Rhode Island Commercial Partnership Agreement between an Investor and Worker: A Comprehensive Guide Introduction: A Rhode Island Commercial Partnership Agreement between an Investor and Worker is a legally binding contract that establishes the terms and conditions of a partnership between an investor and a worker. This agreement outlines the rights, obligations, and responsibilities of both parties involved in the partnership and ensures a smooth and mutually beneficial working relationship. Key Elements of the Agreement: 1. Partnership Structure and Purpose: The agreement must clearly define the partnership structure, whether it is a general partnership or a limited partnership, and state its primary purpose, such as investing in real estate, starting a business venture, or any other explicit objective. 2. Contributions: The agreement specifies the initial contributions made by both the investor and the worker, whether in the form of capital, resources, or expertise. It also outlines any additional contributions required during the partnership term. 3. Profit and Loss Sharing: The agreement defines how profits and losses will be distributed among the partners. This includes determining the percentage or proportion of profits allocated to each partner and any compensation or salary arrangements for the worker. 4. Management and Decision-making: The agreement clarifies the decision-making process and management structure of the partnership. It may grant the investor exclusive decision-making authority or establish a joint management structure, involving both parties in major decisions. 5. Partnership Term and Termination: The agreement specifies the duration of the partnership and the conditions under which it can be terminated. It should outline the notice period required by either party to withdraw from the partnership and the procedures for the winding up of affairs. 6. Duties and Responsibilities: The agreement outlines the specific roles, duties, and responsibilities of the investor and worker within the partnership. This includes expectations regarding the worker's day-to-day responsibilities, reporting requirements, and any limitations or restrictions imposed on both parties. Types of Rhode Island Commercial Partnership Agreements: 1. General Partnership Agreement: This is the most common type of partnership where both the investor and worker share equal rights, responsibilities, and liabilities. Profits and losses are typically divided equally between the partners unless stated otherwise in the agreement. 2. Limited Partnership Agreement: A limited partnership agreement involves at least one general partner (the investor) and one limited partner (the worker). The general partner assumes unlimited liability, while the limited partner has limited liability for partnership debts. Limited partners generally have a passive role in decision-making and a predetermined share of profits. 3. Joint Venture Agreement: In a joint venture agreement, the partnership is formed for a specific project or endeavor rather than a long-term business relationship. Both parties contribute resources, expertise, and share profits and losses as specified in the agreement. Conclusion: In Rhode Island, a Commercial Partnership Agreement between an Investor and Worker is a crucial legal document that ensures clarity, protection, and a mutually beneficial partnership. It establishes the rights, obligations, and responsibilities of both parties, enabling a successful business venture. Different types of partnership agreements, such as general partnerships, limited partnerships, and joint ventures, cater to various business needs and objectives. Seeking professional legal advice is highly recommended before entering into any such partnership agreement to safeguard the interests of all parties involved.

