This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Rhode Island General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement is a legal document that outlines the terms and conditions for the sale and purchase of a business by a sole proprietorship in Rhode Island. This agreement serves as a binding contract between the seller and the buyer, ensuring a smooth and legally sound transaction. Keywords: Rhode Island, General Form of Agreement, Sale of Business, Sole Proprietor, Asset Purchase Agreement. The agreement covers various essential aspects of the sale, including the identification of the involved parties, the description of the business being sold, the purchase price, payment terms, and any contingencies or conditions that must be met before the sale is finalized. In addition to the general form, there may be different types of Rhode Island General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement: 1. Simple Asset Purchase Agreement: This type of agreement is used when the sole proprietor is selling specific assets of their business, such as equipment, inventory, or intellectual property. It focuses on the transfer of assets rather than the entire business entity. 2. Full Business Sale Asset Purchase Agreement: This agreement encompasses the sale of the entire business, including all assets, liabilities, contracts, licenses, and goodwill associated with the sole proprietorship. It provides a comprehensive framework for the buyer to acquire and continue the operations of the business. 3. Purchase Agreement with Seller Financing: In some cases, the buyer may not be able to arrange third-party financing for the purchase and may need the seller to provide financing. This type of agreement outlines the terms and conditions of the seller financing, including interest rates, repayment schedule, and any collateral involved. 4. Non-Disclosure Agreement as part of the Agreement: A non-disclosure agreement (NDA) may be included as an integral part of the Rhode Island General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement. An NDA ensures that any confidential information shared during the negotiation and due diligence process remains protected and cannot be disclosed to third parties. It is crucial for both the seller and the buyer to review and understand the terms of the agreement thoroughly before signing. Engaging legal counsel during the drafting and reviewing process is highly recommended ensuring compliance with Rhode Island laws and to protect the interests of both parties involved in the sale transaction.The Rhode Island General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement is a legal document that outlines the terms and conditions for the sale and purchase of a business by a sole proprietorship in Rhode Island. This agreement serves as a binding contract between the seller and the buyer, ensuring a smooth and legally sound transaction. Keywords: Rhode Island, General Form of Agreement, Sale of Business, Sole Proprietor, Asset Purchase Agreement. The agreement covers various essential aspects of the sale, including the identification of the involved parties, the description of the business being sold, the purchase price, payment terms, and any contingencies or conditions that must be met before the sale is finalized. In addition to the general form, there may be different types of Rhode Island General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement: 1. Simple Asset Purchase Agreement: This type of agreement is used when the sole proprietor is selling specific assets of their business, such as equipment, inventory, or intellectual property. It focuses on the transfer of assets rather than the entire business entity. 2. Full Business Sale Asset Purchase Agreement: This agreement encompasses the sale of the entire business, including all assets, liabilities, contracts, licenses, and goodwill associated with the sole proprietorship. It provides a comprehensive framework for the buyer to acquire and continue the operations of the business. 3. Purchase Agreement with Seller Financing: In some cases, the buyer may not be able to arrange third-party financing for the purchase and may need the seller to provide financing. This type of agreement outlines the terms and conditions of the seller financing, including interest rates, repayment schedule, and any collateral involved. 4. Non-Disclosure Agreement as part of the Agreement: A non-disclosure agreement (NDA) may be included as an integral part of the Rhode Island General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement. An NDA ensures that any confidential information shared during the negotiation and due diligence process remains protected and cannot be disclosed to third parties. It is crucial for both the seller and the buyer to review and understand the terms of the agreement thoroughly before signing. Engaging legal counsel during the drafting and reviewing process is highly recommended ensuring compliance with Rhode Island laws and to protect the interests of both parties involved in the sale transaction.

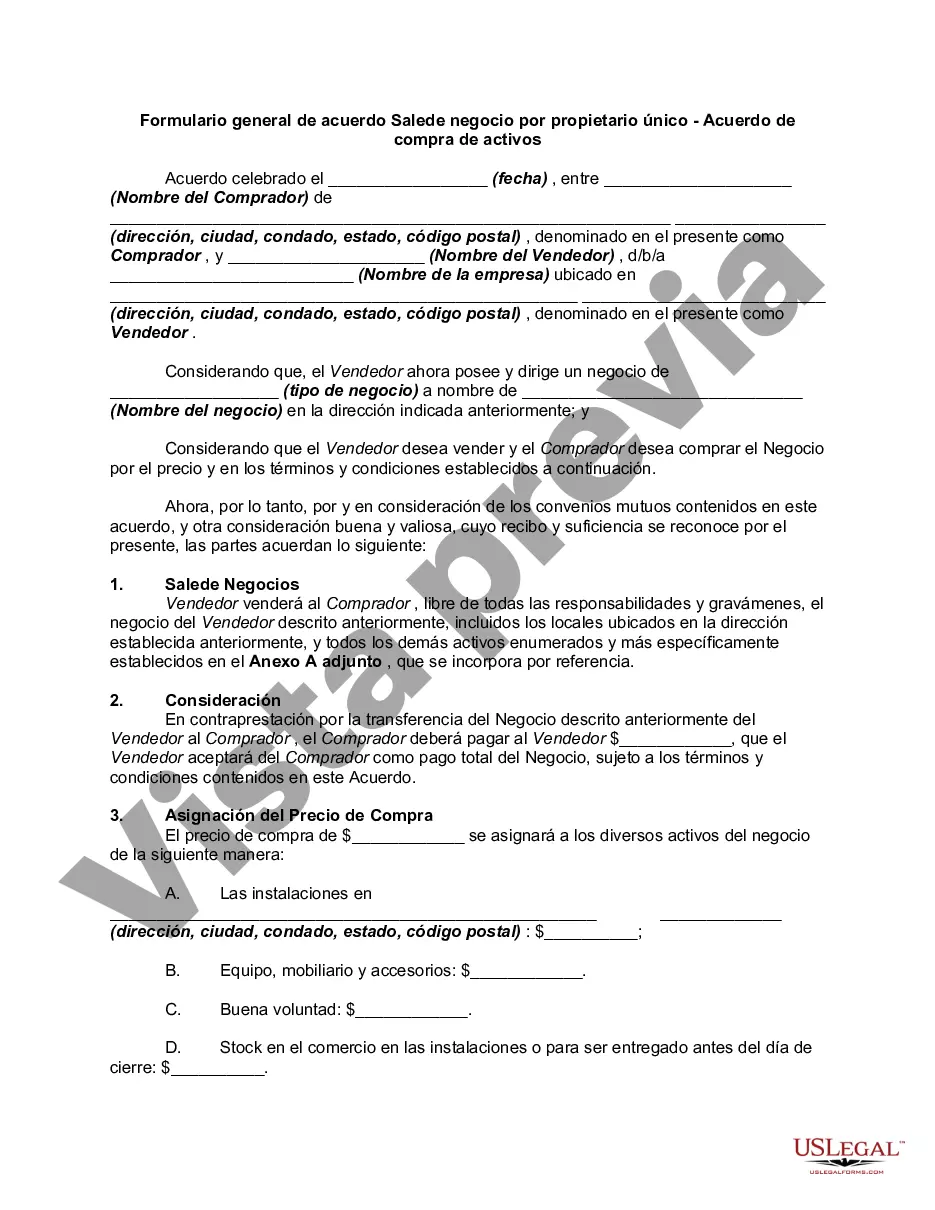

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.