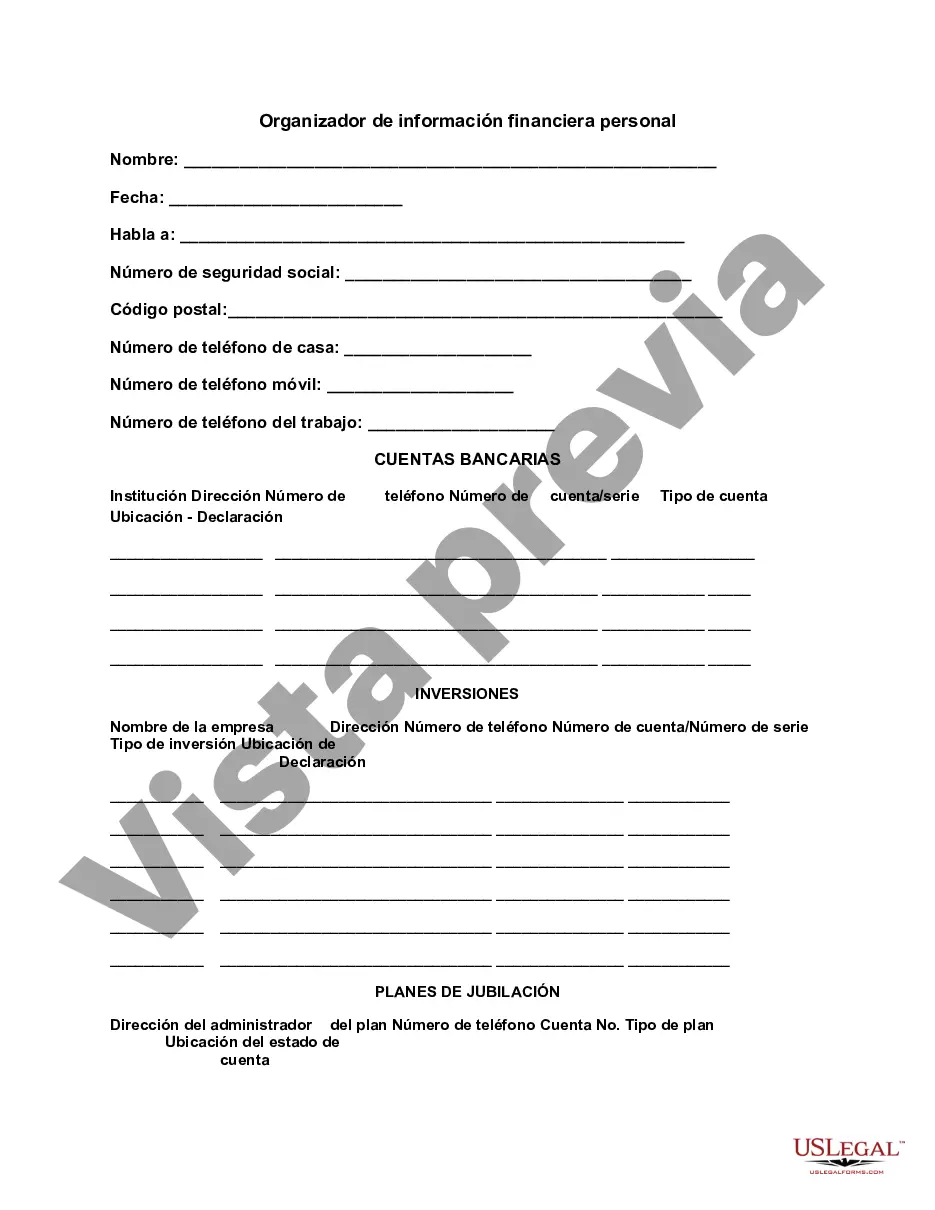

The Rhode Island Personal Financial Information Organizer is a comprehensive tool designed to help individuals efficiently manage their personal finances and keep track of important financial documents. This organizer is essential for anyone who wants to maintain a well-organized and updated record of their financial information and make informed decisions regarding their money matters. The Rhode Island Personal Financial Information Organizer serves as a centralized repository for all essential financial documents, ensuring easy access and reducing the risk of misplaced or lost information. This organizer includes various sections and categories to cover a wide range of financial aspects, enabling users to maintain a complete and accurate overview of their financial situation. Key sections of the Rhode Island Personal Financial Information Organizer may include: 1. Personal Information: This section covers vital personal details such as full name, address, contact information, social security number, date of birth, and the names of family members or dependents. It also allows individuals to list their emergency contacts. 2. Assets and Liabilities: In this section, individuals can record their assets, including cash, investments, real estate, vehicles, and valuable possessions, along with their corresponding values. They can also list their liabilities, such as mortgages, loans, credit card debts, and other outstanding balances. 3. Income and Expenses: This section enables users to track their sources of income, whether from employment, investments, or other financial ventures. It also allows for the tracking of monthly or periodic expenses, including bills, loans, insurance payments, and any other financial obligations. 4. Insurance Policies: Individuals can document their various insurance policies, including health, life, auto, property, and any other relevant coverage. This section helps individuals maintain an up-to-date record of their insurance policies, ensuring they can easily access important details when needed. 5. Estate Planning: This part covers estate planning information, including wills, trusts, power of attorney documents, and healthcare directives. It helps individuals ensure their wishes are carried out correctly and that their loved ones have access to the necessary information and instructions. 6. Financial Advisors and Contacts: This section allows individuals to list their financial advisors, attorneys, accountants, and other professionals who provide financial advice or services. Additionally, it provides space for listing important contact information, such as banks, credit card companies, utility providers, and government agencies. Different versions or variations of the Rhode Island Personal Financial Information Organizer might be tailored to specific demographics, such as retiree-specific organizers, student-focused organizers, or