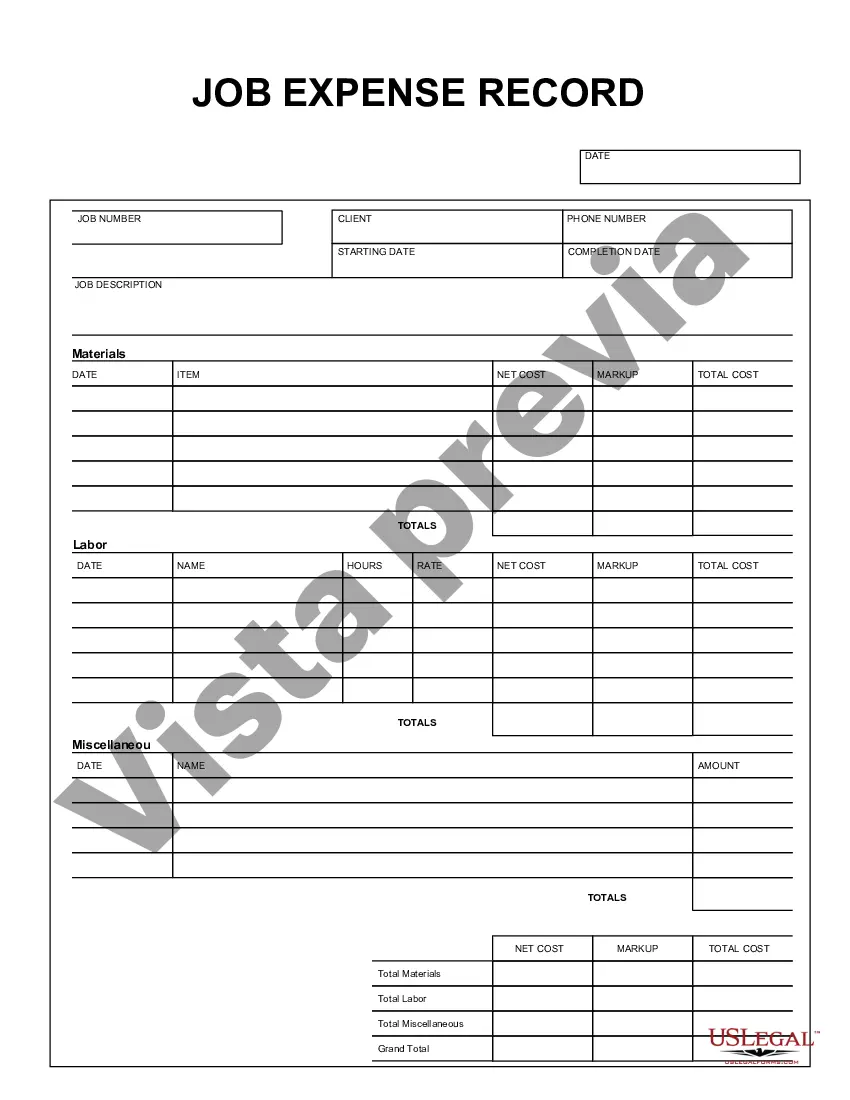

Rhode Island Job Expense Record is a crucial document used for tracking and recording job-related expenses incurred by employees. This record helps individuals or businesses accurately allocate expenses and claim tax deductions in compliance with Rhode Island state laws. Maintaining a comprehensive job expense record is essential for employees seeking reimbursement from their employers or individuals claiming tax deductions on their personal tax returns. The Rhode Island Job Expense Record typically includes various types of expenses, such as: 1. Travel Expenses: This category covers transportation costs, including airfare, train or bus tickets, mileage, car rentals, and parking fees related to job-related travel. 2. Accommodation Expenses: It encompasses costs associated with lodging, such as hotel rooms, vacation rentals, or other accommodation arrangements necessary for business travel. 3. Meal and Entertainment Expenses: This category involves expenses for meals, both during business travel and entertainment expenses incurred while conducting job-related activities. These expenses may be eligible for partial reimbursement or tax deduction, subject to certain limitations. 4. Supplies and Equipment Expenses: This section includes expenses for job-specific supplies and equipment, such as tools, uniforms, safety gear, or office supplies essential for carrying out job duties. 5. Communication Expenses: This refers to expenses incurred for job-related communication purposes, like mobile phone bills, internet charges, or other communication services required for work. 6. Training and Education Expenses: Expenses related to job-specific training, conferences, workshops, or educational courses relevant to the employee's professional development can be captured under this category. It's important to note that every job expense record should include relevant details like the expense date, purpose, amount, and any applicable receipts or supporting documents. Proper organization and documentation of expenses within the Rhode Island Job Expense Record will aid in proving the legitimacy of claims during audits or verification processes. In conclusion, the Rhode Island Job Expense Record acts as a detailed record-keeping system for individuals or businesses to track and document job-related expenses. It helps to ensure accuracy in reimbursement claims and tax deductions, while complying with Rhode Island state regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Rhode Island Registro de gastos de trabajo - Job Expense Record

Description

How to fill out Rhode Island Registro De Gastos De Trabajo?

US Legal Forms - one of many greatest libraries of authorized varieties in the USA - gives an array of authorized papers templates you are able to down load or print out. Utilizing the website, you can get a huge number of varieties for organization and individual purposes, categorized by types, says, or keywords.You can get the most up-to-date versions of varieties much like the Rhode Island Job Expense Record within minutes.

If you already possess a registration, log in and down load Rhode Island Job Expense Record in the US Legal Forms local library. The Down load button will show up on every kind you view. You gain access to all formerly acquired varieties from the My Forms tab of your respective bank account.

If you would like use US Legal Forms the very first time, allow me to share straightforward instructions to get you began:

- Ensure you have chosen the proper kind to your area/area. Click on the Preview button to analyze the form`s content. See the kind explanation to actually have chosen the proper kind.

- When the kind doesn`t suit your requirements, use the Look for area near the top of the display to find the one who does.

- In case you are happy with the form, affirm your selection by visiting the Acquire now button. Then, choose the costs program you like and supply your references to sign up to have an bank account.

- Process the transaction. Use your charge card or PayPal bank account to accomplish the transaction.

- Select the file format and down load the form on your device.

- Make modifications. Fill up, change and print out and indication the acquired Rhode Island Job Expense Record.

Every web template you put into your money does not have an expiry date and it is your own property for a long time. So, if you want to down load or print out yet another duplicate, just check out the My Forms section and then click on the kind you will need.

Obtain access to the Rhode Island Job Expense Record with US Legal Forms, the most comprehensive local library of authorized papers templates. Use a huge number of expert and state-distinct templates that meet your company or individual demands and requirements.