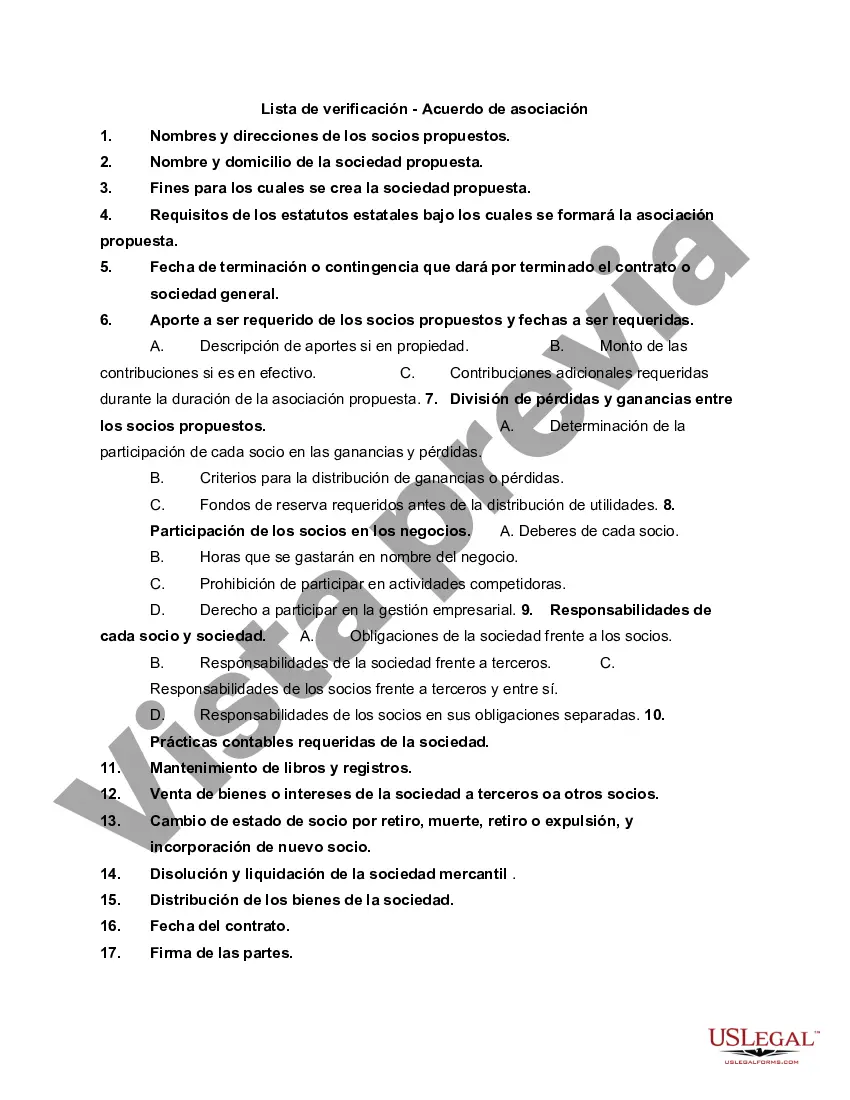

Rhode Island Checklist — Partnership Agreement is a comprehensive legal document that outlines the rights, responsibilities, and obligations of business partners operating within the state of Rhode Island. This agreement serves as a crucial foundation for any partnership, ensuring a clear understanding and consensus among partners. The Rhode Island Checklist — Partnership Agreement typically includes key provisions such as: 1. Partnership Details: This section outlines the basic information about the partnership, including the legal name, principal place of business, term, and purpose of the partnership. 2. Partner Contributions: It highlights the individual contributions made by each partner, in terms of capital, assets, skills, or labor. This ensures transparency and prevents any future disputes regarding the partners' investments. 3. Profit and Loss Allocation: This provision determines how profits and losses will be divided among partners. It specifies each partner's share and any special allocations agreed upon. 4. Decision-Making Authority: It establishes the decision-making process within the partnership, whether it is majority voting, unanimity, or certain matters reserved for specific partners. Clear guidelines help prevent conflicts and streamline decision-making. 5. Partner Roles and Responsibilities: It defines the roles, responsibilities, and authorities of each partner in the partnership, ensuring clarity of duties and avoiding misunderstandings. 6. Dispute Resolution: This section outlines the procedures for resolving conflicts and disputes that may arise between partners. It may include mediation, arbitration, or the jurisdiction of Rhode Island courts. 7. Partnership Dissolution: It outlines the process of dissolving the partnership, covering issues such as the notice period, liquidation of assets, and the distribution of remaining profits or losses. Different types of Rhode Island Checklist — Partnership Agreements may include variations to address specific business needs or particular industries. Some examples are: 1. General Partnership Agreement: This type of agreement is suitable for partnerships without any special legal considerations. It covers the basic terms and provisions applicable to most business partnerships. 2. Limited Partnership Agreement: Limited partnerships involve both general partners, who manage the business and are personally liable for its debts, and limited partners, who have limited liability and passive involvement. This agreement regulates the roles, responsibilities, and liability of each partner type. 3. Limited Liability Partnership (LLP) Agreement: Laps provide limited liability protection to partners, shielding them from personal responsibility for the debts and actions of other partners. The LLP agreement outlines the partnership structure and its limited liability features. In summary, the Rhode Island Checklist — Partnership Agreement covers various aspects of a business partnership, ensuring clear communication, proper allocation of rights and responsibilities, and a framework for dispute resolution. It is a crucial document for all types of partnerships, including general partnerships, limited partnerships, and limited liability partnerships.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Rhode Island Lista de verificación - Acuerdo de asociación - Checklist - Partnership Agreement

Description

How to fill out Rhode Island Lista De Verificación - Acuerdo De Asociación?

If you wish to full, acquire, or produce authorized document themes, use US Legal Forms, the most important collection of authorized varieties, that can be found on the Internet. Take advantage of the site`s basic and convenient look for to find the documents you want. Different themes for business and personal functions are sorted by classes and claims, or key phrases. Use US Legal Forms to find the Rhode Island Checklist - Partnership Agreement in just a number of clicks.

In case you are previously a US Legal Forms client, log in in your profile and click on the Obtain button to get the Rhode Island Checklist - Partnership Agreement. You may also access varieties you in the past saved within the My Forms tab of your respective profile.

If you use US Legal Forms for the first time, follow the instructions below:

- Step 1. Ensure you have chosen the shape for that correct metropolis/nation.

- Step 2. Utilize the Review choice to look through the form`s articles. Never overlook to read the information.

- Step 3. In case you are not happy with the type, take advantage of the Search area on top of the screen to get other models in the authorized type design.

- Step 4. When you have identified the shape you want, click the Buy now button. Select the costs program you like and put your credentials to sign up for the profile.

- Step 5. Method the transaction. You may use your credit card or PayPal profile to finish the transaction.

- Step 6. Choose the structure in the authorized type and acquire it on your product.

- Step 7. Full, modify and produce or indicator the Rhode Island Checklist - Partnership Agreement.

Every single authorized document design you buy is yours for a long time. You may have acces to each type you saved within your acccount. Select the My Forms section and select a type to produce or acquire once again.

Be competitive and acquire, and produce the Rhode Island Checklist - Partnership Agreement with US Legal Forms. There are millions of professional and express-particular varieties you can use to your business or personal requirements.