A Rhode Island Revocable Trust Agreement with a Corporate Trustee is a legal document that allows individuals in Rhode Island to establish and manage their assets for the duration of their lives and ensure proper distribution of those assets after their death. The trust agreement is revocable, meaning that the granter (individual creating the trust) retains the right to make changes or revoke the trust at any time during their lifetime. Having a corporate trustee in Rhode Island Revocable Trust Agreement adds an extra layer of professionalism and expertise. A corporate trustee is typically a bank, trust company, or financial institution that specializes in administering trusts. They act as fiduciaries, managing the assets and ensuring compliance with trust terms and applicable laws. There are several types of Rhode Island Revocable Trust Agreements with a Corporate Trustee: 1. Basic Revocable Trust: This trust agreement allows individuals to transfer their assets into the trust during their lifetime. The granter can name themselves as trustee, but having a corporate trustee can provide increased stability and impartiality. 2. Married Revocable Trust: This type of trust agreement is designed for married couples who wish to combine their assets into one revocable trust. It allows for efficient management and eventual distribution of assets, while providing the flexibility to make changes or revoke the trust as needed. 3. Special Needs Trust: This trust agreement is specifically tailored for individuals with disabilities or special needs. It aims to preserve the beneficiary's eligibility for government benefits, while still providing supplemental support and managing their assets effectively. 4. Charitable Remainder Trust: This type of trust agreement allows individuals to donate their assets to a specific charity or charitable organization while retaining income from those assets during their lifetime. It provides tax benefits and supports a chosen cause. 5. Irrevocable Life Insurance Trust: This trust agreement is designed to hold and manage life insurance policies. It aims to keep the insurance proceeds outside the granter's taxable estate, providing flexibility in the distribution of assets while minimizing taxes. 6. Qualified Personnel Residence Trust: This trust agreement is commonly used to transfer a primary residence or vacation home to future beneficiaries while minimizing estate taxes. The granter retains the right to live in the property for a specified period before it transfers to the beneficiaries. Rhode Island Revocable Trust Agreements with Corporate Trustees offer numerous advantages, including asset protection, privacy, avoiding probate, and efficient distribution of assets. Engaging a corporate trustee with appropriate expertise ensures that the trust is managed professionally and in compliance with Rhode Island laws and regulations.

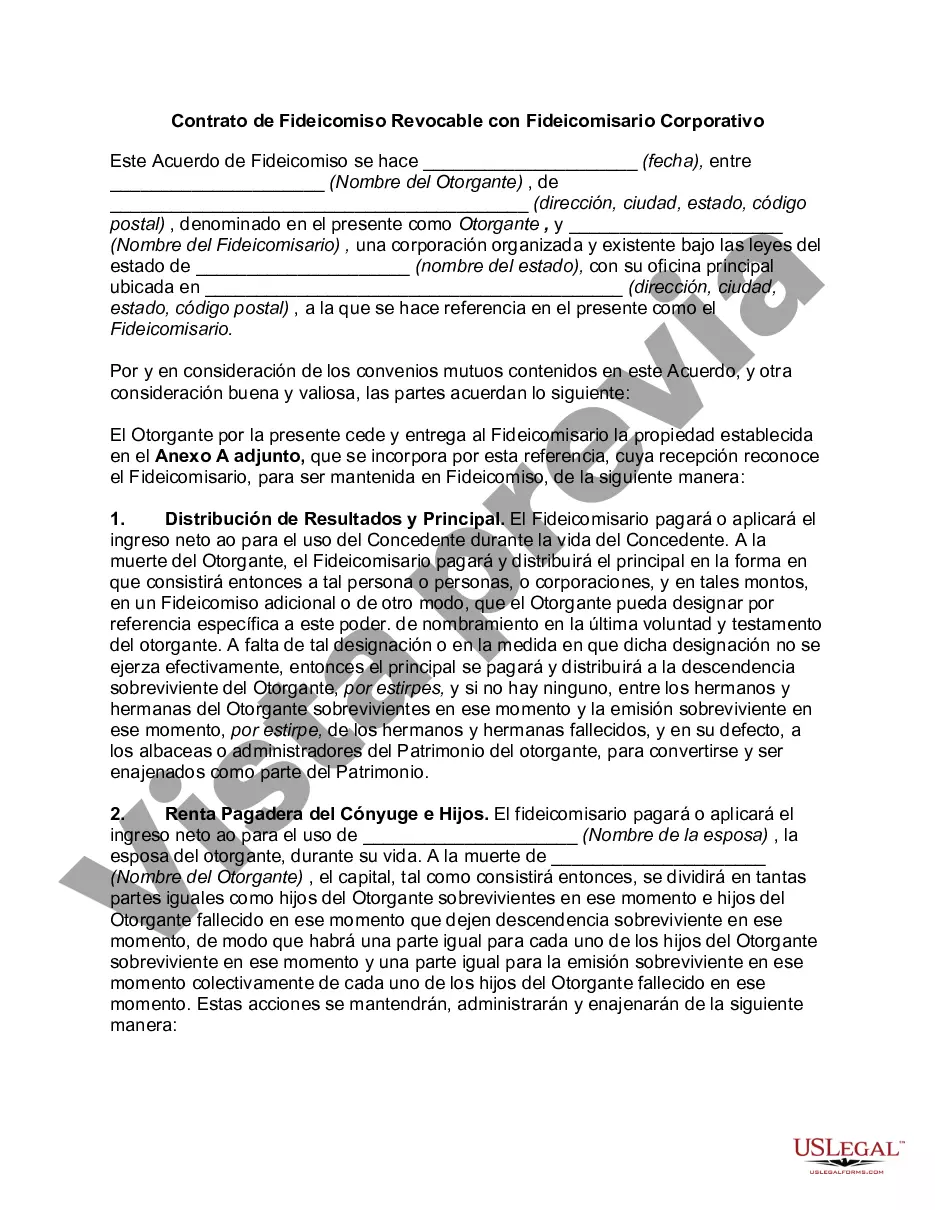

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Rhode Island Contrato de Fideicomiso Revocable con Fideicomisario Corporativo - Revocable Trust Agreement with Corporate Trustee

