Title: Rhode Island Letter Requesting Transfer of Property to Trust — A Comprehensive Guide Keywords: Rhode Island, letter, requesting transfer, property, trust, transfer of property to trust Introduction: Preparing a Rhode Island Letter Requesting Transfer of Property to Trust is an essential step in the estate planning process. By transferring your property into a trust, you can protect your assets, provide for loved ones, and simplify the distribution of your estate upon your passing. This detailed guide outlines the key aspects of creating a Rhode Island Letter Requesting Transfer of Property to Trust, addressing different types and their potential variations. 1. Rhode Island Letter Requesting Transfer of Real Estate to Trust: If you own real estate in Rhode Island and wish to transfer it to a trust, this type of letter is specifically crafted to execute the transfer. It is crucial to follow the appropriate legal procedures and include necessary details, such as property description, trust details, granter's information, and trustee's details, to ensure a successful transfer. 2. Rhode Island Letter Requesting Transfer of Personal Property to Trust: In situations where personal property, such as vehicles, collectibles, or valuable possessions, needs to be transferred to a trust, this type of letter is used. It includes specific information about the asset, including its description, fair market value, beneficiary details, and trustee instructions to ensure a proper transfer to the trust. 3. Rhode Island Letter Requesting Transfer of Financial Assets to Trust: If you have various financial assets, such as bank accounts, stocks, or investment portfolios, this letter addresses the transfer of these assets into a trust. Precise details pertaining to the account numbers, financial institution information, beneficiary designations, and guidance for the trustee to complete the transfer successfully should be included. 4. Rhode Island Letter Requesting Transfer of Business Interests to Trust: For business owners in Rhode Island, this type of letter facilitates the transfer of business interests, including shares, partnership agreements, or sole proprietorship assets, into a trust. It is vital to provide comprehensive information about the business entity, its value, the allocation of shares, and any specific instructions for the successor trustee to ensure a smooth transfer process. Conclusion: When creating a Rhode Island Letter Requesting Transfer of Property to Trust, it is crucial to tailor it to your specific needs and the nature of your assets. This comprehensive guide has introduced different types of transfer letters, including but not limited to real estate, personal property, financial assets, and business interests. By customizing these letters with relevant information and being diligent in adhering to legal requirements, you can secure your assets and plan for the future, ensuring your wishes are followed.

