Title: Rhode Island Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time Introduction: When faced with high credit card interest rates, Rhode Island debtors have the option to reach out to their credit card companies and request a lower interest rate for a certain period. This letter serves as a formal request to negotiate more favorable terms, alleviating the financial burden and allowing debtors to manage their payments effectively. Below, you will find a detailed description of what this letter entails, explaining its purpose, structure, and the different types of letters that can be written based on individual circumstances. 1. Purpose of the Letter: The purpose of this Rhode Island letter is to address credit card debt and request a temporary reduction in the interest rate charged by the credit card company. By presenting a well-structured argument and highlighting the debtor's financial challenges, the letter seeks to persuade the card issuer to provide relief by granting a lower interest rate. 2. Structure of the Letter: To effectively communicate the request, the debtor should adhere to a precise structure. The letter can be divided into the following sections: a. Introductory Paragraph: Begin by introducing yourself and providing the credit card company's details, such as your account number and any other relevant information. Express your intent to request a temporary reduction of the interest rate. b. Body Paragraph(s): In this section, elaborate on your financial situation, explaining the challenges you are currently facing that make it difficult to maintain the current interest rate. Clearly state why a lower interest rate for a specific period would help you manage your debt more effectively, be it due to unexpected medical expenses, job loss, or other financial hardships. c. Supporting Documents: Attach any supporting documents that can bolster your argument, such as medical bills, termination notice, bank statements, or any other relevant paperwork that validates your financial predicament. d. Closing Paragraph: Summarize your request, reiterate the specific period for which you are requesting the lower interest rate, and express gratitude for their consideration. Provide your contact information and request a prompt response. 3. Types of Rhode Island Letters Based on Circumstances: The types of letters requesting a lower interest rate may differ from debtor to debtor, depending on their unique circumstances. Here are a few examples: a. Health-Related Financial Hardship: If a debtor faced substantial medical expenses due to unforeseen health conditions, such as surgery or treatment for a chronic illness, they can write a letter emphasizing how these medical bills are affecting their ability to manage the existing interest rate. b. Job Loss or Reduction in Income: Debtors who have recently experienced job loss, a pay cut, or a reduction in work hours can focus on their current financial instability and explain how temporarily lowering the interest rate would allow them to make consistent payments while they search for new employment. c. Unforeseen Financial Emergencies: Debtors facing unexpected expenses, such as home repairs, car accidents, or unavoidable legal fees, can describe the circumstances of these emergencies and highlight their impact on their ability to pay off credit card debt at the current interest rate. Conclusion: Writing a Rhode Island letter from a debtor to a credit card company requesting a lower interest rate for a specific period requires careful consideration of the debtor's situation. By adopting a professional and persuasive approach, debtors can increase their chances of obtaining temporary relief from high interest rates, enabling them to navigate their debt more effectively.

