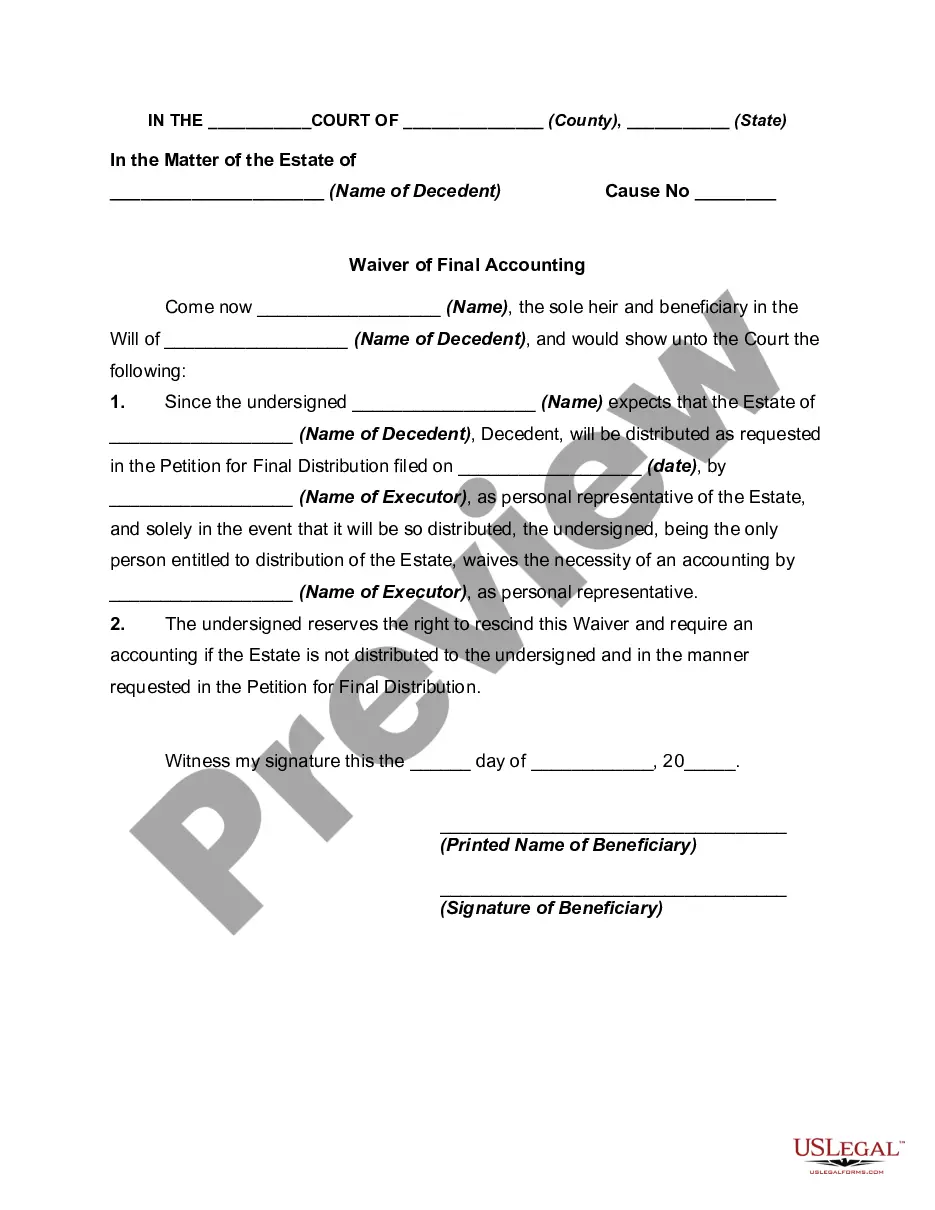

In order to close an estate a petition for final distribution should be filed before the court showing that the estate can be closed and requesting distribution to be made to the beneficiaries. Usually when a petition for final distribution is filed, the court requires detailed accounting of all the monies and other items received and all monies paid out during administration. However, the accounting may be waived when all persons entitled to receive property from the estate have executed a written waiver of accounting. Waiver simplifies the closing of the estate. When all the beneficiaries are friendly obtaining waiver is not a problem.