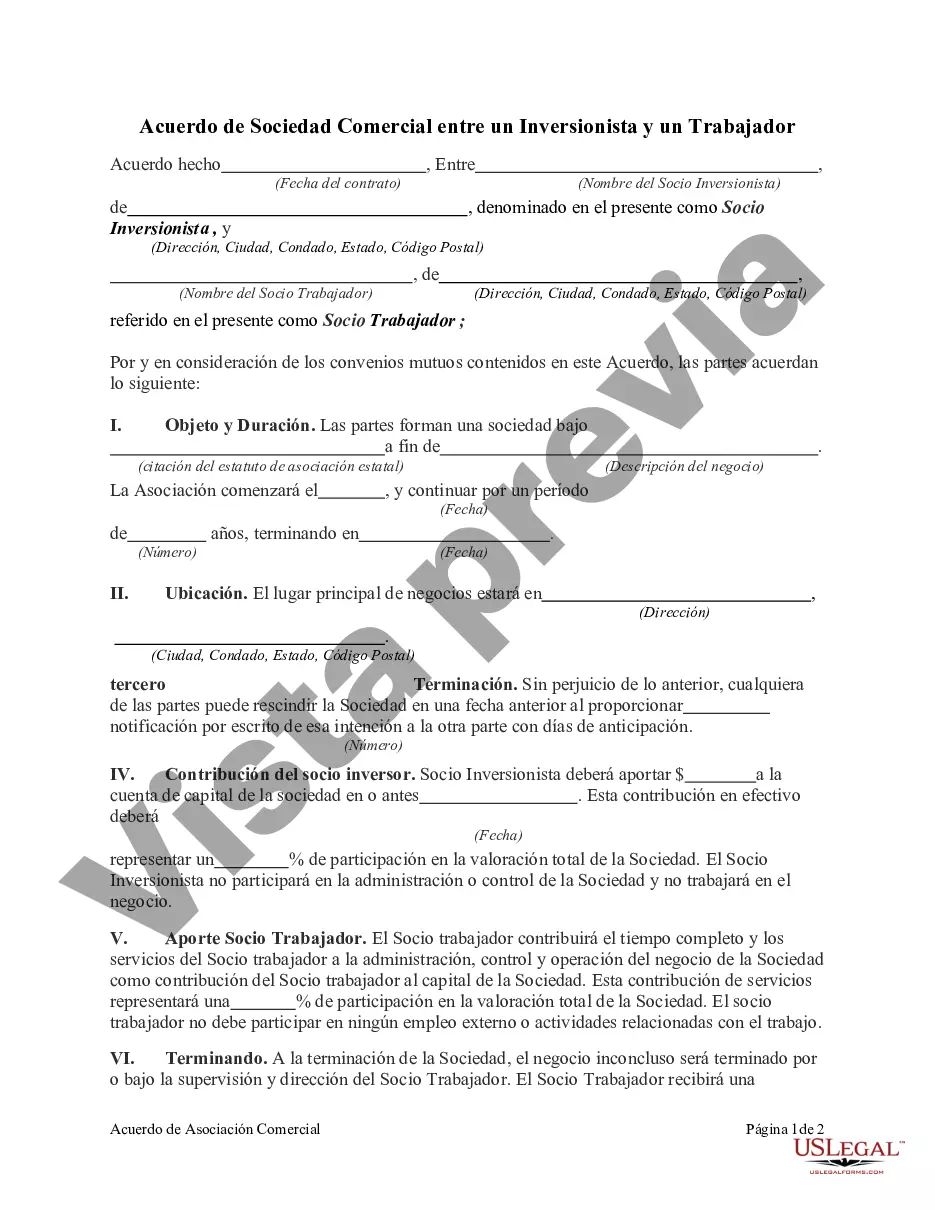

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Rhode Island Acuerdo de Sociedad Comercial entre un Inversionista y un Trabajador - Commercial Partnership Agreement between an Investor and Worker

Description

How to fill out Rhode Island Acuerdo De Sociedad Comercial Entre Un Inversionista Y Un Trabajador?

Are you currently within a placement in which you will need paperwork for both enterprise or person uses almost every day time? There are tons of legitimate document themes available on the Internet, but locating kinds you can rely on isn`t easy. US Legal Forms provides 1000s of kind themes, such as the Rhode Island Commercial Partnership Agreement between an Investor and Worker, that are created to meet federal and state needs.

If you are currently acquainted with US Legal Forms internet site and also have a merchant account, basically log in. After that, you may acquire the Rhode Island Commercial Partnership Agreement between an Investor and Worker design.

Should you not provide an profile and wish to begin to use US Legal Forms, abide by these steps:

- Discover the kind you require and ensure it is for that proper town/county.

- Take advantage of the Preview key to review the shape.

- Read the description to ensure that you have chosen the right kind.

- If the kind isn`t what you`re trying to find, use the Search industry to discover the kind that meets your needs and needs.

- When you find the proper kind, click on Purchase now.

- Pick the costs strategy you would like, complete the necessary info to produce your bank account, and pay money for your order utilizing your PayPal or charge card.

- Decide on a handy paper formatting and acquire your backup.

Get each of the document themes you might have bought in the My Forms food selection. You can aquire a further backup of Rhode Island Commercial Partnership Agreement between an Investor and Worker at any time, if possible. Just click the essential kind to acquire or printing the document design.

Use US Legal Forms, by far the most considerable variety of legitimate varieties, to save lots of time as well as steer clear of mistakes. The service provides skillfully made legitimate document themes that you can use for an array of uses. Make a merchant account on US Legal Forms and start making your life easier.