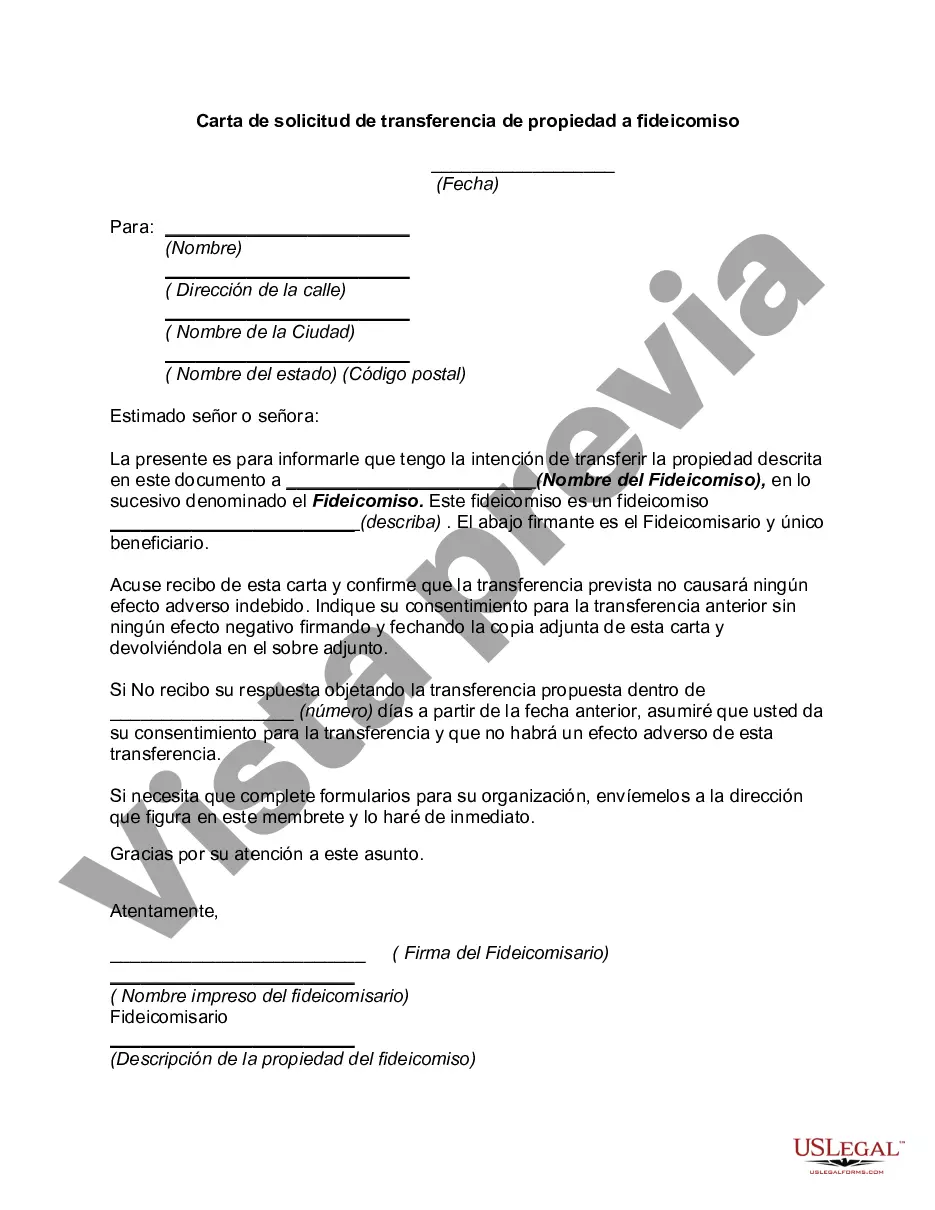

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Rhode Island Carta de solicitud de transferencia de propiedad a fideicomiso - Letter Requesting Transfer of Property to Trust

Description

How to fill out Rhode Island Carta De Solicitud De Transferencia De Propiedad A Fideicomiso?

Are you presently within a placement that you will need documents for both organization or personal reasons nearly every time? There are tons of lawful file layouts accessible on the Internet, but getting types you can depend on is not simple. US Legal Forms gives a large number of form layouts, much like the Rhode Island Letter Requesting Transfer of Property to Trust, that are published to satisfy federal and state needs.

When you are already knowledgeable about US Legal Forms web site and get a free account, merely log in. Following that, you can download the Rhode Island Letter Requesting Transfer of Property to Trust format.

Should you not come with an profile and want to start using US Legal Forms, follow these steps:

- Obtain the form you want and ensure it is to the appropriate town/state.

- Take advantage of the Preview option to check the form.

- Read the description to ensure that you have chosen the correct form.

- In case the form is not what you`re seeking, make use of the Search industry to obtain the form that meets your needs and needs.

- When you discover the appropriate form, click on Purchase now.

- Pick the rates program you would like, fill out the required information to produce your bank account, and pay money for an order making use of your PayPal or bank card.

- Select a handy data file file format and download your copy.

Locate all the file layouts you have purchased in the My Forms food selection. You may get a extra copy of Rhode Island Letter Requesting Transfer of Property to Trust whenever, if possible. Just select the essential form to download or printing the file format.

Use US Legal Forms, one of the most considerable assortment of lawful varieties, to save time and prevent faults. The support gives expertly produced lawful file layouts which can be used for an array of reasons. Generate a free account on US Legal Forms and begin producing your lifestyle easier.