Description

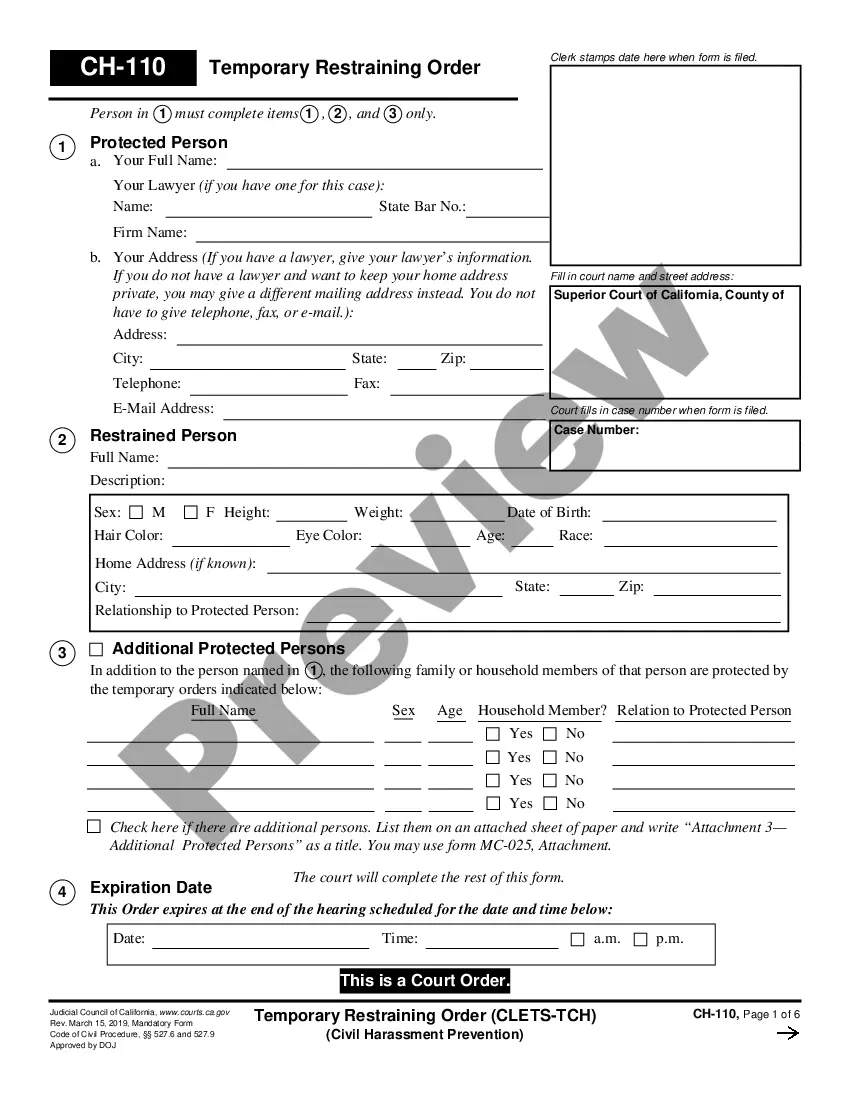

How to fill out Rhode Island Contrato De Fideicomiso Revocable Con Fideicomisario Corporativo?

US Legal Forms - one of the greatest libraries of legitimate forms in the USA - offers a wide array of legitimate papers templates you are able to acquire or print. Making use of the web site, you can find 1000s of forms for organization and person uses, categorized by groups, claims, or key phrases.You will find the most recent models of forms just like the Rhode Island Revocable Trust Agreement with Corporate Trustee in seconds.

If you already possess a registration, log in and acquire Rhode Island Revocable Trust Agreement with Corporate Trustee through the US Legal Forms catalogue. The Obtain button can look on every type you look at. You get access to all formerly acquired forms in the My Forms tab of your profile.

If you want to use US Legal Forms the very first time, listed here are simple instructions to help you get started:

- Be sure you have chosen the proper type for your area/region. Go through the Preview button to review the form`s content material. Look at the type outline to actually have selected the appropriate type.

- When the type doesn`t match your needs, take advantage of the Look for field towards the top of the display to obtain the the one that does.

- If you are happy with the form, confirm your decision by clicking on the Buy now button. Then, choose the pricing prepare you prefer and provide your qualifications to sign up on an profile.

- Procedure the purchase. Make use of your bank card or PayPal profile to complete the purchase.

- Choose the formatting and acquire the form on your system.

- Make alterations. Fill out, change and print and sign the acquired Rhode Island Revocable Trust Agreement with Corporate Trustee.

Each format you included with your money lacks an expiry date which is your own eternally. So, in order to acquire or print yet another version, just go to the My Forms section and click on the type you want.

Get access to the Rhode Island Revocable Trust Agreement with Corporate Trustee with US Legal Forms, the most considerable catalogue of legitimate papers templates. Use 1000s of professional and state-particular templates that fulfill your organization or person demands and needs.