small business owner-oriented organizers. These variations address the specific financial needs and considerations of these distinct groups while providing the same core organizational structure. In conclusion, the Rhode Island Personal Financial Information Organizer is an invaluable tool for individuals seeking to manage their personal finances effectively. By utilizing this organizer, individuals can maintain a clear overview of their financial situation, securely store important documents, and make well-informed financial decisions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Rhode Island Organizador de información financiera personal - Personal Financial Information Organizer

Description

How to fill out Rhode Island Organizador De Información Financiera Personal?

If you have to complete, down load, or produce legal file themes, use US Legal Forms, the most important selection of legal types, that can be found online. Use the site`s easy and handy search to discover the paperwork you require. A variety of themes for organization and individual reasons are categorized by classes and claims, or key phrases. Use US Legal Forms to discover the Rhode Island Personal Financial Information Organizer with a couple of click throughs.

In case you are previously a US Legal Forms customer, log in for your account and then click the Down load button to find the Rhode Island Personal Financial Information Organizer. You may also access types you in the past acquired within the My Forms tab of your account.

If you use US Legal Forms the very first time, follow the instructions beneath:

- Step 1. Make sure you have selected the form to the proper town/nation.

- Step 2. Utilize the Preview solution to examine the form`s information. Do not neglect to read the explanation.

- Step 3. In case you are not satisfied with all the kind, make use of the Research discipline on top of the display to find other variations from the legal kind web template.

- Step 4. Upon having located the form you require, click the Get now button. Pick the prices program you prefer and put your references to sign up for an account.

- Step 5. Method the financial transaction. You can use your credit card or PayPal account to finish the financial transaction.

- Step 6. Choose the file format from the legal kind and down load it on your own gadget.

- Step 7. Comprehensive, modify and produce or indication the Rhode Island Personal Financial Information Organizer.

Every legal file web template you get is your own for a long time. You might have acces to every single kind you acquired in your acccount. Select the My Forms segment and pick a kind to produce or down load once more.

Remain competitive and down load, and produce the Rhode Island Personal Financial Information Organizer with US Legal Forms. There are thousands of specialist and status-distinct types you can utilize for your personal organization or individual needs.