A power of attorney is an instrument containing an authorization for one to act as the agent of the principal. The person appointed is usually called an Attorney-in-Fact. A power of attorney can be either general or limited. This power of attorney is obviously limited.

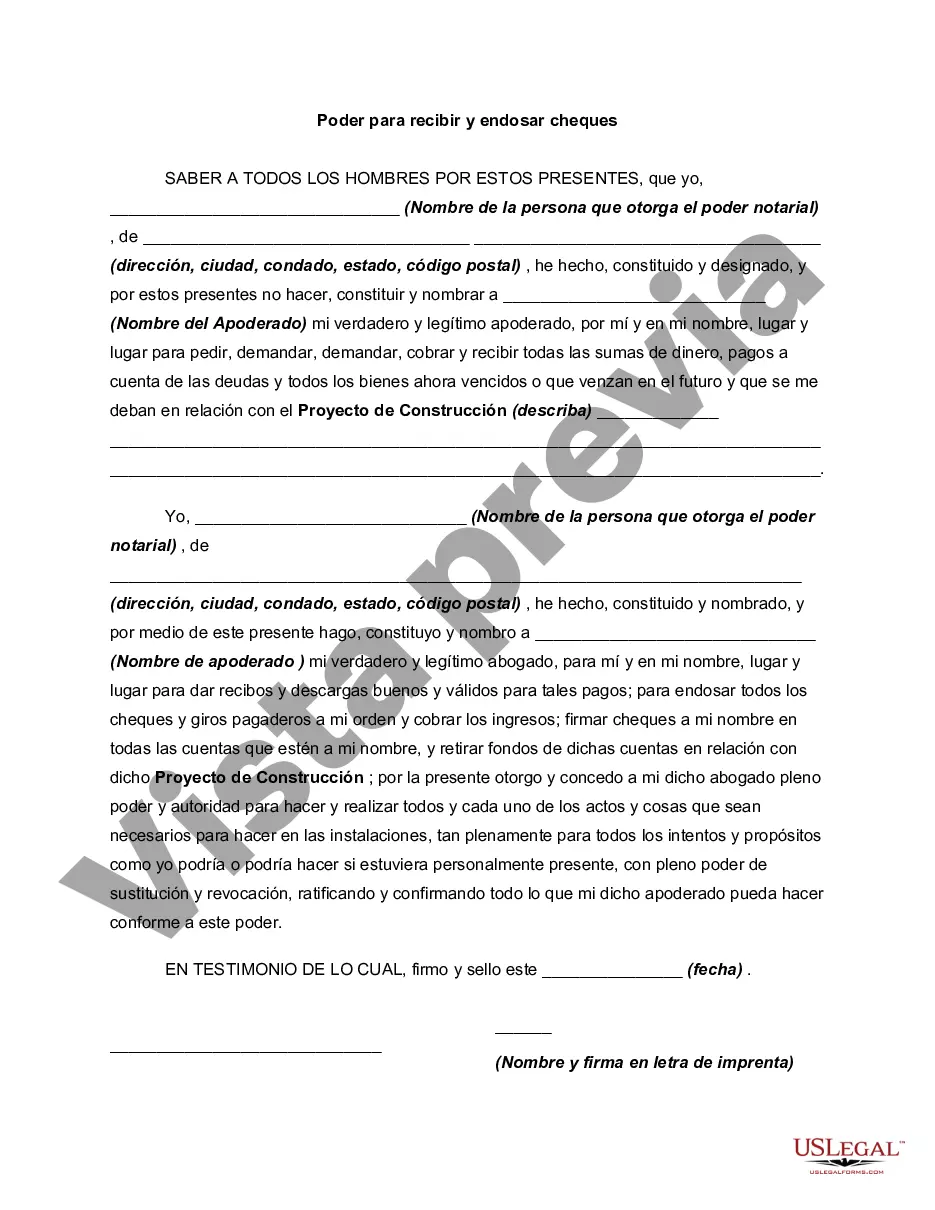

Rhode Island Power of Attorney to Receive and Endorse Checks is a legal document that grants authority to an individual or entity to act on behalf of another person or business in receiving and endorsing checks. This authorization enables the appointed individual, known as the attorney-in-fact or agent, to handle check-related transactions on behalf of the principal. The Rhode Island Power of Attorney to Receive and Endorse Checks is an essential legal tool that can be used in various situations. It enables individuals who may be unable to personally manage their financial matters due to physical or mental incapacitation to appoint a trusted agent to carry out these tasks on their behalf. There are several types of Rhode Island Power of Attorney to Receive and Endorse Checks, which cater to specific needs and circumstances. Some common types include: 1. General Power of Attorney: This type grants broad authority to the agent to handle a wide range of financial affairs, including receiving and endorsing checks. 2. Limited Power of Attorney: Unlike a general power of attorney, a limited power of attorney grants the agent specific authority to perform designated tasks, such as receiving and endorsing checks. 3. Durable Power of Attorney: A durable power of attorney remains valid even if the principal becomes incapacitated or mentally incompetent. This type is commonly used when there is a possibility of future incapacity. 4. Springing Power of Attorney: This type only becomes effective upon the occurrence of a specific event or condition, such as the principal becoming incapacitated. It allows the agent to receive and endorse checks in such situations. When creating a Rhode Island Power of Attorney to Receive and Endorse Checks, it is crucial to carefully consider the terms and conditions. The document should clearly outline the scope of the agent's authority, the limitations, and any specific instructions or restrictions. In summary, the Rhode Island Power of Attorney to Receive and Endorse Checks is a legal document that grants authority to handle check-related transactions on behalf of another person or business. It plays a vital role in ensuring the smooth management of financial affairs when a person is unable to do so themselves. Understanding the different types of power of attorney available can help individuals choose the most appropriate option for their specific needs.Rhode Island Power of Attorney to Receive and Endorse Checks is a legal document that grants authority to an individual or entity to act on behalf of another person or business in receiving and endorsing checks. This authorization enables the appointed individual, known as the attorney-in-fact or agent, to handle check-related transactions on behalf of the principal. The Rhode Island Power of Attorney to Receive and Endorse Checks is an essential legal tool that can be used in various situations. It enables individuals who may be unable to personally manage their financial matters due to physical or mental incapacitation to appoint a trusted agent to carry out these tasks on their behalf. There are several types of Rhode Island Power of Attorney to Receive and Endorse Checks, which cater to specific needs and circumstances. Some common types include: 1. General Power of Attorney: This type grants broad authority to the agent to handle a wide range of financial affairs, including receiving and endorsing checks. 2. Limited Power of Attorney: Unlike a general power of attorney, a limited power of attorney grants the agent specific authority to perform designated tasks, such as receiving and endorsing checks. 3. Durable Power of Attorney: A durable power of attorney remains valid even if the principal becomes incapacitated or mentally incompetent. This type is commonly used when there is a possibility of future incapacity. 4. Springing Power of Attorney: This type only becomes effective upon the occurrence of a specific event or condition, such as the principal becoming incapacitated. It allows the agent to receive and endorse checks in such situations. When creating a Rhode Island Power of Attorney to Receive and Endorse Checks, it is crucial to carefully consider the terms and conditions. The document should clearly outline the scope of the agent's authority, the limitations, and any specific instructions or restrictions. In summary, the Rhode Island Power of Attorney to Receive and Endorse Checks is a legal document that grants authority to handle check-related transactions on behalf of another person or business. It plays a vital role in ensuring the smooth management of financial affairs when a person is unable to do so themselves. Understanding the different types of power of attorney available can help individuals choose the most appropriate option for their specific needs.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.