Rhode Island Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code are essential documents that outline the proceedings and resolutions taken by the company's board of directors to establish a stock ownership plan compliant with Section 1244 of the Internal Revenue Code. This plan aims to provide certain tax advantages to investors, encourage capital financing, and promote the growth of small businesses. These minutes hold immense significance for the corporation and its stakeholders as they provide an official record of the meeting's discussions, decisions, and actions taken by the board. By adopting a stock ownership plan under Section 1244, the corporation hopes to attract potential investors by offering them a unique opportunity to take advantage of special tax benefits. The Rhode Island Minutes of Special Meeting of the Board of Directors may have different types, such as: 1. Initial Adoption of Stock Ownership Plan: In this type, the board of directors convenes a special meeting to discuss and formally adopt a stock ownership plan under Section 1244 of the Internal Revenue Code. The minutes would outline the purpose, terms, and conditions of the plan, as well as any necessary amendments to the corporation's bylaws or articles of incorporation. 2. Amendment or Modification of an Existing Stock Ownership Plan: If the board of directors has already established a stock ownership plan under Section 1244, they may hold a special meeting to amend or modify certain provisions. The minutes would detail the changes proposed, the rationale behind them, and the voting outcome. 3. Termination or Suspension of a Stock Ownership Plan: In certain circumstances, the board of directors might decide to terminate or suspend an existing stock ownership plan. The minutes would capture the reasons for such a decision, the motions raised, and the final resolution voted upon during the special meeting. 4. Annual Review and Evaluation of Stock Ownership Plan: To ensure the effectiveness and fairness of the stock ownership plan, the board of directors may conduct an annual review and evaluation. This type of meeting would focus on assessing the plan's performance, any necessary adjustments, and potential recommendations for improvement. The minutes would document the board's discussions, findings, and any actions taken based on the evaluation. Overall, the Rhode Island Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code are crucial for maintaining transparency, compliance, and accountability within the corporation. These minutes serve as an official record of the board's actions and resolutions related to the stock ownership plan, ensuring the corporation operates in accordance with applicable laws and regulations while providing tax benefits to its shareholders.

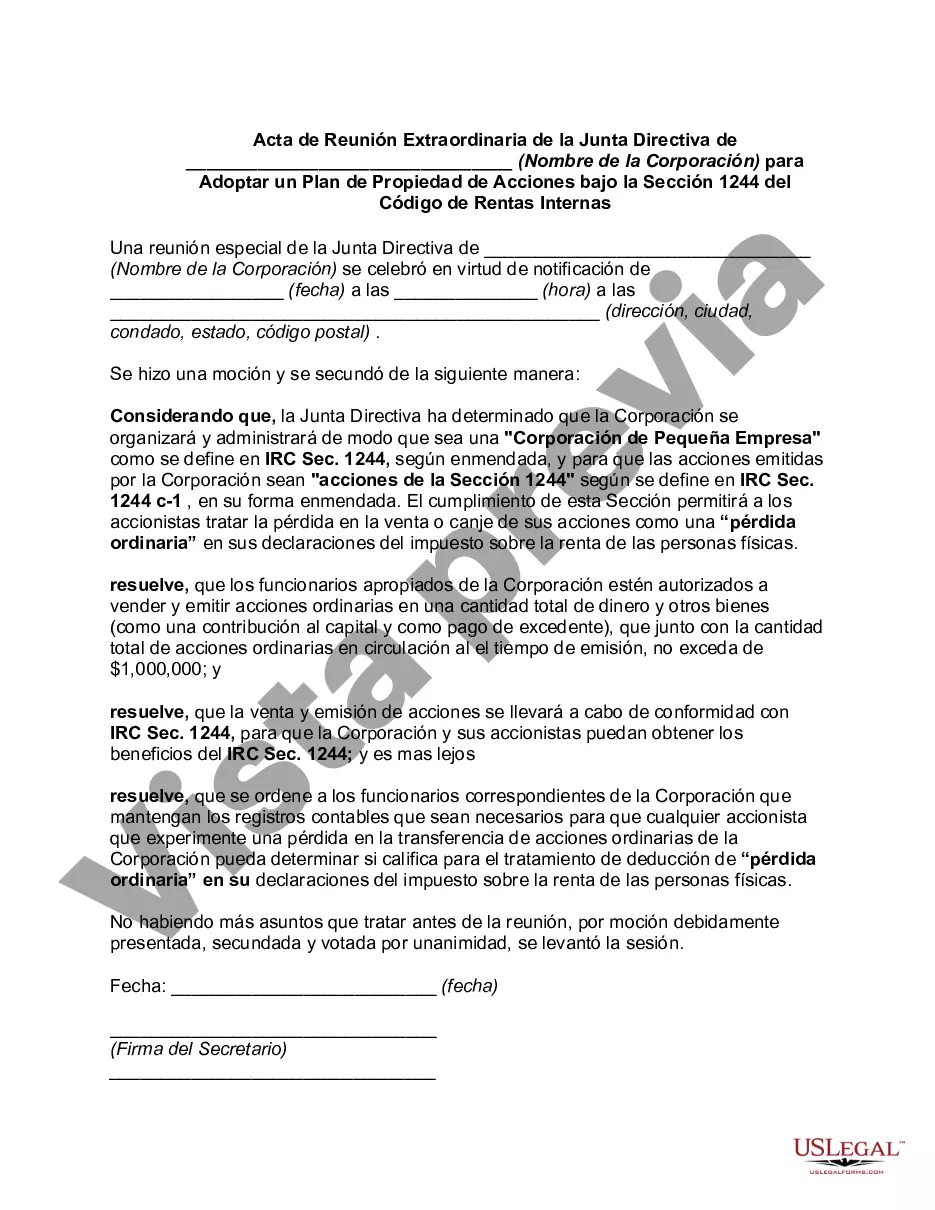

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Rhode Island Minutas de la reunión especial de la Junta Directiva de (Nombre de la corporación) para adoptar el Plan de propiedad de acciones bajo la Sección 1244 del Código de Rentas Internas - Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code

Description

How to fill out Rhode Island Minutas De La Reunión Especial De La Junta Directiva De (Nombre De La Corporación) Para Adoptar El Plan De Propiedad De Acciones Bajo La Sección 1244 Del Código De Rentas Internas?

Choosing the right legitimate record template might be a struggle. Of course, there are a variety of templates accessible on the Internet, but how will you get the legitimate type you want? Make use of the US Legal Forms web site. The assistance provides thousands of templates, like the Rhode Island Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code, which you can use for organization and private demands. All of the types are checked out by experts and fulfill federal and state needs.

In case you are already registered, log in to your accounts and click the Download option to get the Rhode Island Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code. Use your accounts to look from the legitimate types you might have bought previously. Visit the My Forms tab of your own accounts and obtain one more backup from the record you want.

In case you are a brand new end user of US Legal Forms, listed here are simple guidelines for you to follow:

- Initial, ensure you have chosen the right type for your area/state. You can look over the shape using the Preview option and study the shape explanation to make certain it will be the best for you.

- When the type will not fulfill your requirements, utilize the Seach field to find the proper type.

- Once you are positive that the shape is suitable, go through the Get now option to get the type.

- Opt for the rates strategy you need and enter the required information and facts. Build your accounts and pay money for an order utilizing your PayPal accounts or Visa or Mastercard.

- Opt for the document file format and acquire the legitimate record template to your gadget.

- Complete, modify and produce and signal the acquired Rhode Island Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code.

US Legal Forms may be the greatest local library of legitimate types that you can see various record templates. Make use of the service to acquire skillfully-created documents that follow status needs.