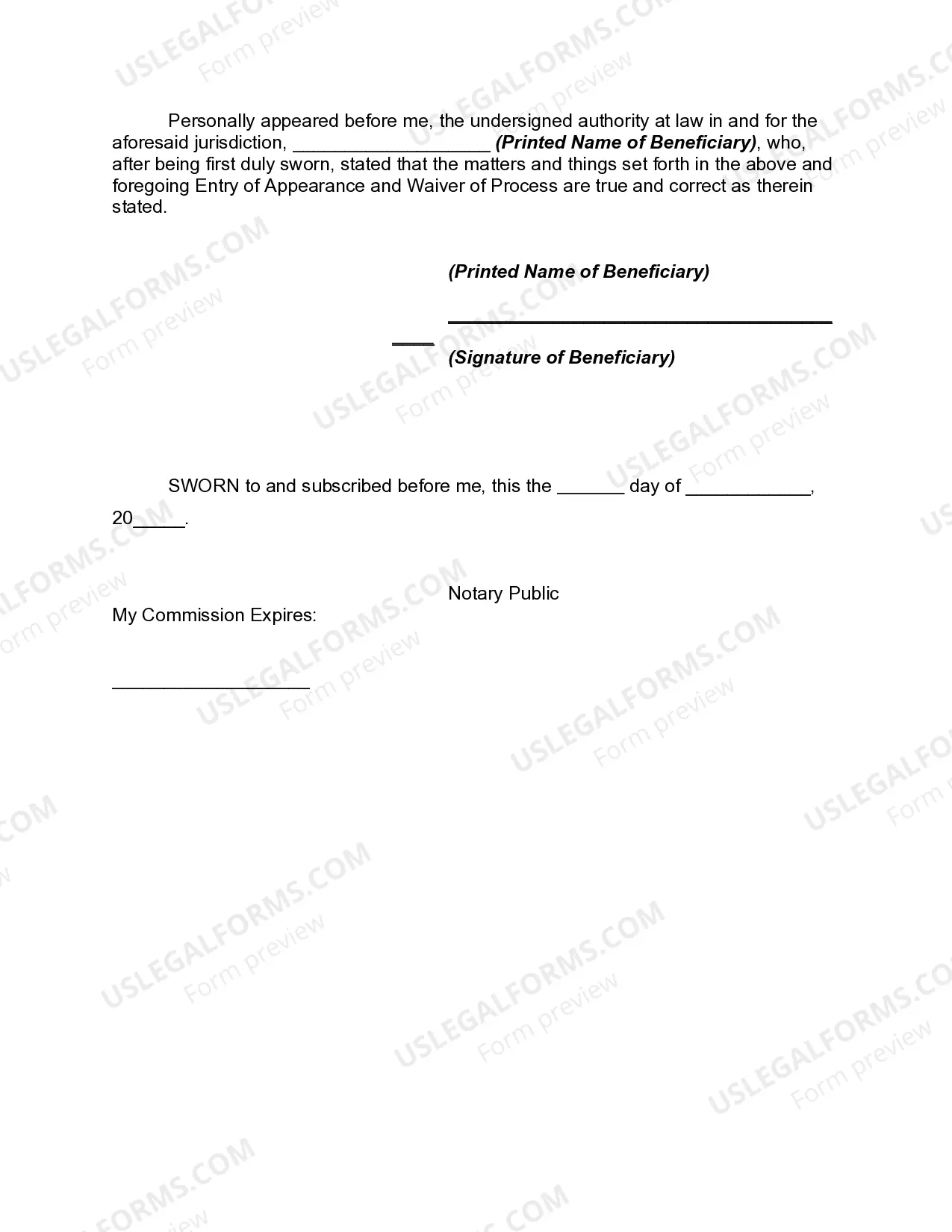

Rhode Island Waiver of Final Accounting by Sole Beneficiary is a legal document that allows a sole beneficiary to waive their right to receive a final accounting of an estate. This waiver can simplify the probate process by eliminating the need for the executor or trustee to provide a detailed report of the estate's financial transactions. In Rhode Island, there are two main types of waivers of final accounting by a sole beneficiary. The first type is a voluntary waiver, where the beneficiary willingly gives up their right to receive a final accounting. This type of waiver is commonly used when the beneficiary trusts the executor or trustee and prefers not to burden them with the additional paperwork and time required for a detailed accounting. The second type of waiver is an involuntary waiver, which occurs when the court determines it is in the best interest of the estate to waive the final accounting requirement. This may happen if the estate is small or if the court believes that providing a final accounting would be unduly burdensome or costly. By signing a Rhode Island Waiver of Final Accounting by Sole Beneficiary, the beneficiary acknowledges that they have received all the information necessary to understand the estate's assets, debts, and distributions. They also acknowledge that they waive their right to receive a detailed report of the executor or trustee's actions throughout the administration of the estate. It is important for beneficiaries to fully understand the implications of signing a waiver of final accounting, as once signed, they generally cannot later request or demand a full accounting of the estate. Beneficiaries may wish to consult with an attorney to ensure they fully understand their rights and the potential consequences of signing the waiver. In conclusion, a Rhode Island Waiver of Final Accounting by Sole Beneficiary is a legal document that allows a sole beneficiary to waive their right to receive a detailed report of an estate's financial transactions. It simplifies the probate process and can be either voluntary or involuntary. However, beneficiaries should carefully consider their decision and seek legal advice if needed.Rhode Island Waiver of Final Accounting by Sole Beneficiary is a legal document that allows a sole beneficiary to waive their right to receive a final accounting of an estate. This waiver can simplify the probate process by eliminating the need for the executor or trustee to provide a detailed report of the estate's financial transactions. In Rhode Island, there are two main types of waivers of final accounting by a sole beneficiary. The first type is a voluntary waiver, where the beneficiary willingly gives up their right to receive a final accounting. This type of waiver is commonly used when the beneficiary trusts the executor or trustee and prefers not to burden them with the additional paperwork and time required for a detailed accounting. The second type of waiver is an involuntary waiver, which occurs when the court determines it is in the best interest of the estate to waive the final accounting requirement. This may happen if the estate is small or if the court believes that providing a final accounting would be unduly burdensome or costly. By signing a Rhode Island Waiver of Final Accounting by Sole Beneficiary, the beneficiary acknowledges that they have received all the information necessary to understand the estate's assets, debts, and distributions. They also acknowledge that they waive their right to receive a detailed report of the executor or trustee's actions throughout the administration of the estate. It is important for beneficiaries to fully understand the implications of signing a waiver of final accounting, as once signed, they generally cannot later request or demand a full accounting of the estate. Beneficiaries may wish to consult with an attorney to ensure they fully understand their rights and the potential consequences of signing the waiver. In conclusion, a Rhode Island Waiver of Final Accounting by Sole Beneficiary is a legal document that allows a sole beneficiary to waive their right to receive a detailed report of an estate's financial transactions. It simplifies the probate process and can be either voluntary or involuntary. However, beneficiaries should carefully consider their decision and seek legal advice if needed.