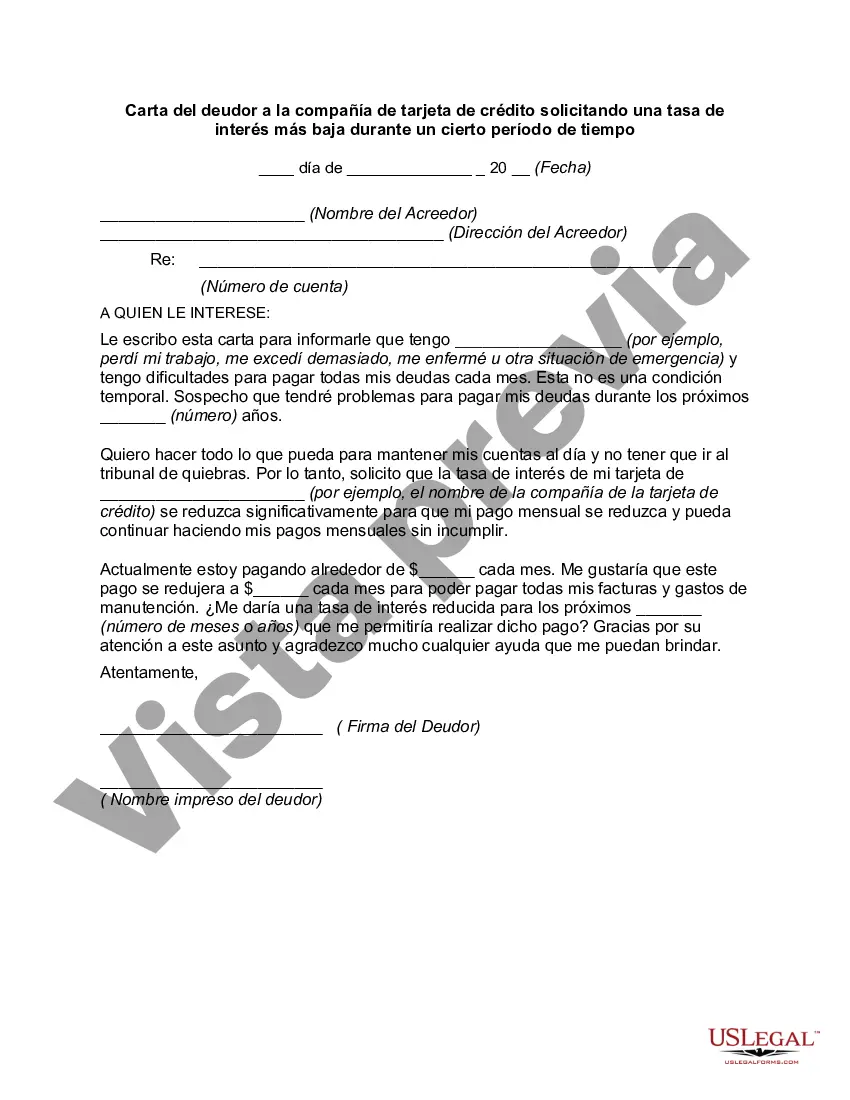

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Rhode Island Carta del deudor a la compañía de tarjeta de crédito solicitando una tasa de interés más baja durante un cierto período de tiempo - Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time

Description

How to fill out Rhode Island Carta Del Deudor A La Compañía De Tarjeta De Crédito Solicitando Una Tasa De Interés Más Baja Durante Un Cierto Período De Tiempo?

You can spend hours on the Internet attempting to find the authorized record web template that meets the federal and state demands you will need. US Legal Forms provides a large number of authorized forms that happen to be reviewed by professionals. You can easily download or print the Rhode Island Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time from your assistance.

If you have a US Legal Forms bank account, it is possible to log in and click the Acquire switch. Following that, it is possible to complete, revise, print, or sign the Rhode Island Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time. Each authorized record web template you acquire is your own for a long time. To have one more backup of the purchased type, proceed to the My Forms tab and click the corresponding switch.

If you are using the US Legal Forms site the very first time, keep to the straightforward guidelines below:

- Very first, be sure that you have chosen the proper record web template for your county/area of your liking. Look at the type explanation to make sure you have picked out the proper type. If accessible, use the Review switch to appear through the record web template as well.

- If you would like discover one more edition from the type, use the Look for discipline to get the web template that meets your requirements and demands.

- Upon having discovered the web template you want, simply click Buy now to continue.

- Choose the costs prepare you want, type in your qualifications, and sign up for an account on US Legal Forms.

- Full the transaction. You can utilize your credit card or PayPal bank account to cover the authorized type.

- Choose the formatting from the record and download it for your system.

- Make modifications for your record if needed. You can complete, revise and sign and print Rhode Island Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time.

Acquire and print a large number of record web templates utilizing the US Legal Forms website, which provides the greatest variety of authorized forms. Use professional and status-distinct web templates to tackle your company or person demands.