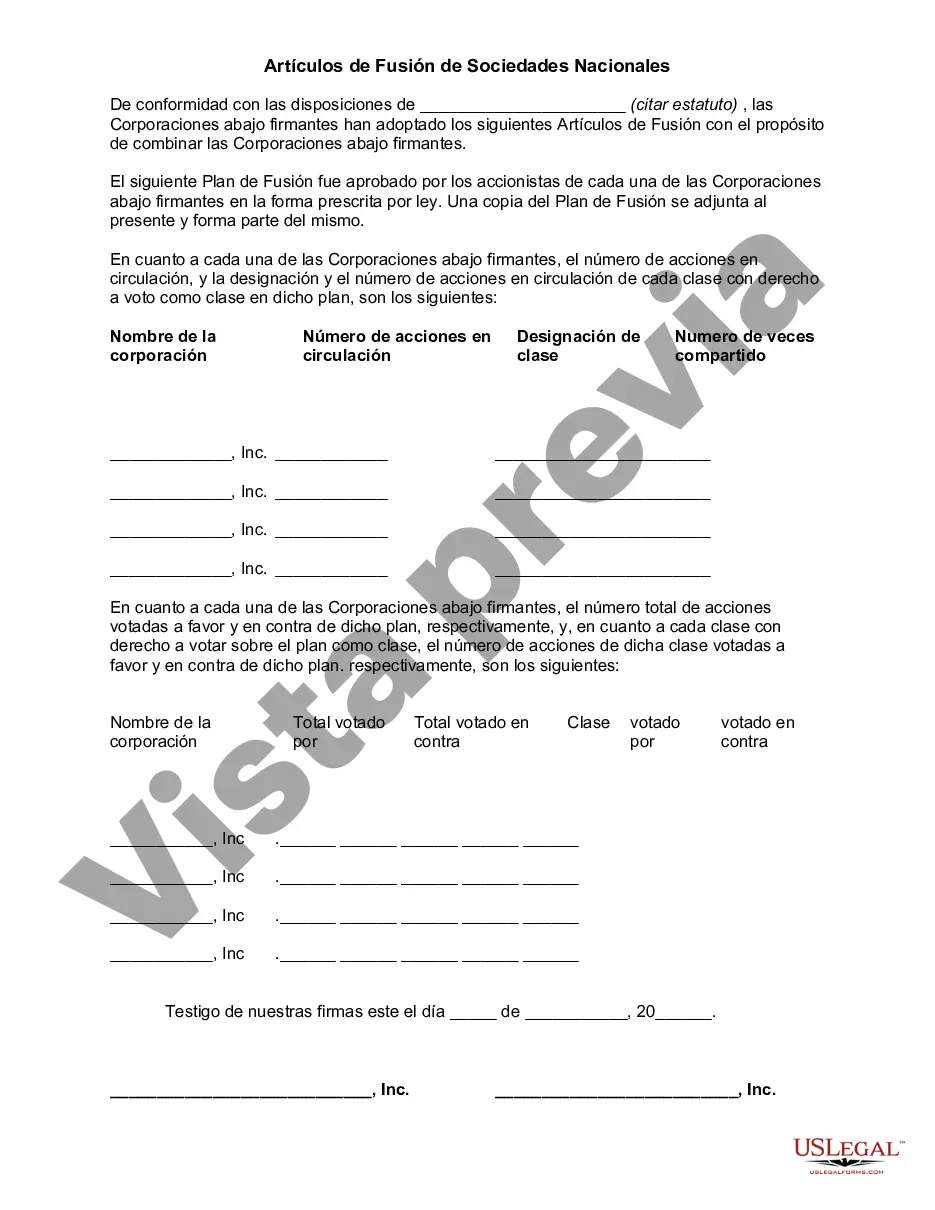

Statutes of the particular jurisdiction may require that merging corporations file copies of the proposed plan of combination with a state official or agency. Generally, information as to voting rights of classes of stock, number of shares outstanding, and results of any voting are required to be included, and there may be special requirements for the merger or consolidation of domestic and foreign corporations.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Rhode Island Articles of Merger of Domestic Corporations are legal documents required for the consolidation or merger of two or more domestic corporations within the state. These articles provide a detailed description of the process, requirements, and legal implications involved in merging corporations in Rhode Island. When two or more corporations decide to merge into a single entity, they must file Rhode Island Articles of Merger of Domestic Corporations with the Secretary of State. This document outlines the terms and conditions agreed upon by the merging entities and covers various important aspects of the merger. It ensures compliance with state laws and regulations and serves as a formal record of the consolidation. The Rhode Island Articles of Merger of Domestic Corporations typically include essential information such as the names and addresses of the merging corporations, their business purposes, and details about the surviving or new corporation resulting from the merger. It may also include provisions related to the distribution of assets, allocation of shares and ownership, management structure, and other relevant corporate governance matters. These articles provide clarity on how the merger will be executed, protecting the interests of the corporations and their shareholders. Different types of Rhode Island Articles of Merger of Domestic Corporations may be filed, depending on the specific nature of the merger. These could include: 1. Short Form Merger: This type of merger involves the acquisition of one corporation by another, where a parent company already owns at least 90% of the outstanding shares of the subsidiary. Here, the surviving corporation absorbs the assets, liabilities, and business of the subsidiary, without needing the approval of the subsidiary's shareholders. 2. Statutory Merger: In this type of merger, two or more corporations combine to form a new corporation. This requires approval from the boards of directors and shareholders of each merging entity and involves the transfer of assets, liabilities, and business to the newly formed corporation. 3. Consolidation: A consolidation occurs when two or more corporations merge to form an entirely new corporation. This process involves the transfer of assets, liabilities, and business from each merging entity to the newly formed corporation. Both the boards of directors and shareholders of each merging corporation must approve the consolidation. 