credit Bureau Requesting Correction of Limit/Credit Line Errors 5. Rhode Island Letter to Credit Bureau Requesting Removal of Duplicate Accounts By using the Rhode Island Letter to Credit Bureau Requesting the Removal of Inaccurate Information effectively, individuals can rectify errors that may harm their creditworthiness. It serves as a crucial step towards maintaining an accurate credit history and ensuring financial well-being.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.