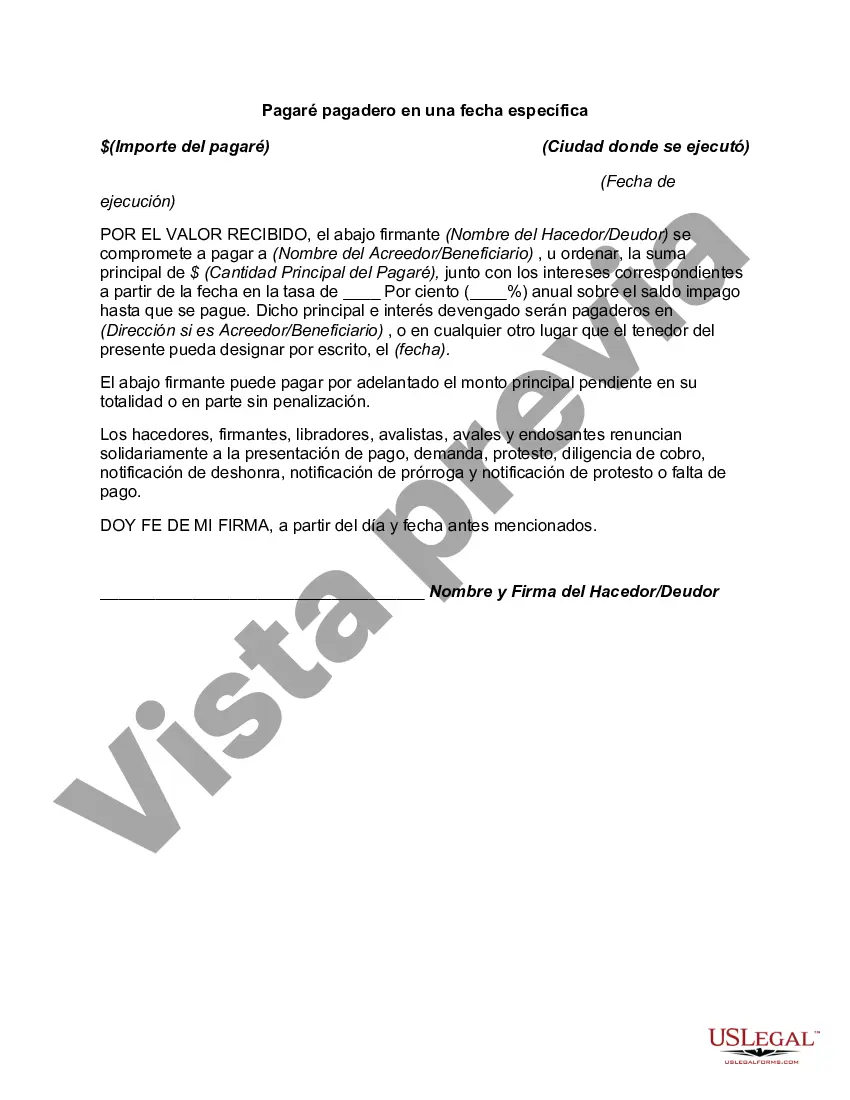

A Rhode Island Promissory Note Payable on a Specific Date is a legally binding document that outlines the terms and conditions of a loan agreement between a lender and a borrower in the state of Rhode Island. This type of promissory note specifies a specific date on which the borrower is obligated to repay the loan amount in full. Keywords: 1. Rhode Island Promissory Note: A legal document used to formalize a loan agreement in Rhode Island. 2. Payable on a Specific Date: Refers to the provision in the note stating the exact date by which the borrower must repay the loan. 3. Lender: The individual or entity providing the loan amount. 4. Borrower: The individual or entity receiving the loan and responsible for repaying the loan amount. 5. Loan Agreement: The contractual agreement between the lender and the borrower, specifying the terms and conditions of the loan. 6. Legal Document: A written agreement that is enforceable by law. 7. Loan Repayment: The act of returning the borrowed funds, including any accrued interest, to the lender. 8. Loan Amount: The principal sum borrowed by the borrower. 9. Terms and Conditions: The specific provisions and obligations that govern the loan agreement. 10. Interest Rate: The percentage charged by the lender on the loan amount. Different Types of Rhode Island Promissory Notes Payable on a Specific Date: 1. Unsecured Promissory Note: This type of promissory note does not require any collateral to secure the loan. The borrower's promise to repay the loan is the only form of security provided. 2. Secured Promissory Note: In contrast to an unsecured promissory note, a secured promissory note requires the borrower to provide collateral (such as real estate or valuable assets) to secure the loan, which can be used to repay the lender in the event of default. 3. Demand Promissory Note: This type of note allows the lender to demand repayment of the loan amount at any time, without specifying a specific due date. However, the lender must provide reasonable notice to the borrower. 4. Installment Promissory Note: An installment promissory note allows the borrower to repay the loan in equal periodic installments over a specific period, rather than paying the entire loan amount on a single due date. 5. Balloon Promissory Note: A balloon promissory note requires the borrower to make smaller regular payments over a certain period, with a large "balloon" payment due on a specific date, representing the remaining amount owed. 6. Construction Loan Promissory Note: This specific type of note is used for construction projects. It provides funds at various stages of the project and requires repayment once the project is completed or reaches a certain milestone. 7. Personal Promissory Note: A personal promissory note is a loan agreement between individuals without any business involvement. It outlines the terms, repayment schedule, and interest rate for personal loans. It is important, when using or creating a Rhode Island Promissory Note Payable on a Specific Date, to consult with an attorney or legal professional to ensure compliance with Rhode Island laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Rhode Island Pagaré pagadero en una fecha específica - Promissory Note Payable on a Specific Date

Description

How to fill out Rhode Island Pagaré Pagadero En Una Fecha Específica?

Choosing the best legal record format could be a have a problem. Obviously, there are a lot of templates available online, but how do you obtain the legal type you require? Make use of the US Legal Forms website. The services gives a huge number of templates, like the Rhode Island Promissory Note Payable on a Specific Date, which can be used for business and personal needs. Every one of the kinds are checked out by pros and meet federal and state needs.

Should you be previously signed up, log in to the account and then click the Download key to have the Rhode Island Promissory Note Payable on a Specific Date. Make use of account to check throughout the legal kinds you possess ordered in the past. Go to the My Forms tab of the account and obtain one more version of your record you require.

Should you be a brand new consumer of US Legal Forms, here are simple instructions so that you can stick to:

- Initially, be sure you have chosen the appropriate type for your area/county. It is possible to check out the form while using Preview key and study the form description to guarantee it is the best for you.

- If the type does not meet your requirements, make use of the Seach field to obtain the right type.

- When you are positive that the form would work, select the Get now key to have the type.

- Choose the costs program you would like and enter in the essential info. Make your account and buy the order using your PayPal account or Visa or Mastercard.

- Select the data file structure and acquire the legal record format to the system.

- Full, modify and print and sign the received Rhode Island Promissory Note Payable on a Specific Date.

US Legal Forms is definitely the biggest local library of legal kinds that you can discover a variety of record templates. Make use of the company to acquire appropriately-made paperwork that stick to express needs.