4. Asset Acquisition: This type of merger involves the purchase of assets, rather than the merging or consolidation of entire corporations. The acquiring corporation typically takes over specific assets and liabilities from the target corporation but does not assume the entity as a whole. It is crucial for corporations planning to merge or consolidate in Rhode Island to consult with legal professionals or corporate advisors who can guide them through the process and ensure compliance with all relevant laws and regulations. Properly drafting and filing the Rhode Island Articles of Merger of Domestic Corporations is essential to ensure a smooth and legally valid merger process and protect the interests of all parties involved.Rhode Island Articles of Merger of Domestic Corporations are legal documents required for the consolidation or merger of two or more domestic corporations within the state. These articles provide a detailed description of the process, requirements, and legal implications involved in merging corporations in Rhode Island. When two or more corporations decide to merge into a single entity, they must file Rhode Island Articles of Merger of Domestic Corporations with the Secretary of State. This document outlines the terms and conditions agreed upon by the merging entities and covers various important aspects of the merger. It ensures compliance with state laws and regulations and serves as a formal record of the consolidation. The Rhode Island Articles of Merger of Domestic Corporations typically include essential information such as the names and addresses of the merging corporations, their business purposes, and details about the surviving or new corporation resulting from the merger. It may also include provisions related to the distribution of assets, allocation of shares and ownership, management structure, and other relevant corporate governance matters. These articles provide clarity on how the merger will be executed, protecting the interests of the corporations and their shareholders. Different types of Rhode Island Articles of Merger of Domestic Corporations may be filed, depending on the specific nature of the merger. These could include: 1. Short Form Merger: This type of merger involves the acquisition of one corporation by another, where a parent company already owns at least 90% of the outstanding shares of the subsidiary. Here, the surviving corporation absorbs the assets, liabilities, and business of the subsidiary, without needing the approval of the subsidiary's shareholders. 2. Statutory Merger: In this type of merger, two or more corporations combine to form a new corporation. This requires approval from the boards of directors and shareholders of each merging entity and involves the transfer of assets, liabilities, and business to the newly formed corporation. 3. Consolidation: A consolidation occurs when two or more corporations merge to form an entirely new corporation. This process involves the transfer of assets, liabilities, and business from each merging entity to the newly formed corporation. Both the boards of directors and shareholders of each merging corporation must approve the consolidation. 4. Asset Acquisition: This type of merger involves the purchase of assets, rather than the merging or consolidation of entire corporations. The acquiring corporation typically takes over specific assets and liabilities from the target corporation but does not assume the entity as a whole. It is crucial for corporations planning to merge or consolidate in Rhode Island to consult with legal professionals or corporate advisors who can guide them through the process and ensure compliance with all relevant laws and regulations. Properly drafting and filing the Rhode Island Articles of Merger of Domestic Corporations is essential to ensure a smooth and legally valid merger process and protect the interests of all parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.